- United States

- /

- Media

- /

- NasdaqGS:MGNI

Assessing Magnite (MGNI) Valuation After Recent Share Price Correction

Reviewed by Kshitija Bhandaru

Magnite (MGNI) has caught investors' attention lately as its stock performance diverges from broader sector trends. Over the past month, shares have dropped by 27%. This has prompted questions about the factors shaping sentiment around this US-based ad tech company.

See our latest analysis for Magnite.

While Magnite's 1-month share price return of -27% has caught many off guard, it is worth noting that this comes after a strong push earlier in the year. Despite the recent correction, the 1-year total shareholder return still sits at an impressive 41%, and investors who have held for three years have seen even larger gains. Short-term momentum is fading for now, as sentiment seems to have shifted, but long-term performance remains robust in the broader context.

If you’re curious what other dynamic companies are building momentum in the tech and AI sector, it’s a good time to explore See the full list for free.

With shares still trading 40% below average analyst price targets, but strong year-to-date and multi-year gains already logged, investors are faced with a dilemma. Is Magnite undervalued now, or is the market simply recognizing its future prospects?

Most Popular Narrative: 37.9% Undervalued

According to the most widely followed narrative, Magnite’s fair value sits significantly above its recent closing price, suggesting the market may be missing a major opportunity hidden in plain sight.

Magnite is positioned to benefit from the accelerating shift of ad spend from traditional TV to digital and connected TV (CTV) platforms, as evidenced by deepened partnerships with top streamers (Roku, Netflix, LG, Warner Bros. Discovery, Paramount) and expanding SMB participation in CTV. This shift is expected to drive sustained revenue growth and result in a higher-margin business mix.

Want to crack the code behind this lucrative narrative? The secret lies in a forward-looking earnings surge and bold expectations for future profitability. Which financial metric is the linchpin of this valuation? You’ll only know if you explore what drives analysts’ sky-high estimates. This could be the inflection point you’re waiting for.

Result: Fair Value of $28.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on major CTV partners and execution risks around regulatory shifts could quickly change Magnite's growth outlook and valuation story.

Find out about the key risks to this Magnite narrative.

Another View: Earnings Multiple Poses Caution

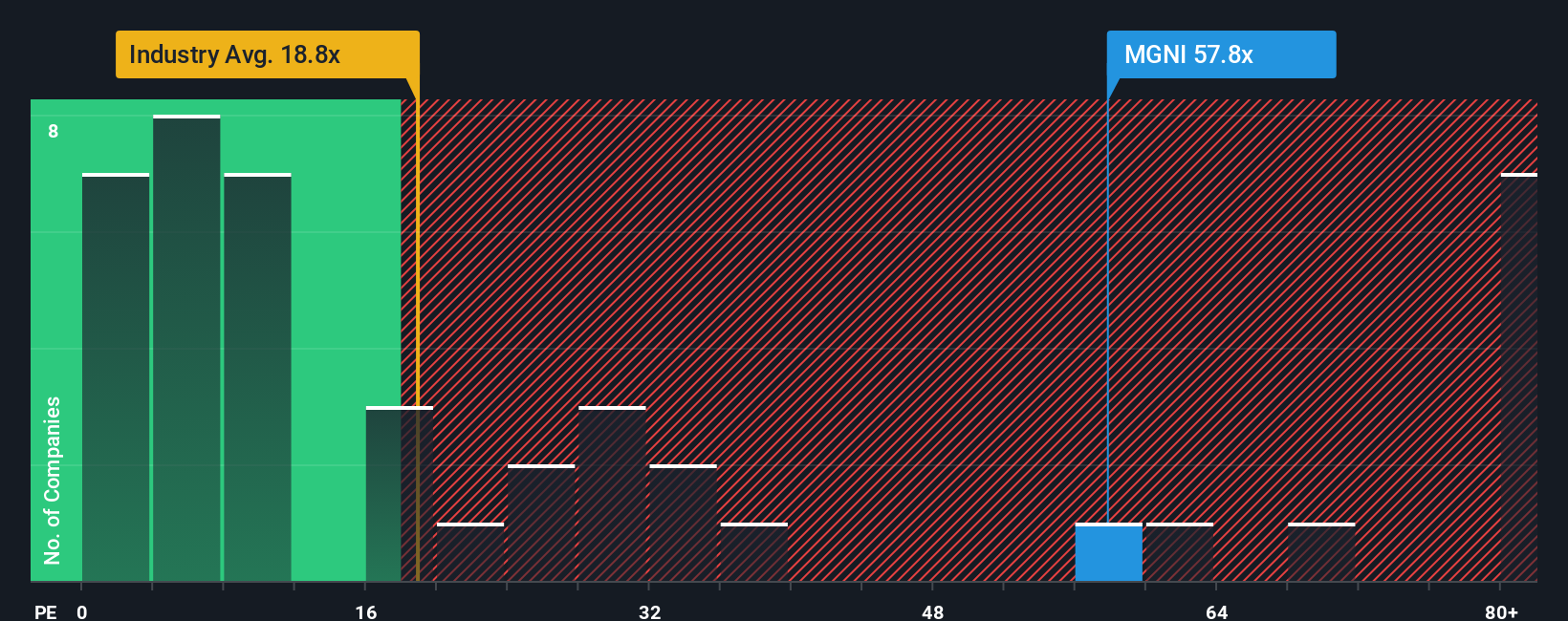

While Magnite appears deeply undervalued by some fair value estimates, its current price-to-earnings ratio of 57.8x is much higher than the US Media industry average of 18.8x and a fair ratio of 29.1x. This sharp gap signals valuation risk that could limit upside if market optimism fades. Does this make Magnite a value trap or a hidden gem?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Magnite Narrative

If you have your own perspective or want a deeper look at the numbers, building your own narrative is quick and easy. Just a few minutes is all it takes. Do it your way

A great starting point for your Magnite research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why settle for just one opportunity? There are smart investors finding their edge by tapping directly into trends that move markets and deliver real results.

- Tap into innovation by browsing these 26 quantum computing stocks, where companies push the boundaries of computing and technology.

- Kickstart your search for stable income with these 18 dividend stocks with yields > 3%, which offers robust yields and potential portfolio resilience.

- Spot high-potential leaders in artificial intelligence with these 25 AI penny stocks, capturing attention across future-focused industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGNI

Magnite

Operates an independent omni-channel sell-side advertising platform in the United States and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives