- United States

- /

- Entertainment

- /

- NasdaqGS:ROKU

Assessing Roku’s Value After Shares Jump 7% on International Expansion News

Reviewed by Bailey Pemberton

- If you have ever wondered whether Roku is a bargain or overpriced, you are not alone. Today we are diving into what the numbers really say about its value.

- Roku's stock has been anything but quiet lately, jumping 7.2% in the past week, adding to an impressive 41.9% gain year-to-date and 46.2% over the last year. However, its five-year return is still down 54.3%.

- Some of these moves have been fueled by recent headlines about Roku's expansion into international markets and its evolving advertising business, both of which have caught investors' attention. News about partnerships with smart TV makers and new streaming content initiatives have also driven conversations about future growth.

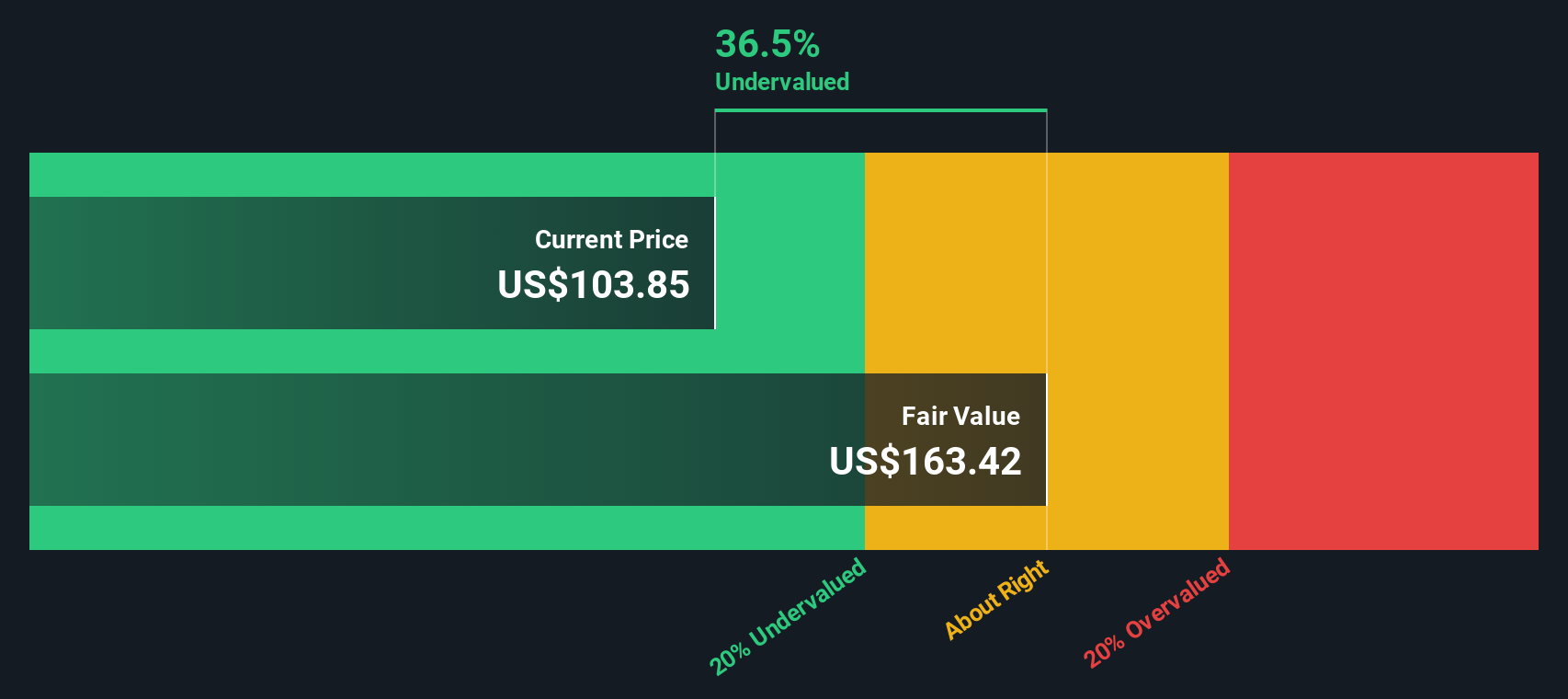

- When it comes to traditional valuation checks, Roku scores a 3 out of 6 on our valuation score. This means it is undervalued by half the metrics we track, but numbers only tell part of the story. Stick around for a deeper look at valuation approaches and a smarter way to judge Roku's true potential.

Approach 1: Roku Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true worth by projecting future cash flows and discounting them back to today's value. Essentially, it helps gauge what all that future cash might really be worth in the present, based on today’s dollars.

For Roku, the latest available Free Cash Flow stands at approximately $395 million. Analysts predict strong growth ahead, estimating Roku’s Free Cash Flow could reach over $1.3 billion by 2029. This represents an impressive increase, driven by both internal projections and extrapolations beyond the initial five-year analyst coverage. All these figures are expressed in U.S. dollars and serve as the backbone of the DCF calculation.

Based on the two-stage Free Cash Flow to Equity model, this forecast leads to an intrinsic value of $156.04 per share. This value is 32.3% higher than the current share price, indicating that Roku’s stock appears meaningfully undervalued according to this approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Roku is undervalued by 32.3%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

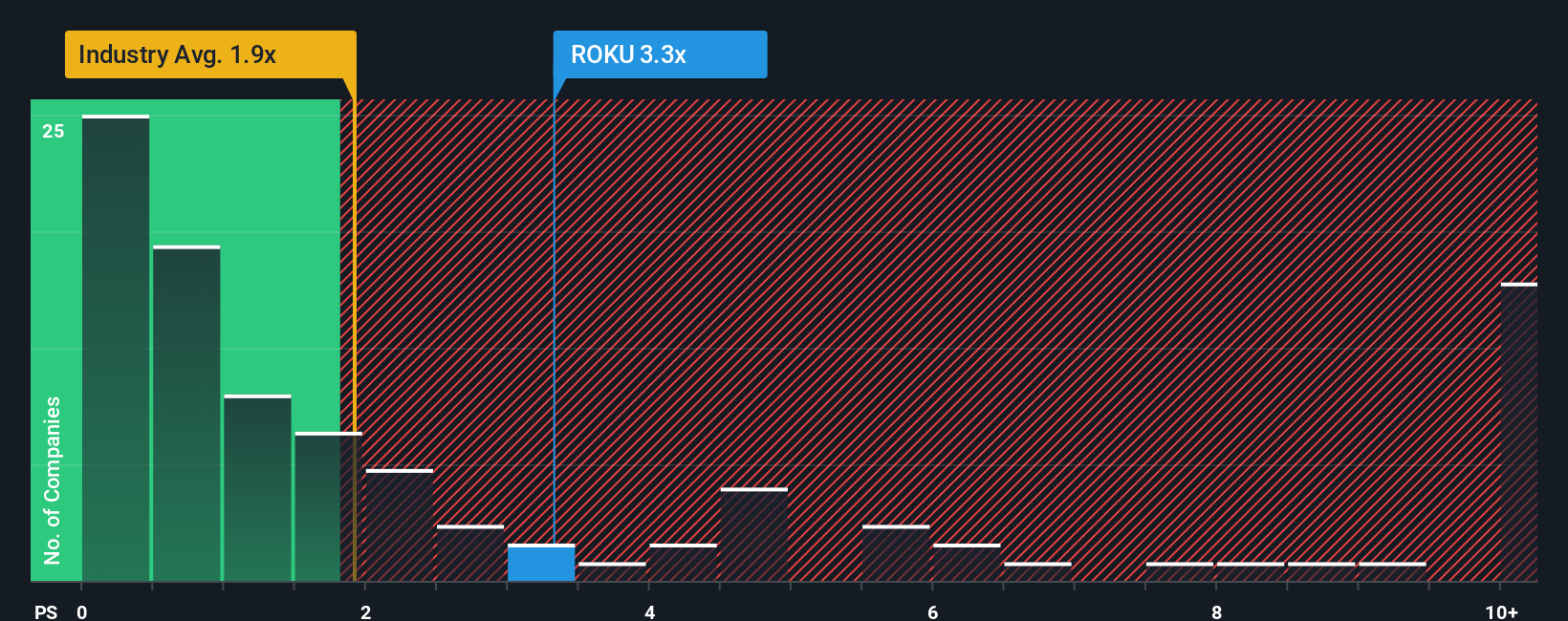

Approach 2: Roku Price vs Sales

For companies like Roku, which have yet to reach consistent profitability, the Price-to-Sales (P/S) ratio is often a more useful valuation tool than earnings-based multiples. This metric helps investors judge if the company’s revenues are being over- or under-valued by the market. It is particularly insightful for high-growth businesses that reinvest in expansion rather than posting regular profits.

It is important to remember that growth expectations and risk significantly affect what qualifies as a "fair" P/S ratio. Fast-growing or innovative companies typically trade at higher P/S multiples because investors are pricing in future expansion and market leadership. Meanwhile, higher business risks or uncertain profitability can push the appropriate ratio lower.

Currently, Roku trades at a P/S ratio of 3.44x. This puts it below the peer average of 4.66x but above the entertainment industry average of 1.59x. However, relying only on these benchmarks gives a limited view because peers and industry averages do not consider a company's unique growth path, competitive position, profit margin, or risk factors.

This is where Simply Wall St's “Fair Ratio” offers a deeper perspective. The Fair Ratio for Roku, calculated at 2.69x, considers the company's expected revenue growth, profitability horizon, size, and relevant industry factors. Unlike generic averages, this tailored ratio reflects what investors should rationally pay for Roku’s sales today, given all its strengths and risks.

Comparing Roku's current P/S of 3.44x with the Fair Ratio of 2.69x suggests the stock is trading above its fair value based on revenue multiples. The spread, at 0.75x, signals a degree of overvaluation using this lens.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

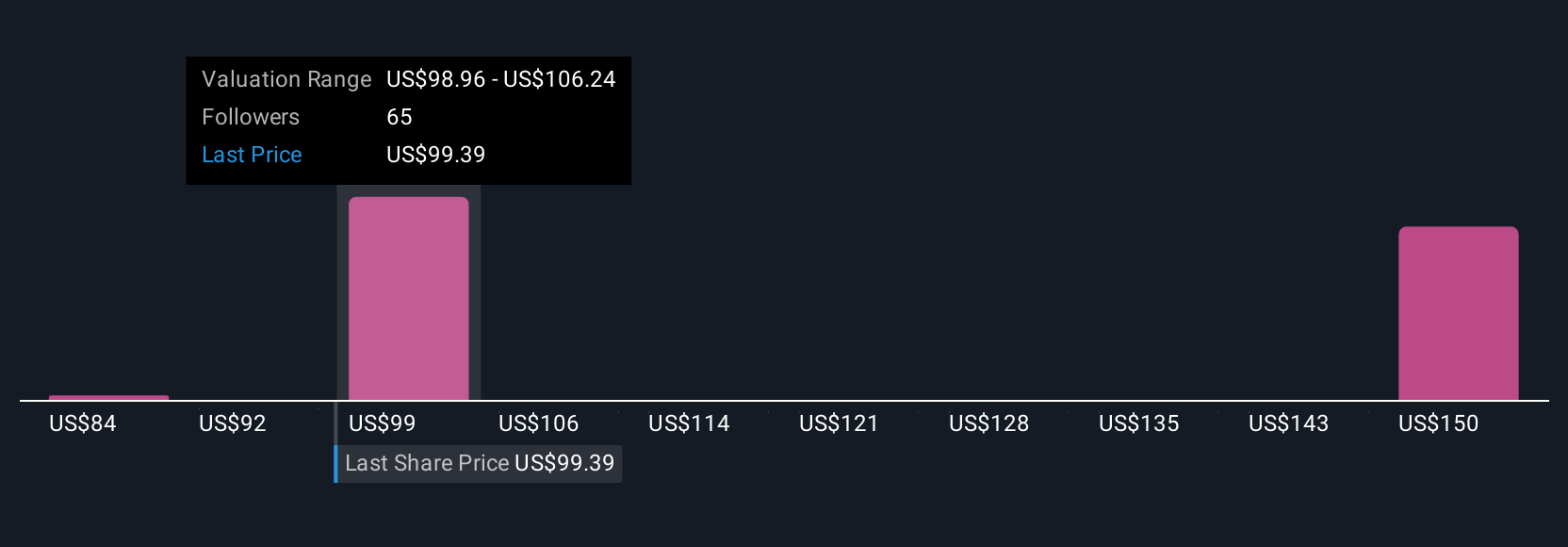

Upgrade Your Decision Making: Choose your Roku Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, powerful tool that lets you build and share the story behind your numbers. It captures your vision of Roku’s future, what you expect for its revenue, earnings, and margins, and what you believe is a fair value for the stock.

Narratives bring context to your investment by connecting Roku’s business developments, such as streaming growth or new ad partnerships, with financial forecasts and a resulting valuation. They are easy to create and follow on Simply Wall St’s Community page, where millions of investors use Narratives to visualize their thinking, track changing assumptions, and compare outcomes.

Narratives guide buy or sell decisions by continuously comparing your Fair Value with the current share price, so you can act when new information like news or earnings is released. The Narrative updates dynamically to reflect the latest developments. For example, some Roku investors currently build bullish Narratives with price targets as high as $130, expecting rapid platform monetization and margin gains. Others are more cautious, projecting fair values as low as $70, reflecting worries about competition and ad market risks. Narratives let you align your decisions with the factors you believe matter most.

Do you think there's more to the story for Roku? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROKU

Roku

Operates a TV streaming platform in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives