- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TEAD

Slammed 28% Outbrain Inc. (NASDAQ:OB) Screens Well Here But There Might Be A Catch

Unfortunately for some shareholders, the Outbrain Inc. (NASDAQ:OB) share price has dived 28% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 46% in that time.

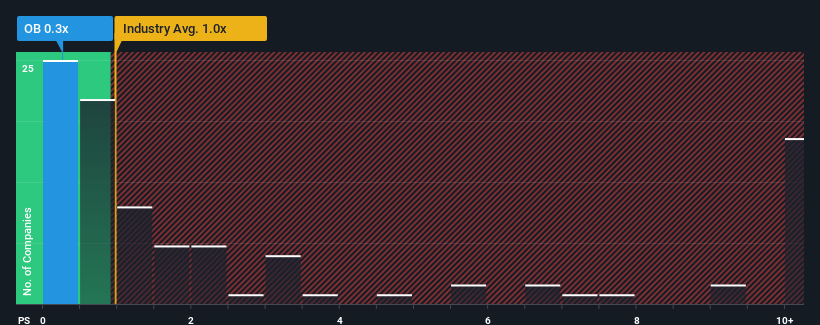

After such a large drop in price, Outbrain may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Interactive Media and Services industry in the United States have P/S ratios greater than 1x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Outbrain

What Does Outbrain's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Outbrain has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Outbrain.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Outbrain's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.2% last year. Still, lamentably revenue has fallen 7.9% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 53% during the coming year according to the five analysts following the company. With the industry only predicted to deliver 12%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Outbrain's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Outbrain's recently weak share price has pulled its P/S back below other Interactive Media and Services companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at Outbrain's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for Outbrain you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Teads Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TEAD

Teads Holding

Operates a technology platform that connects media owners and advertisers with engaged audiences to drive business outcomes in the United States, Europe, the Middle East, Africa, and internationally.

Very undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives