Stock Analysis

- United States

- /

- Banks

- /

- NasdaqCM:VABK

Exploring Three Prominent Dividend Stocks In The United States

Reviewed by Sasha Jovanovic

Amid a backdrop of sharp declines in U.S. stocks and heightened concerns about inflation and interest rate policies, investors are navigating a challenging economic landscape. In such times, dividend stocks often come into focus as potential stabilizers in investment portfolios due to their potential for providing regular income streams.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 7.66% | ★★★★★★ |

| AGCO (NYSE:AGCO) | 5.39% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.19% | ★★★★★★ |

| Resources Connection (NasdaqGS:RGP) | 5.07% | ★★★★★★ |

| Evans Bancorp (NYSEAM:EVBN) | 5.16% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 4.98% | ★★★★★★ |

| Arrow Financial (NasdaqGS:AROW) | 4.85% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.79% | ★★★★★★ |

| Camden National (NasdaqGS:CAC) | 5.38% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.03% | ★★★★★★ |

Click here to see the full list of 208 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Virginia National Bankshares (NasdaqCM:VABK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Virginia National Bankshares Corporation, with a market cap of $152.06 million, serves as the holding company for Virginia National Bank, offering various commercial and retail banking services.

Operations: Virginia National Bankshares Corporation primarily generates revenue through commercial and retail banking services.

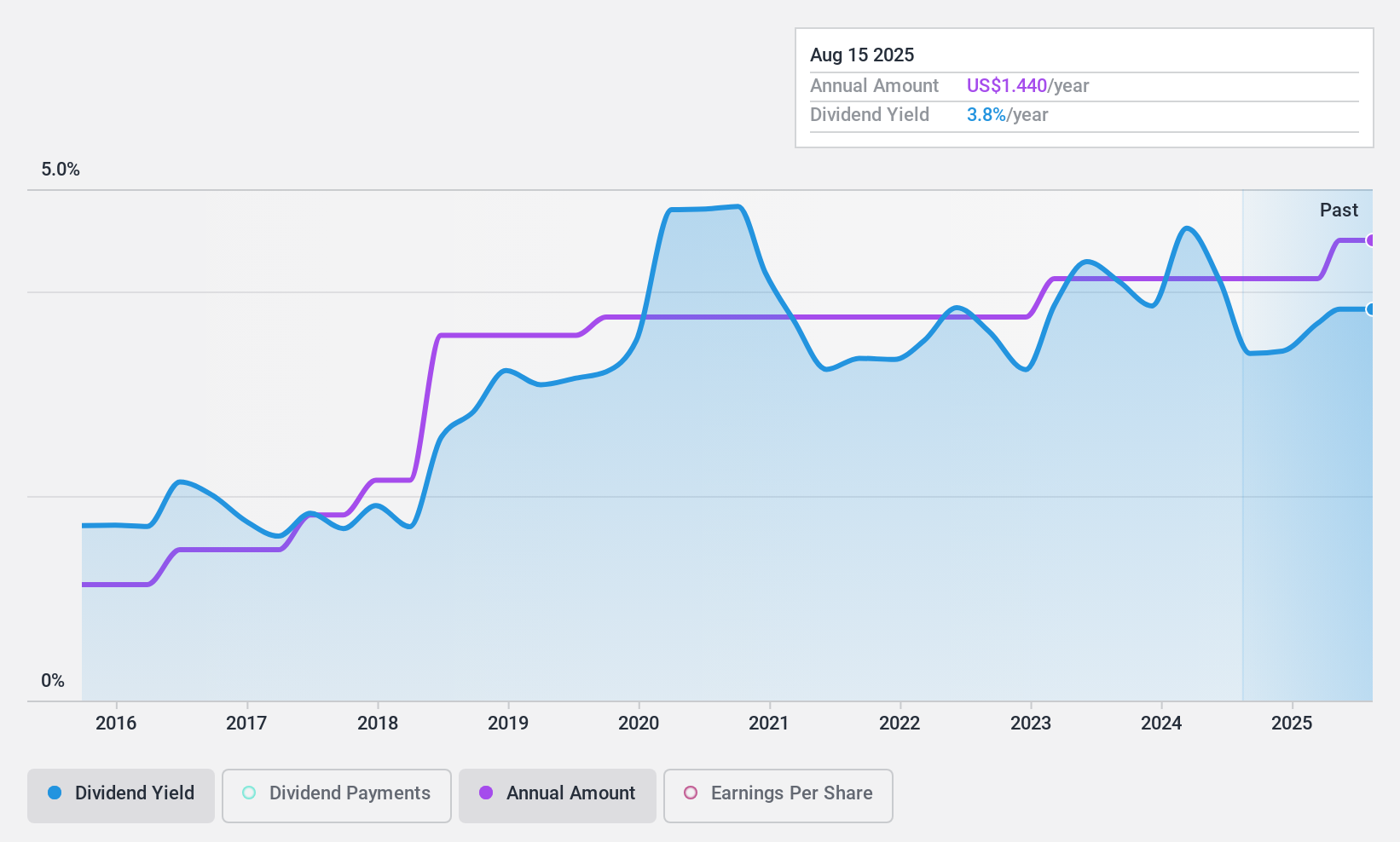

Dividend Yield: 4.7%

Virginia National Bankshares has demonstrated a consistent dividend track record, with stable and growing payouts over the past decade. The company's recent quarterly dividend declaration of US$0.33 per share aligns with a yield of approximately 4.42%. Despite this, its current yield of 4.68% remains slightly below the top quartile for U.S. dividend stocks. Financial performance shows a decline, with Q1 net interest income and net income dropping from the previous year to US$10.94 million and US$3.65 million respectively, potentially impacting future payout sustainability despite a reasonable payout ratio of 41.4%.

- Unlock comprehensive insights into our analysis of Virginia National Bankshares stock in this dividend report.

- According our valuation report, there's an indication that Virginia National Bankshares' share price might be on the cheaper side.

First Guaranty Bancshares (NasdaqGM:FGBI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Guaranty Bancshares, Inc., serving as the holding company for First Guaranty Bank, offers commercial banking services across Louisiana and Texas, with a market capitalization of approximately $140.43 million.

Operations: First Guaranty Bancshares, Inc. generates its revenue through commercial banking operations across Louisiana and Texas.

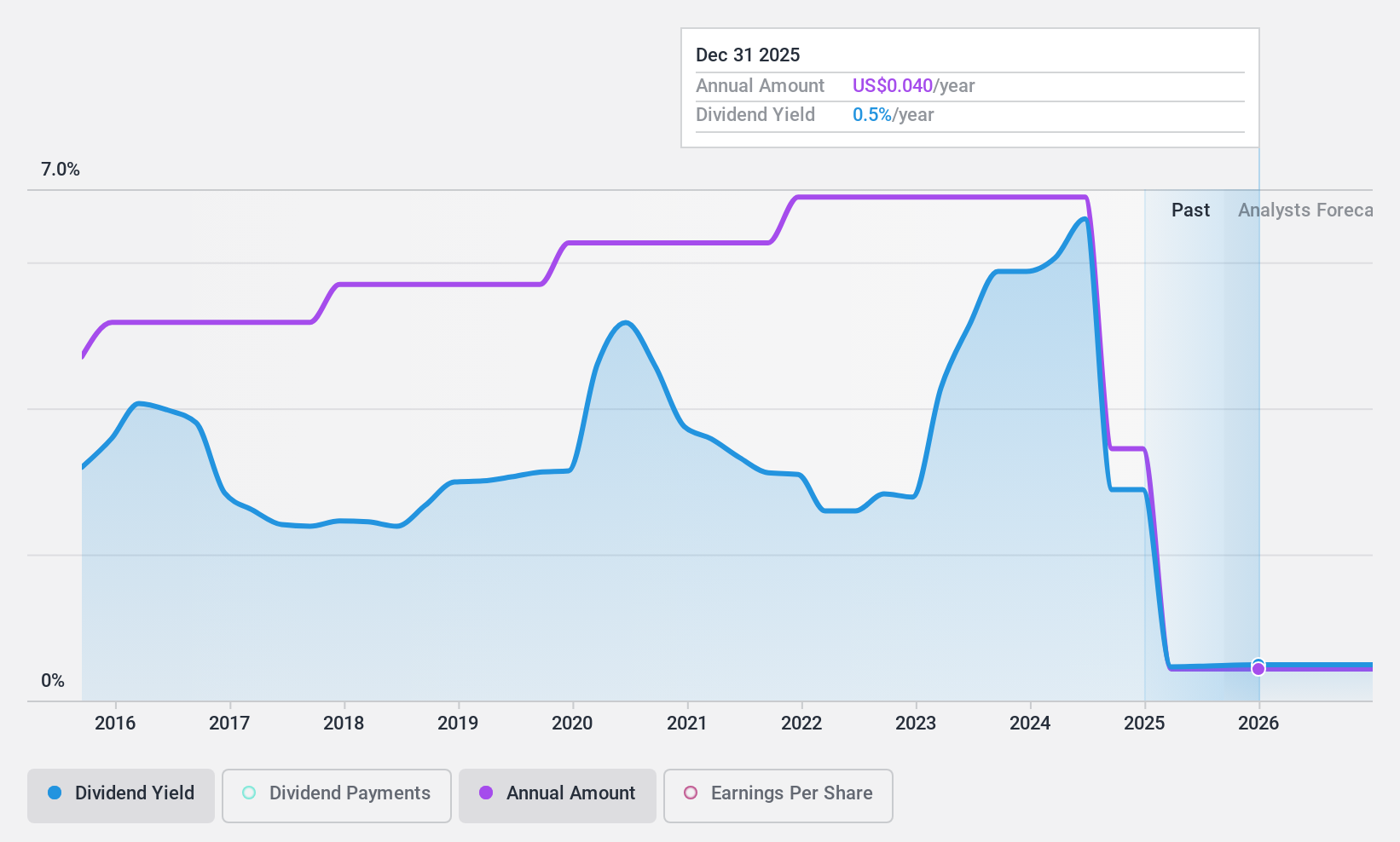

Dividend Yield: 5.7%

First Guaranty Bancshares reported a decline in Q1 earnings with net interest income at US$21.92 million and net income at US$2.31 million, reflecting a downward trend from the previous year. Despite this, the company maintains a high dividend yield of 5.7%, which is competitive but raises concerns about sustainability given its payout ratio of 129.6%. The firm continues its history of dividends, marking the 123rd consecutive payment with a recent quarterly dividend of US$0.16 per share, although shareholder dilution has occurred over the past year.

- Navigate through the intricacies of First Guaranty Bancshares with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, First Guaranty Bancshares' share price might be too optimistic.

Fulton Financial (NasdaqGS:FULT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fulton Financial Corporation is a financial holding company offering consumer and commercial banking products and services across Pennsylvania, Delaware, Maryland, New Jersey, and Virginia, with a market cap of approximately $2.96 billion.

Operations: Fulton Financial Corporation generates its revenue primarily through banking activities, totaling approximately $1.04 billion.

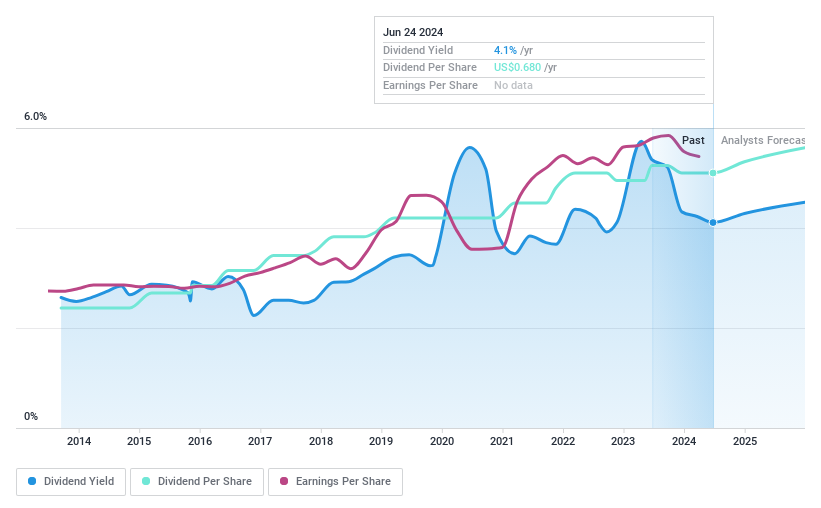

Dividend Yield: 4.1%

Fulton Financial offers a stable dividend yield of 4.11%, supported by a payout ratio of 40.5%, indicating sound coverage by earnings. The company has consistently increased its dividend over the last decade, underscoring reliability in shareholder returns. Despite trading at 48.9% below estimated fair value, recent activities including a follow-on equity offering of US$250 million and executive shifts signal ongoing strategic adjustments. However, Q1 reports show a decrease in net interest income and net income year-over-year, alongside reduced loan charge-offs from the previous year.

- Click here to discover the nuances of Fulton Financial with our detailed analytical dividend report.

- The analysis detailed in our Fulton Financial valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 205 more companies for you to explore.Click here to unveil our expertly curated list of 208 Top Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Virginia National Bankshares is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VABK

Virginia National Bankshares

Operates as the holding company for Virginia National Bank that provides a range of commercial and retail banking services.

Flawless balance sheet average dividend payer.