- United States

- /

- Media

- /

- NasdaqGS:PERI

Perion Network Ltd.'s (NASDAQ:PERI) 30% Jump Shows Its Popularity With Investors

Perion Network Ltd. (NASDAQ:PERI) shareholders have had their patience rewarded with a 30% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 53%.

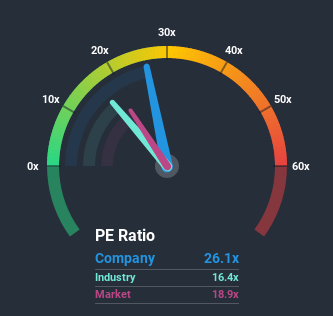

Since its price has surged higher, Perion Network's price-to-earnings (or "P/E") ratio of 26.1x might make it look like a sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 18x and even P/E's below 10x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's lofty.

Perion Network has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Perion Network

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Perion Network's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 31%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 19% each year as estimated by the four analysts watching the company. With the market only predicted to deliver 14% each year, the company is positioned for a stronger earnings result.

With this information, we can see why Perion Network is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Perion Network's P/E?

The large bounce in Perion Network's shares has lifted the company's P/E to a fairly high level. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Perion Network maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Perion Network, and understanding them should be part of your investment process.

Of course, you might also be able to find a better stock than Perion Network. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

If you’re looking to trade Perion Network, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:PERI

Perion Network

Provides digital advertising solutions to brands, agencies, and retailers in the United States and internationally.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives