- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Netflix (NFLX): Assessing Valuation After Recent Share Price Volatility and Analyst Upgrades

Reviewed by Simply Wall St

Netflix (NFLX) shares have seen some movement recently, catching the eye of investors who are watching the stock’s performance over the past month. With growth in both revenue and net income, there is a fresh round of interest in the streaming giant’s fundamentals.

See our latest analysis for Netflix.

Netflix’s share price has slipped 7.9% over the past month, with some volatility after a stretch of strong performance. Looking at the bigger picture, momentum is still apparent given its nearly 29% total shareholder return over the last year and more than tripling investor wealth over three years.

If streaming’s surge has you thinking about where innovation meets rapid growth, it is a great moment to discover See the full list for free.

With recent gains tempered by short-term volatility, investors now face a key question: is Netflix currently offering an attractive entry point, or is the market already reflecting all of its expected future growth?

Most Popular Narrative: 91.6% Undervalued

With Netflix’s last close at $1,263.25 and the narrative’s fair value at $1,350.32, the current share price sits well below the consensus view. This suggests significant upside potential should optimistic earnings forecasts materialize.

The wider rollout and promising early metrics of Netflix's proprietary ad tech stack enable global expansion and increased monetization of the ad-supported tier. This positions Netflix to significantly accelerate ad revenues and improve margin leverage with scale as more advertising demand shifts to streaming.

Curious about what’s propelling such a bullish price target? Discover the secret formula, baked into forecasts of higher margins and a rapidly growing new revenue engine. Want to know why analysts see Netflix surging ahead, while others stand back? Unpack the full playbook behind this eye-catching fair value.

Result: Fair Value of $1,350.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid escalation in content costs or intensifying competition could quickly erode Netflix’s profit margins and momentum, which could shift the bullish narrative.

Find out about the key risks to this Netflix narrative.

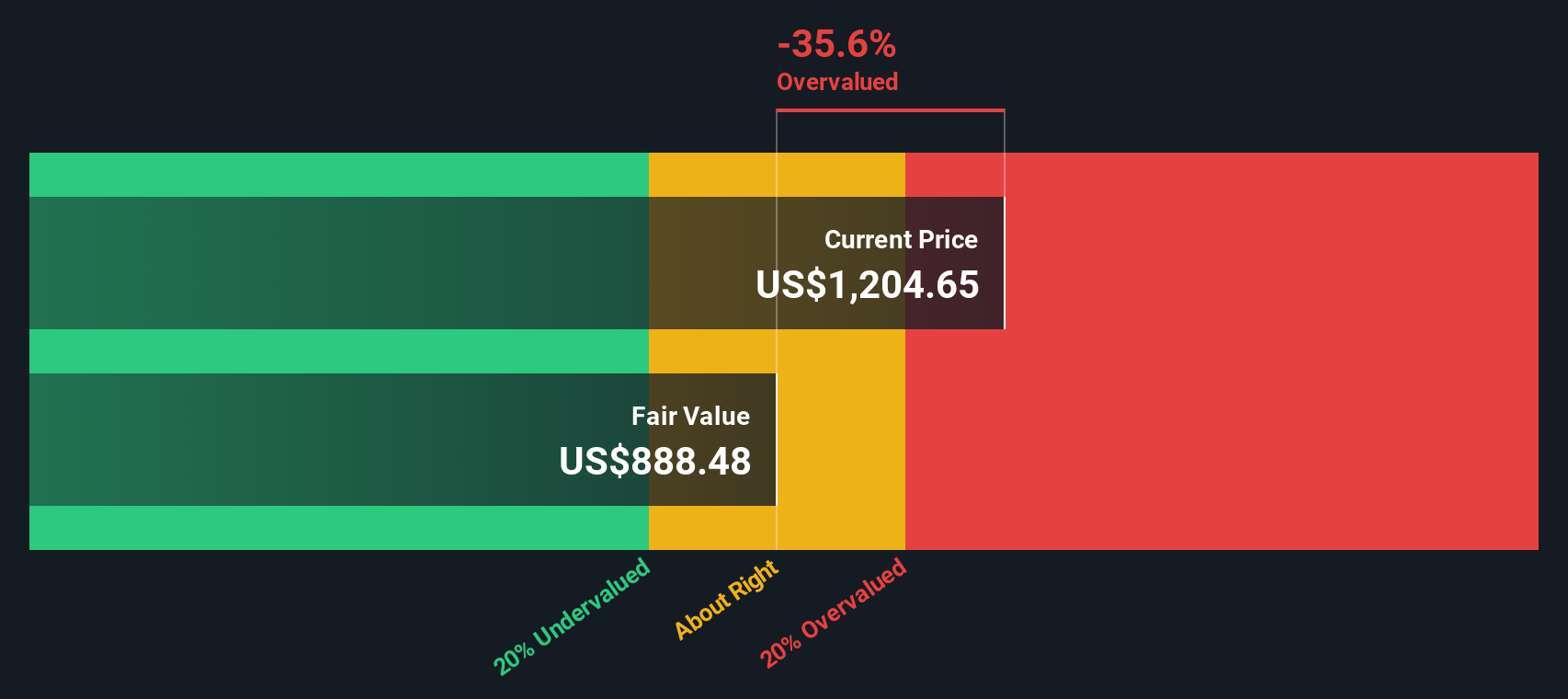

Another View: What Does Our DCF Model Say?

To challenge the optimistic fair value, our SWS DCF model takes a cash flow perspective and finds Netflix ($114.09) trading above its estimated fair value of $86.48. While multiples point to upside, the DCF suggests the market might be running ahead of fundamentals. Which lens gives the clearer picture for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Netflix for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Netflix Narrative

If you want a fresh perspective or believe your view might differ, you can quickly dig into the numbers and craft your own take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Netflix.

Looking for More Investment Ideas?

Make your next smart move by scanning for standout stocks and untapped sectors using these powerful tools. Each one is packed with opportunities you do not want to miss.

- Spot fresh value plays and get ahead of the market by checking out these 905 undervalued stocks based on cash flows for underappreciated companies based on real cash flow analysis.

- Seize the advantage in AI-driven innovation and find your edge with these 27 AI penny stocks showing strong momentum in artificial intelligence breakthroughs.

- Start earning more from your investments with these 18 dividend stocks with yields > 3% offering yields above 3 percent and attractive payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives