- United States

- /

- Media

- /

- NasdaqGS:MGNI

Exploring Magnite’s Valuation After Shares Drop 20.9% This Month

Reviewed by Bailey Pemberton

- Wondering if Magnite stock is a bargain or overpriced right now? Let’s explore what makes this company’s valuation interesting for curious investors.

- Despite some swings in sentiment lately, Magnite’s share price is down 2.8% this week, off 20.9% for the past month, and sits 12.1% lower year-to-date. However, it has gained nearly 40% over the past three years.

- Recent headlines highlight shifts in the digital advertising industry as Magnite navigates a rapidly changing landscape with new partnerships and technology developments that influence how ad space is bought and sold. These industry moves are fueling both excitement and questions about the company's future path.

- Magnite currently scores 3 out of 6 on our undervaluation checks, suggesting there is more to this stock’s story than just the headline numbers. From here, we will break down the key valuation methods used, and at the end of the article, I will share an even more insightful angle that gives you a deeper understanding of what Magnite might really be worth.

Approach 1: Magnite Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model calculates what a company could be worth today by projecting its future cash flows and discounting them back to the present. This approach helps estimate a stock’s intrinsic value based on how much cash the business is expected to generate in the coming years.

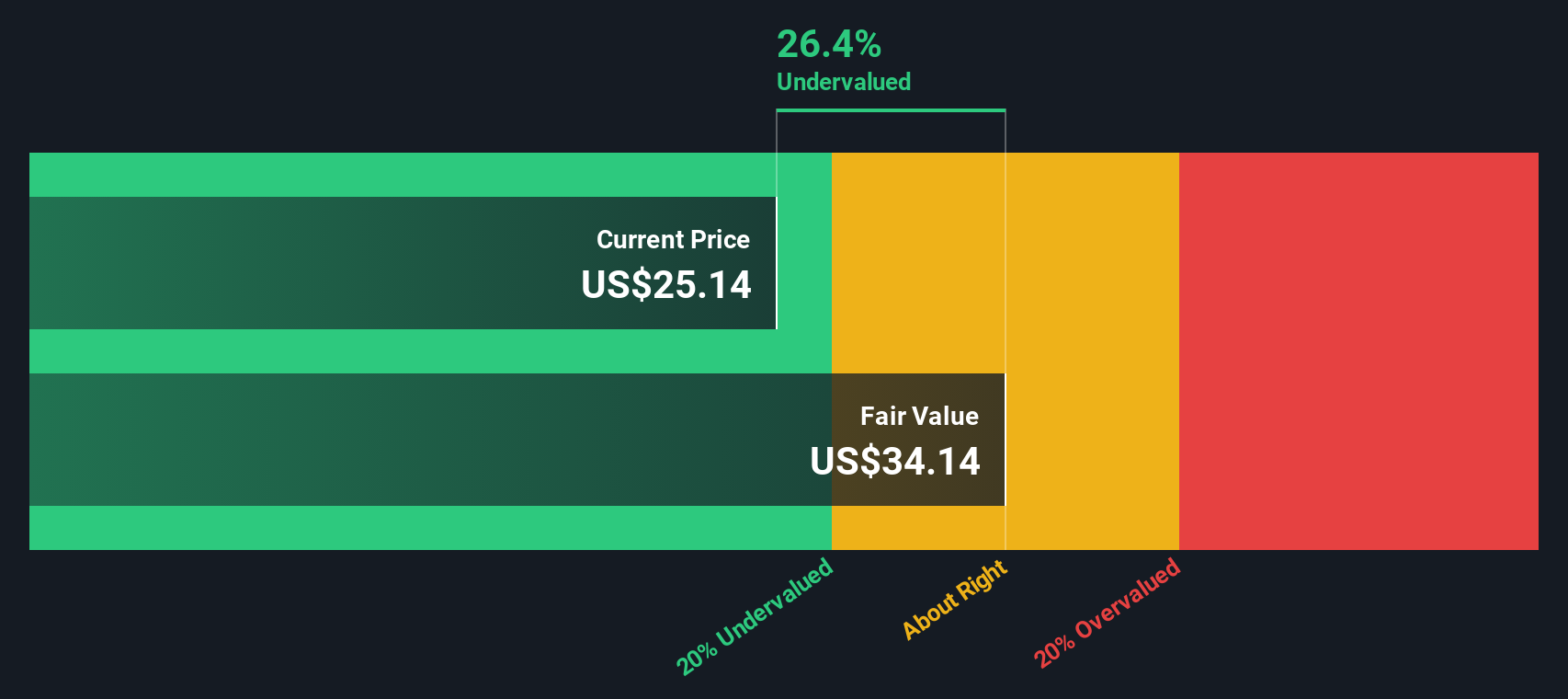

For Magnite, the current Free Cash Flow is $167.2 million. Analyst estimates suggest Free Cash Flow will reach $199.4 million by 2026. Projections extrapolated over the next decade imply continued moderate growth, supported by detailed analyst and internally generated estimates from Simply Wall St. By 2035, Free Cash Flow could climb as high as $312.4 million, providing a framework for long-term value assessment.

After crunching all these numbers, the DCF valuation puts Magnite’s intrinsic value at $42.28 per share. This represents a 66.5% discount to the recent trading price, indicating that, according to these cash flow projections, Magnite appears to be significantly undervalued at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Magnite is undervalued by 66.5%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: Magnite Price vs Earnings

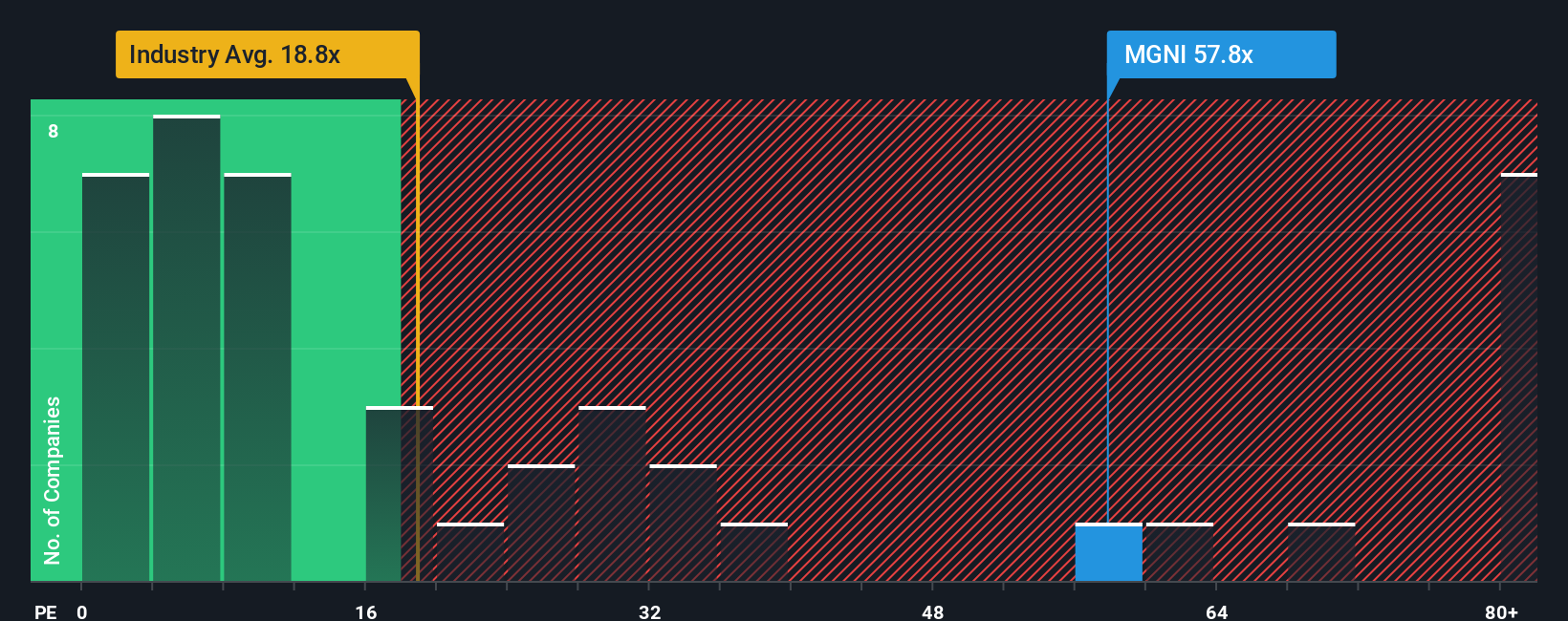

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Magnite, as it reflects how much investors are willing to pay per dollar of the company’s earnings. The PE ratio makes earnings growth and risk easy to compare between companies in the same sector. Generally, higher expected growth or lower risk justifies a higher “normal” or “fair” PE ratio, while companies with slower growth or greater risk should trade at a lower PE.

Currently, Magnite trades at a PE ratio of 35.1x. This is in line with the average for its peers, which sits at 35.6x, and well above the broader Media industry average of 16.1x. While a high PE ratio can sometimes be concerning, the context matters. Magnite’s positioning and growth profile may explain investor willingness to pay more.

The “Fair Ratio,” calculated by Simply Wall St, blends in factors beyond industry or peer comparisons, including Magnite’s expected earnings growth, margins, market cap, and risk profile. This makes it a more customized valuation benchmark. For Magnite, the Fair Ratio is 21.7x. By comparing the Fair Ratio with the actual PE, we see that Magnite’s shares look overvalued based on this more tailored view and are trading well above what would typically be justified for its fundamentals, even though they line up with peers.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1413 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Magnite Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company, including the reasoning and expectations behind your fair value calculation and your assumptions about future revenue, profit margins, and growth opportunities.

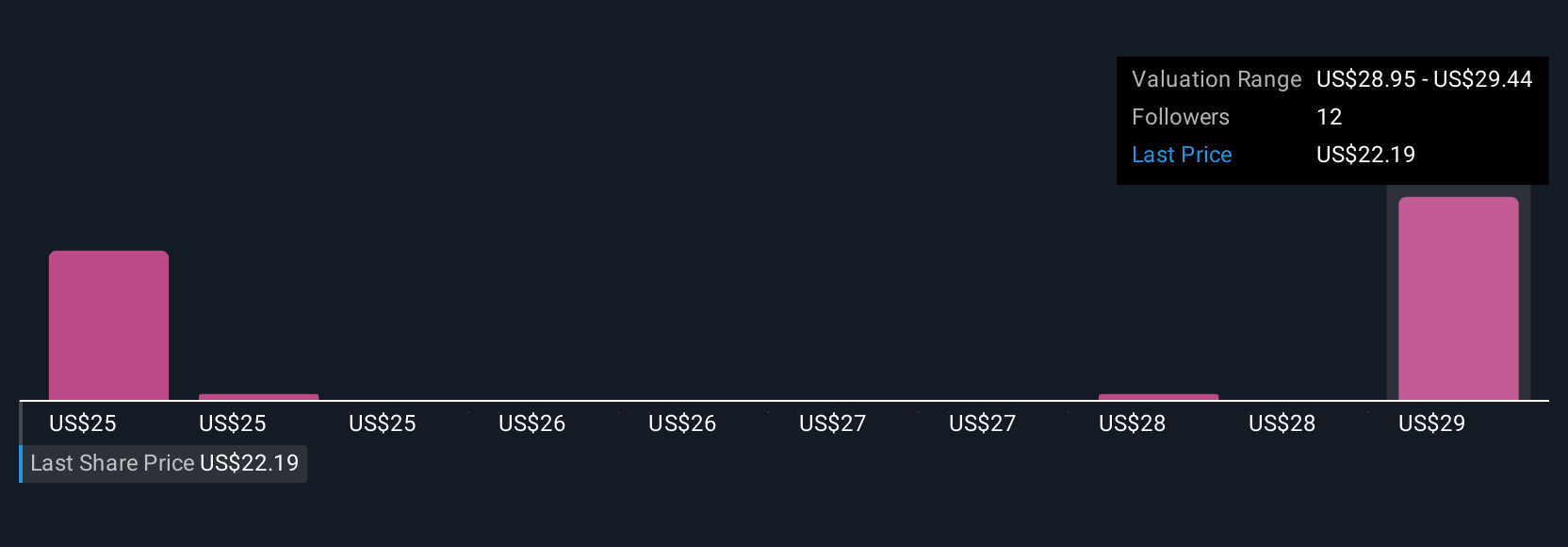

Instead of only relying on headline numbers, Narratives enable you to link Magnite’s evolving business story to your own financial forecasts and ultimately determine what you believe is a fair value for the stock. On Simply Wall St’s Community page, used by millions of investors, Narratives are at your fingertips and easy to create, update, and compare with others.

This approach not only helps you clarify why you might buy or sell shares, but also lets you see how your view compares to the market or analyst consensus by comparing your calculated Fair Value to the current Price. Narratives are dynamic and update instantly with new news, earnings results, or business updates, keeping your insights relevant in real time.

For example, some investors see Magnite heading toward a $39.00 target by 2028 due to its growth in connected TV and partnerships, while others remain cautious and set a fair value closer to $24.00 because of its customer concentration and industry risks.

Do you think there's more to the story for Magnite? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGNI

Magnite

Operates an independent omni-channel sell-side advertising platform in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives