- United States

- /

- Media

- /

- NasdaqCM:QMMM

Is Nasdaq and SEC Scrutiny Changing the Investment Case for QMMM Holdings (QMMM)?

Reviewed by Sasha Jovanovic

- In recent days, The Nasdaq Stock Market halted trading in QMMM Holdings Limited after previously being suspended by the Securities and Exchange Commission from September 29 to October 10, 2025, as regulators requested additional information from the company.

- This sequence of regulatory actions highlights increased scrutiny and ongoing uncertainty regarding QMMM Holdings' compliance and disclosure standards.

- We'll explore how the extended regulatory halt and information requests impact QMMM Holdings' investment narrative and market outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is QMMM Holdings' Investment Narrative?

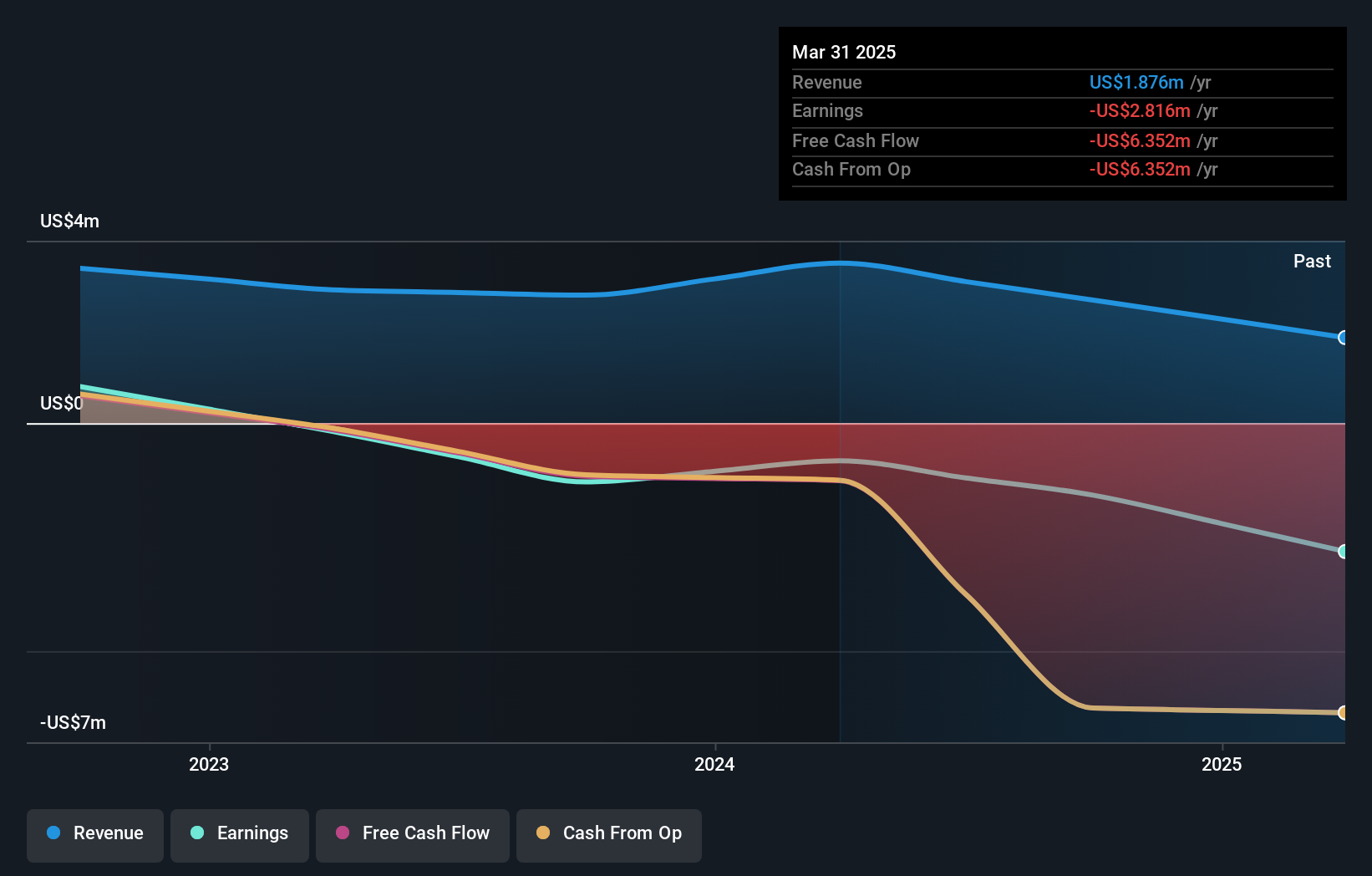

For anyone considering QMMM Holdings, it’s clear the big picture rests on belief in both its new blockchain and crypto analytics platform, and the company’s ability to turn these ambitions into meaningful revenue. Prior to the recent trading halt, short-term catalysts centered on whether QMMM could deliver product progress, attract strategic partnerships, or address ongoing risks like persistent losses, governance changes, and delisting threats after a sharp drop in sales and a larger net loss. However, the regulatory suspensions and the lack of clarity around Nasdaq and SEC information requests may upend these narratives, at least in the near term. The halt introduces a new, material uncertainty, shifting the focus dramatically to compliance and transparency concerns, and making it hard for any business or product catalyst to take center stage until regulatory questions are resolved.

But it's the ongoing risk of delisting that investors really need to keep on their radar. The analysis detailed in our QMMM Holdings valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore 2 other fair value estimates on QMMM Holdings - why the stock might be worth as much as $0.22!

Build Your Own QMMM Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QMMM Holdings research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free QMMM Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QMMM Holdings' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QMMM Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:QMMM

QMMM Holdings

Through its subsidiaries, provides digital media advertising and marketing production services primarily in Hong Kong.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success