- United States

- /

- Media

- /

- NasdaqGS:MGNI

Magnite (MGNI) Is Up 11.6% After Reporting Strong Revenue and Free Cash Flow Growth Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Magnite recently reported exceptional revenue growth and strong profitability, highlighted by impressive free cash flow performance that supports ongoing investment and shareholder rewards.

- This financial performance suggests Magnite is well positioned to capitalize on opportunities in digital advertising and reinforces its ability to deliver returns through disciplined reinvestment.

- We'll now look at how Magnite’s robust free cash flow and profit profile influence its long-term investment outlook and digital market trajectory.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Magnite Investment Narrative Recap

To be a Magnite shareholder, you must believe that demand for transparent, independent programmatic advertising will keep rising, and that Magnite’s platform can maintain a leading role among connected TV and digital ad partners. The recent strong revenue growth and profitable free cash flow reinforce investor confidence, but do not significantly lessen the biggest short-term risk: Magnite’s heavy revenue reliance on large CTV streamers, where any contract change or in-housing by partners could create material volatility.

One recent announcement closely tied to Magnite’s financial position is the share buyback activity, including the repurchase of 369,700 shares for US$3.7 million this past quarter. While these buybacks signal management’s belief in Magnite’s value and add to shareholder returns, they do not mitigate the central risk of customer concentration, which remains tied to programmatic demand from leading streaming partners.

But with so much potential, investors should still be aware that Magnite’s concentration among major CTV streamers means…

Read the full narrative on Magnite (it's free!)

Magnite's narrative projects $796.3 million in revenue and $189.5 million in earnings by 2028. This requires 5.1% yearly revenue growth and a $146.4 million earnings increase from $43.1 million today.

Uncover how Magnite's forecasts yield a $28.19 fair value, a 41% upside to its current price.

Exploring Other Perspectives

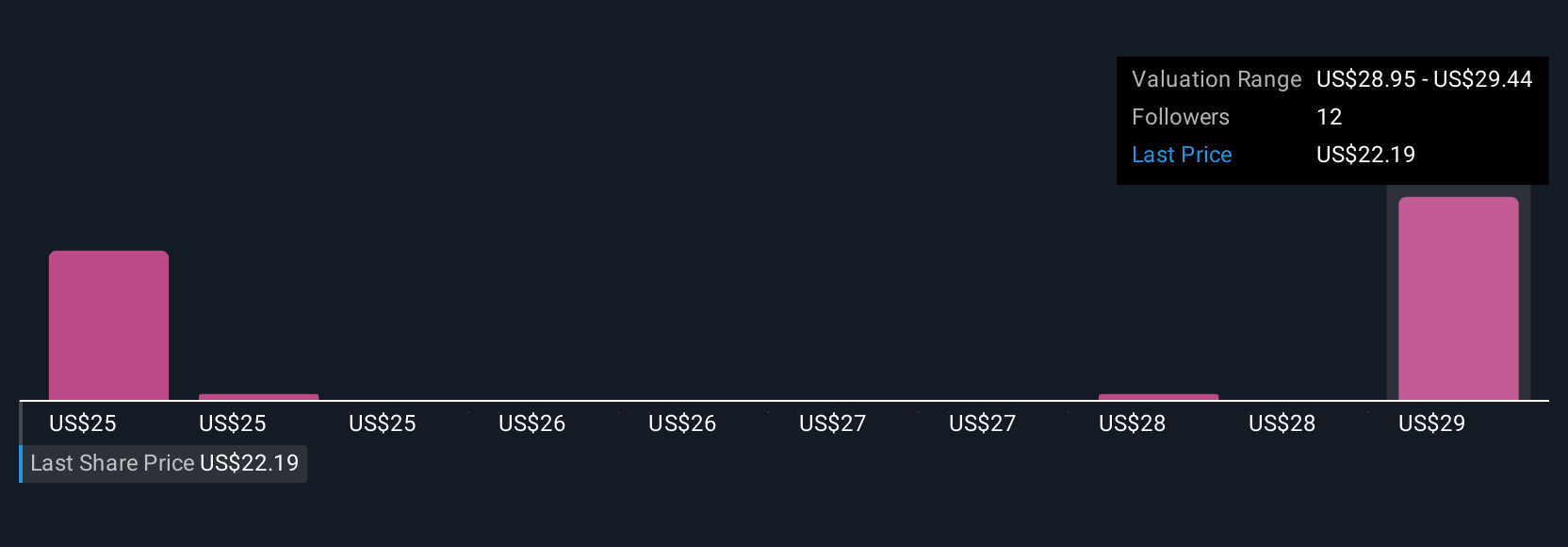

Simply Wall St Community members valued Magnite shares from US$24.70 up to US$120.79, reflecting five sharply different views. With such differing outlooks, it is important to consider how Magnite’s reliance on a few large streaming clients could affect future results.

Explore 5 other fair value estimates on Magnite - why the stock might be worth just $24.70!

Build Your Own Magnite Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Magnite research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Magnite research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Magnite's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGNI

Magnite

Operates an independent omni-channel sell-side advertising platform in the United States and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives