- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Has the Recent 24% Rally Made Netflix Too Expensive for Investors in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Netflix is actually worth its sky-high share price, or if the recent buzz outweighs its real value? You are definitely not alone in asking that question right now.

- Netflix has seen some dramatic moves, with a 23.9% gain year-to-date and a staggering 331.3% return over the past three years, despite a slight 5.6% dip in the last month.

- Investor optimism has been fueled by headlines about Netflix's continuing expansion into global markets and its strategic push into gaming and ad-supported subscriptions. Both moves have driven debate about future growth and risk.

- On our six-point valuation checklist, Netflix earns a 2 out of 6, reflecting that it currently appears undervalued in just two areas, but that only tells part of the story. Let's explore the different ways to size up Netflix's value, and stick around for a better approach that might surprise you at the end.

Netflix scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Netflix Discounted Cash Flow (DCF) Analysis

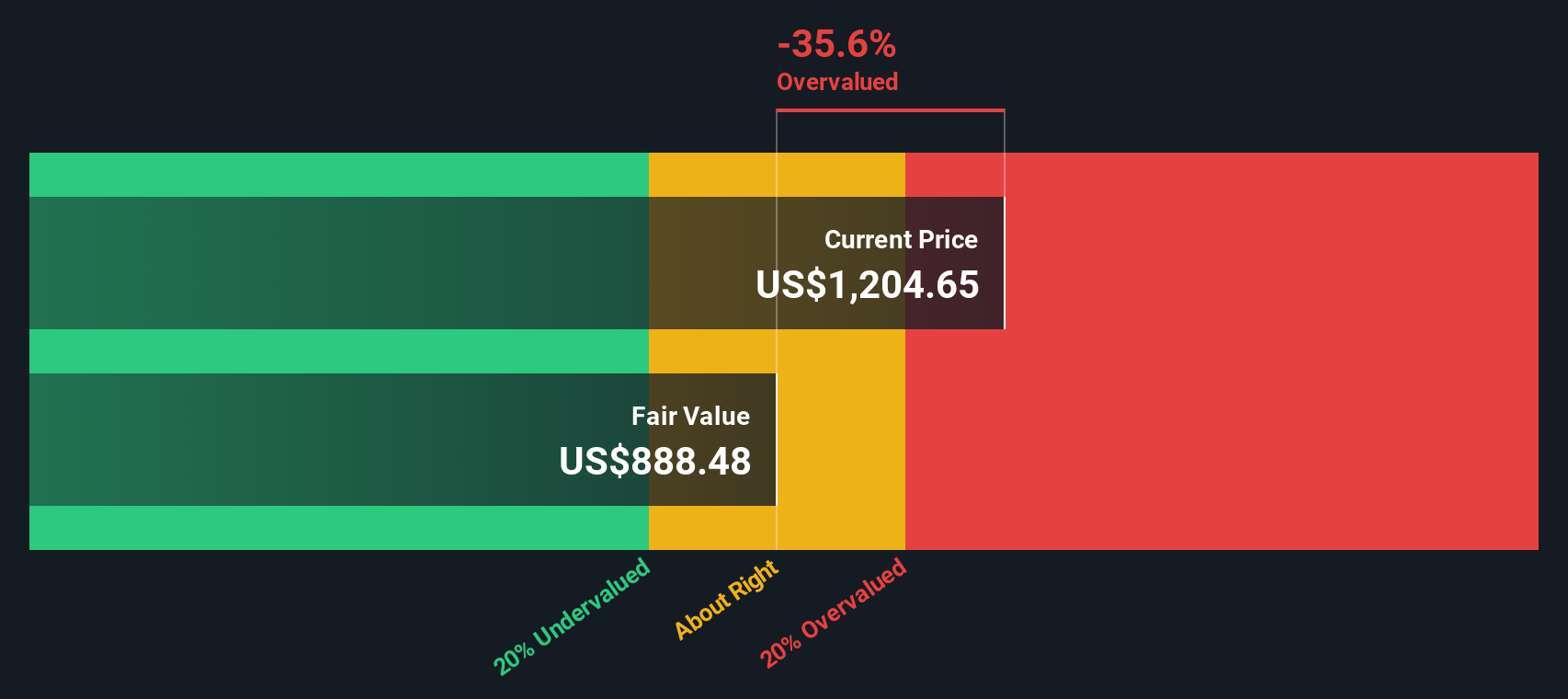

The Discounted Cash Flow (DCF) model projects a company's future cash flows and then discounts them back to today's value, giving investors an idea of what the company is really worth right now. For Netflix, this approach uses a 2 Stage Free Cash Flow to Equity method, which considers both near-term analyst estimates and longer-term extrapolations by Simply Wall St.

Currently, Netflix's Free Cash Flow stands at $9.06 Billion. Analysts forecast that by 2029, this figure could more than double to approximately $20.57 Billion, with further growth projected beyond that. The DCF model weighs these future billions in free cash flow and brings them back to present-day value, taking into account uncertainty and risk over time.

Based on these projections, the DCF arrives at an estimated intrinsic value of $874.95 per share. However, this valuation suggests the stock is about 25.5% overvalued compared to its current price.

While Netflix's future growth in cash generation appears solid, the numbers indicate the market is pricing in expectations that may be slightly too optimistic for now.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Netflix may be overvalued by 25.5%. Discover 836 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Netflix Price vs Earnings

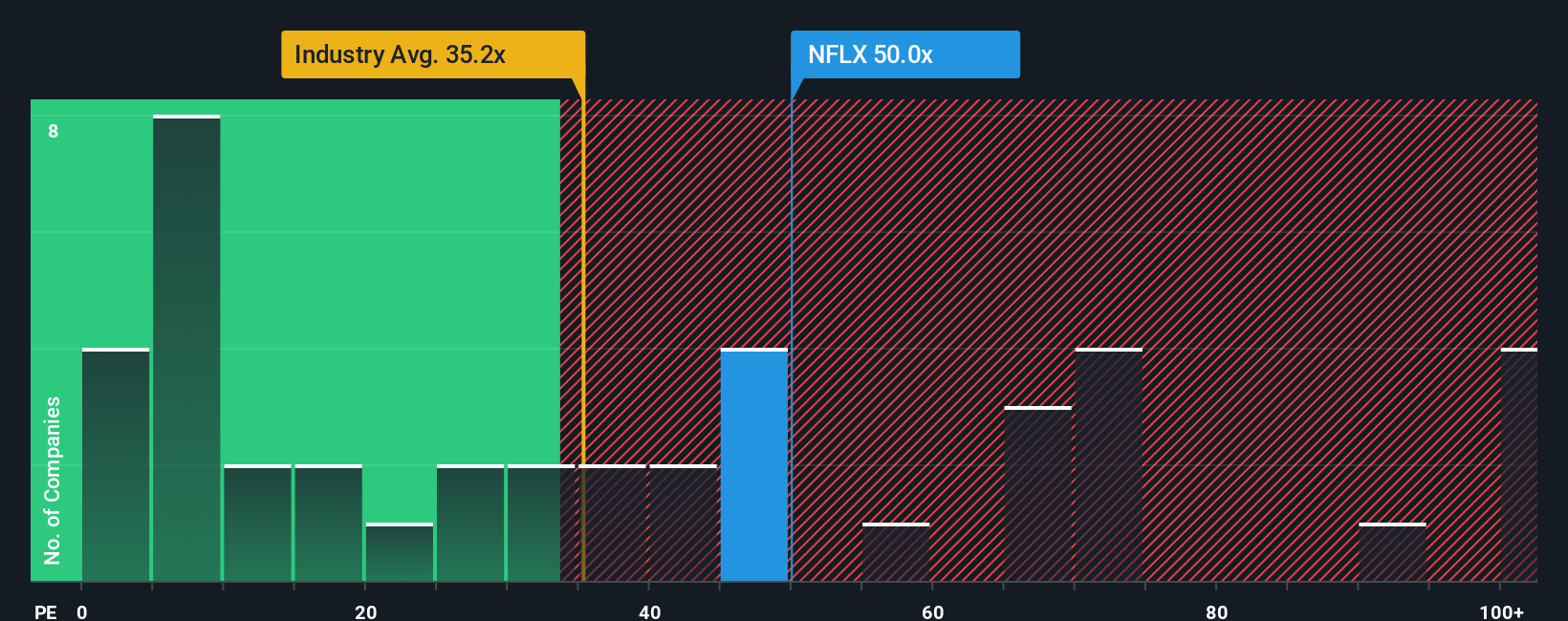

The Price-to-Earnings (PE) ratio is a popular and useful valuation measure for profitable companies like Netflix because it allows investors to see how much they are paying for each dollar of current earnings. Since Netflix is steadily profitable, the PE ratio gives a snapshot of how the market values its earnings power relative to its peers and the broader industry.

Of course, what counts as a "normal" or fair PE depends on investor expectations for future earnings growth, as well as perceived risks. Companies with higher expected growth or lower risk often justify a higher PE, while mature or riskier businesses typically trade for less.

Currently, Netflix is trading at a PE ratio of 44.6x. That is strikingly higher than the average PE for the Entertainment industry, which sits at 24.8x, and even above the peer average of 56.7x. To dig deeper, Simply Wall St calculates a proprietary "Fair Ratio" for Netflix. This metric factors in earnings growth prospects, profit margins, industry dynamics, company size, and relevant risks, and currently lands at 36.2x.

The strength of the Fair Ratio is that it reflects what investors should be willing to pay for Netflix's earnings, beyond straightforward peer or industry comparisons. By incorporating company-specific metrics alongside market context, it serves as a more nuanced, tailored benchmark for what "fair value" really means for Netflix at this time.

Comparing Netflix’s actual PE of 44.6x to its Fair Ratio of 36.2x, the stock appears a little richly priced on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Netflix Narrative

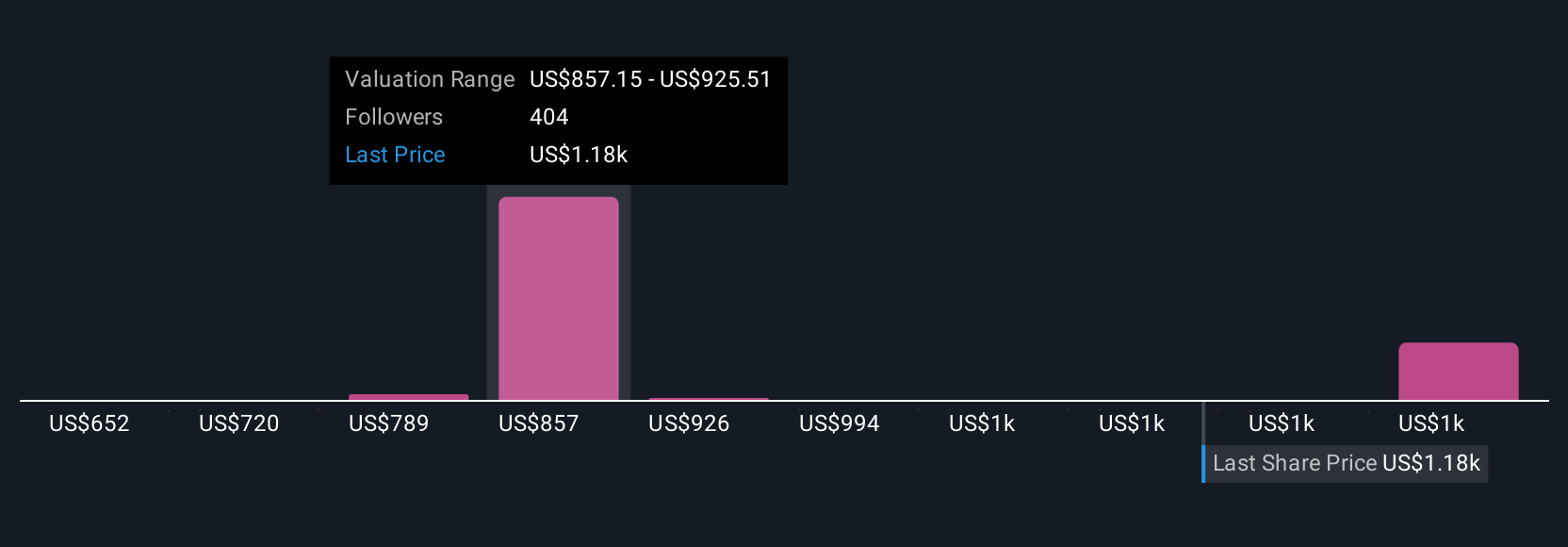

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or perspective about a company, combining your view of its future with concrete financial forecasts like fair value, expected revenue, profit margins, and growth. Instead of relying solely on ratios or broad consensus, Narratives connect what you believe about Netflix—why and how it will succeed or face challenges—directly to numbers and valuation outcomes, making the story behind your investment decisions both explicit and actionable.

On Simply Wall St's Community page, millions of investors are already using Narratives to visualize their reasoning and track how their fair value compares to the current market price, helping them confidently decide when to buy or sell. Narratives are updated dynamically with every new earnings report or news event, so your view always reflects the latest information. For example, some investors may see Netflix's future fair value at $1,600 per share, expecting international ad-tech growth and operational leverage, while others set it much lower, at $750, focusing on risks from competition, costs, and changing habits. With Narratives, you can build and refine your own smarter investment story as the Netflix journey evolves.

For Netflix, however, we'll make it really easy for you with previews of two leading Netflix Narratives:

Fair Value: $1,350.32

Currently Identified as: 18.6% undervalued

Projected Revenue Growth Rate: 12.5%

- The rollout of Netflix's proprietary ad technology and international partnerships is expected to drive stronger monetization and subscriber gains, which could fuel top-line and margin expansion.

- Investments in regional, high-quality content and advanced AI for user experiences are forecast to boost engagement, retention, and operational efficiency.

- Key risks include intensifying competition, escalating content costs, market saturation in mature geographies, evolving viewing habits, and increasing global regulatory pressures.

Fair Value: $797.74

Currently Identified as: 37.7% overvalued

Projected Revenue Growth Rate: 13.0%

- Industry consolidation and Netflix's ad-supported and premium sharing initiatives are anticipated to support ongoing subscriber and revenue growth, with ARPM expected to rise over time.

- Operational discipline in content costs and scaling efficiencies should expand margin and cash flows, even as content competition persists.

- Risks involve execution challenges on new business strategies, slowing subscriber growth after initial paid-sharing gains, and possible market revaluation if growth expectations are not sustained.

Do you think there's more to the story for Netflix? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives