- United States

- /

- Media

- /

- NasdaqGS:MGNI

Magnite’s Valuation in Focus After 12% Rally and New Partnership News

Reviewed by Bailey Pemberton

If you're wondering what to do with Magnite stock right now, you're definitely not alone. After a nearly 12% pop in just the past week, following a near-10% dip over the last month, Magnite has put on quite a rollercoaster performance. Looking further back, the year-to-date return stands at a strong 23.9%, and over the past year the stock has soared nearly 60%. If you were among the early believers, the long-term returns over the past three and five years—172.4% and 120.8%, respectively—really make the case for staying power.

Some recent moves in Magnite’s share price seem linked to industry-wide trends in digital advertising and the shifting landscape for programmatic platforms. Just last week, news broke about a growing partnership network that has the potential to expand Magnite’s reach among premium content publishers. This may have contributed to a wave of renewed optimism around the company’s potential to capture market share as media buyers look for scalable solutions.

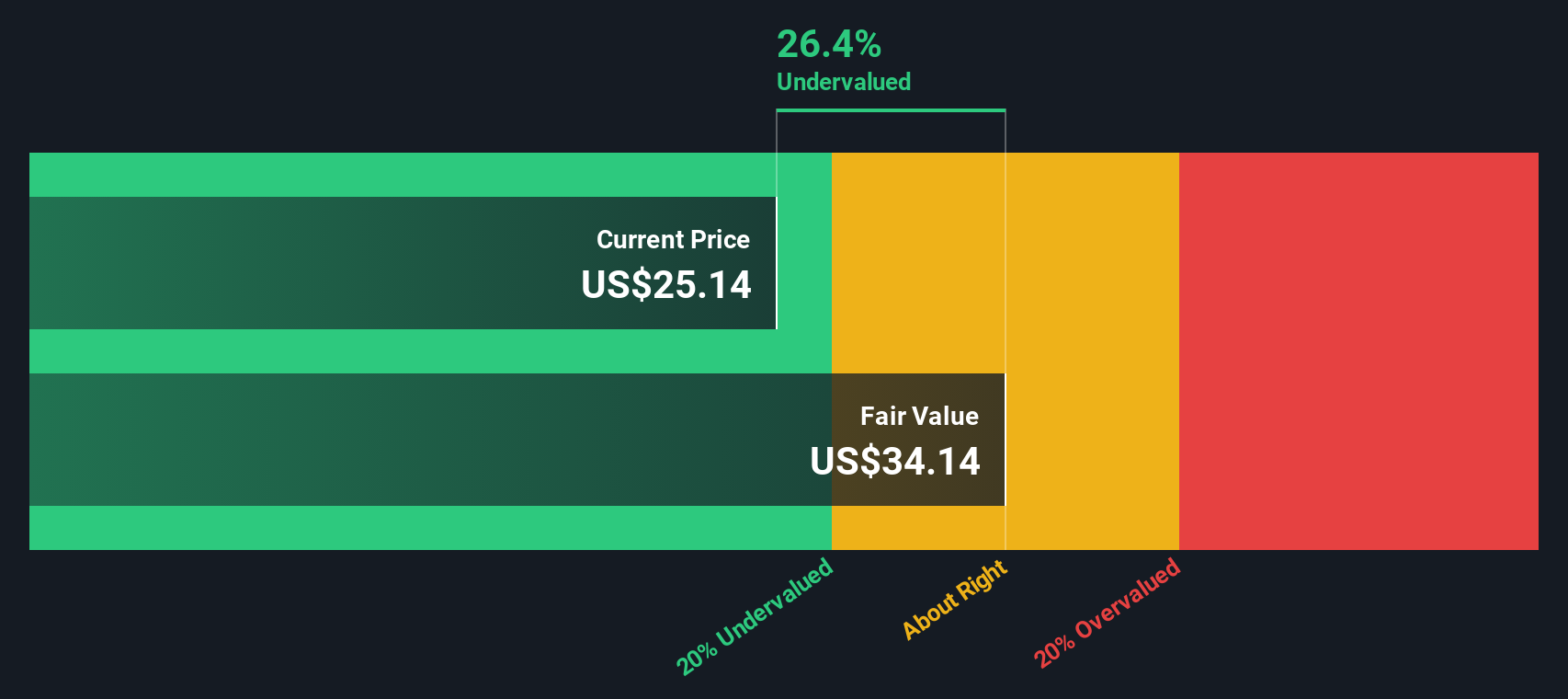

But what about Magnite’s valuation? According to our valuation model, which includes six different checks ranging from traditional price-to-earnings ratios to discounted cash flow analysis, Magnite is scoring a 3 out of 6. That is a clear sign it is undervalued in half the major ways investors typically measure opportunities. Of course, understanding whether a stock is truly undervalued goes far beyond just checking boxes.

Let’s take a closer look at the main valuation approaches in the next section, and then consider whether there is an even more insightful way to assess Magnite’s true worth.

Approach 1: Magnite Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and then discounting them back to today’s dollars. For Magnite, this involves analyzing how much cash the company is expected to generate each year and then summing the present value of those future amounts.

Currently, Magnite’s Free Cash Flow stands at $175.5 million. According to projections, analysts expect this to reach $387 million by the end of 2027. Beyond 2027, Simply Wall St extrapolates these numbers and estimates continued growth, so that by 2035, Free Cash Flow could be approaching $987 million. All projections are denominated in USD. These forecasts suggest robust scaling capacity, with the DCF model capturing both analyst consensus and longer-term trends.

After discounting these projected cash flows, the DCF analysis produces an estimated intrinsic value of $121.44 per share. This value implies the stock trades at an 83.6% discount to its intrinsic worth, suggesting Magnite is significantly undervalued at current market prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Magnite is undervalued by 83.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Magnite Price vs Earnings (PE)

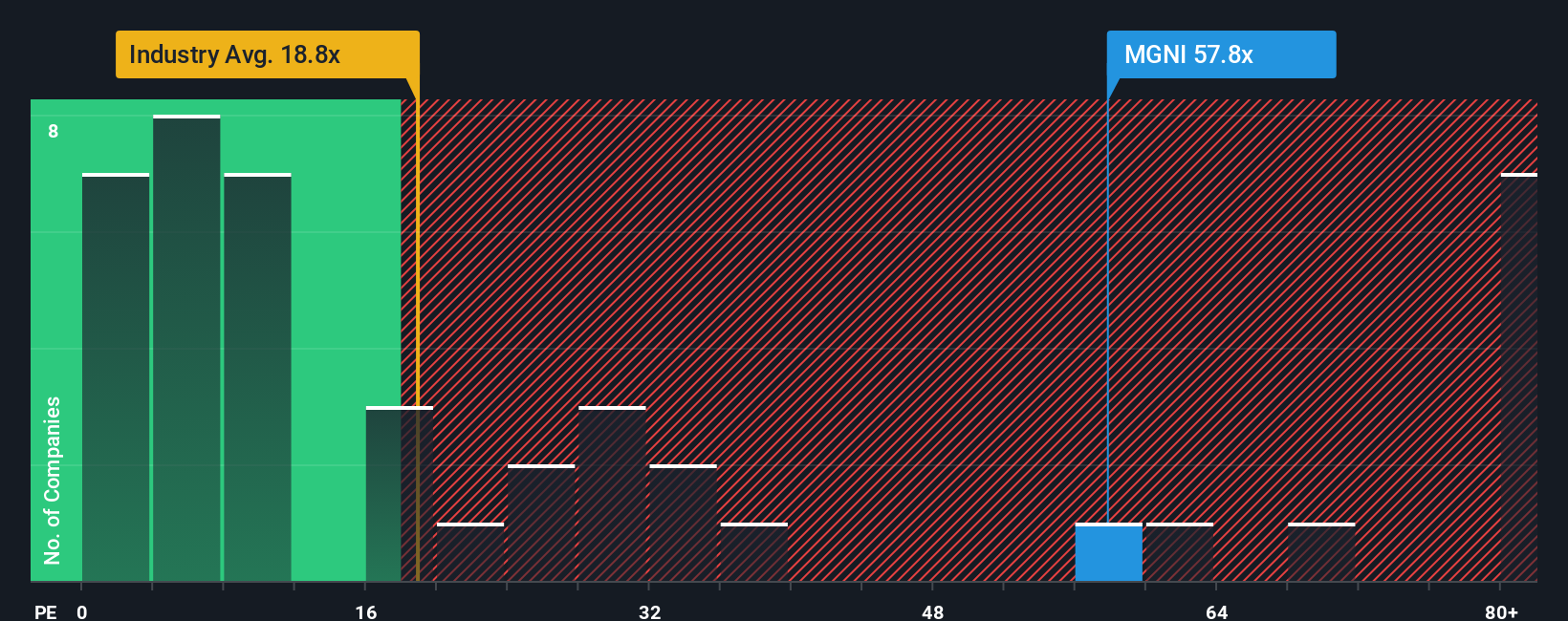

The Price-to-Earnings (PE) ratio is one of the most widely used valuation methods for companies that are currently profitable, as it directly links a company’s share price to its earnings performance. For Magnite, which has moved into profitability, the PE ratio is a logical metric to gauge whether investors are getting good value relative to the company’s ability to generate earnings.

A “normal” or “fair” PE ratio for any stock depends on factors like expected future growth, profitability, and risk. Rapidly growing companies or those with more stable earnings may warrant higher PE multiples, while companies facing uncertainty or lower growth often trade at lower ratios. At present, Magnite’s PE sits at 65.84x. By comparison, the media industry average stands at 19.63x, and direct peers are averaging 48.45x, suggesting Magnite trades at a substantial premium.

However, Simply Wall St’s proprietary “Fair Ratio” takes this further by estimating the most appropriate PE multiple based on Magnite’s earnings growth potential, risk profile, profit margins, market cap, and its industry context. This Fair Ratio for Magnite currently stands at 29.65x, which is more comprehensive than a simple peer or industry average comparison, as it adjusts for company-specific strengths and vulnerabilities.

Comparing Magnite’s actual PE of 65.84x to its Fair Ratio of 29.65x indicates the stock is trading well above what is justified by its underlying fundamentals, making it look overvalued on this basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Magnite Narrative

Earlier, we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives, a smarter, more dynamic approach to investment decisions that goes far beyond just crunching numbers. A Narrative lets you craft your own story about a company, connecting your unique perspective on Magnite's future (such as where revenue, margins, or risks are headed) to an actionable financial forecast and a personal fair value.

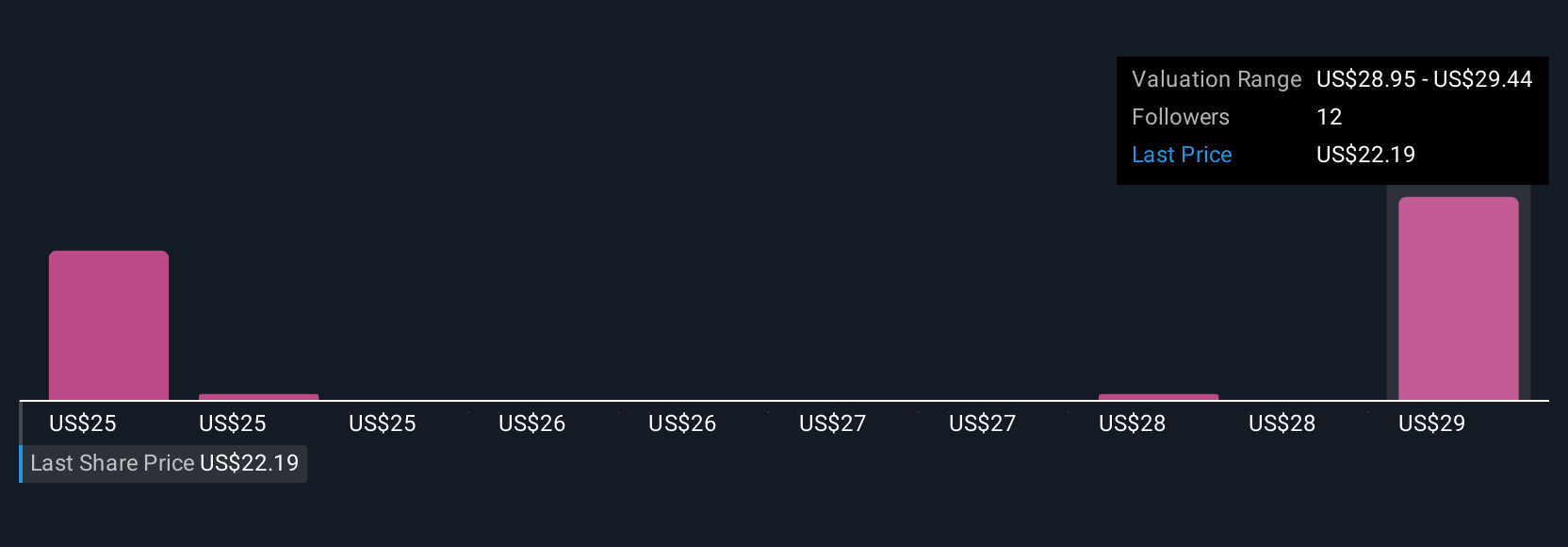

Unlike static valuation ratios, Narratives bring together the big picture, such as why you think Magnite will win or lose, and link it directly to real financial outcomes. This makes it a clear, approachable guide for when to buy or sell based on where your own Fair Value stands relative to the current share price. Best of all, Narratives are available for free on Simply Wall St’s Community page, where millions of investors update, compare, and discuss their scenarios in real time. Every Narrative is automatically refreshed with the latest news or earnings, so your view stays relevant. For example, on Magnite, some investors see its connected TV growth and partnerships driving fair values up to $39, while others flag margin risks or industry concentration, placing fair value closer to $24. Choose or create your own and let the Narrative guide your next move.

Do you think there's more to the story for Magnite? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGNI

Magnite

Operates an independent omni-channel sell-side advertising platform in the United States and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives