- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Meta Platforms (META) Declares US$0.53 Dividend for Class A and B Shares

Reviewed by Simply Wall St

Meta Platforms (META) recently declared a steady quarterly cash dividend of $0.525 per share, underscoring its commitment to shareholder value. Over the last quarter, Meta's share price climbed 10%, which is aligned with the broader market's upward movement. The company's positive earnings report, with substantial year-over-year sales and net income growth, and strategic joint ventures, including a partnership with Reliance Industries, likely reinforced investor confidence. While the tech-heavy Nasdaq reached new record highs, Meta's focus on AI and sustainable business expansions might have added weight to its share price increase during this period.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

Meta Platforms' recent quarterly dividend announcement aligns with its broader strategy to enhance shareholder value, potentially reaffirming investor confidence in the company's long-term growth prospects. Over the past three years, Meta's total shareholder returns have reached about 404.86%, highlighting substantial long-term gains for investors. In contrast, over the last year, Meta underperformed compared to the US Interactive Media and Services industry, which saw a 50% return, indicating challenges in maintaining recent momentum.

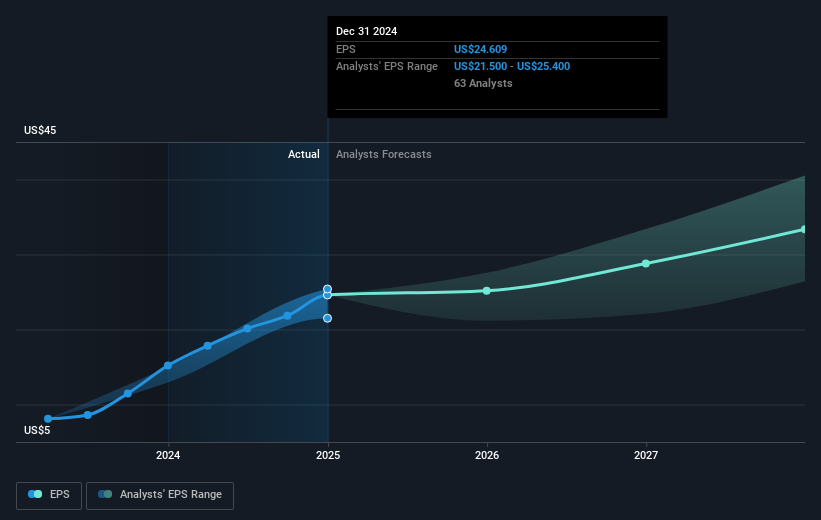

Current market dynamics and Meta's innovations in AI and digital commerce could significantly influence future revenue and earnings. The ongoing advancements in AI-driven ad targeting and expanded digital commerce initiatives are expected to drive revenue growth. However, increasing investment in AI and metaverse-related projects may pressure profit margins. With Meta's current share price at US$750.90, it remains below consensus analyst price targets of US$863.20. This suggests that analysts anticipate further growth potential, supported by strong future earnings forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success