Stock Analysis

- United States

- /

- Media

- /

- NasdaqGS:PERI

The total return for Perion Network (NASDAQ:PERI) investors has risen faster than earnings growth over the last five years

Perion Network Ltd. (NASDAQ:PERI) shareholders might be concerned after seeing the share price drop 26% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been spectacular. In that time, the share price has soared some 588% higher! So it might be that some shareholders are taking profits after good performance. Only time will tell if there is still too much optimism currently reflected in the share price. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 47% decline over the last twelve months. Anyone who held for that rewarding ride would probably be keen to talk about it.

Since the long term performance has been good but there's been a recent pullback of 4.9%, let's check if the fundamentals match the share price.

See our latest analysis for Perion Network

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

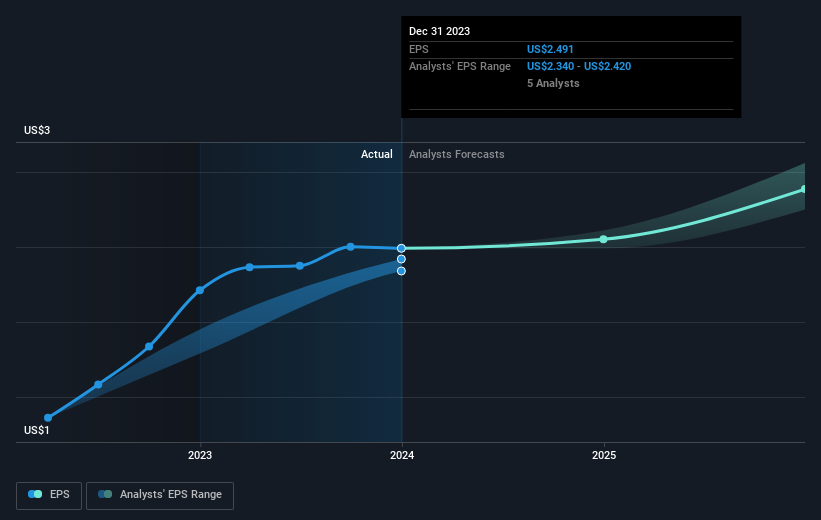

Over half a decade, Perion Network managed to grow its earnings per share at 51% a year. So the EPS growth rate is rather close to the annualized share price gain of 47% per year. That suggests that the market sentiment around the company hasn't changed much over that time. Indeed, it would appear the share price is reacting to the EPS.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Perion Network's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 27% in the last year, Perion Network shareholders lost 47%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 47%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Before deciding if you like the current share price, check how Perion Network scores on these 3 valuation metrics.

Of course Perion Network may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Perion Network is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PERI

Perion Network

Perion Network Ltd. provides digital advertising solutions to brands, agencies, and publishers in North America, Europe, and internationally.

Flawless balance sheet and undervalued.