- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Meta (META) Profit Margin Down to 30.9% Versus 35.6%—Community Optimism Faces Reality Check

Reviewed by Simply Wall St

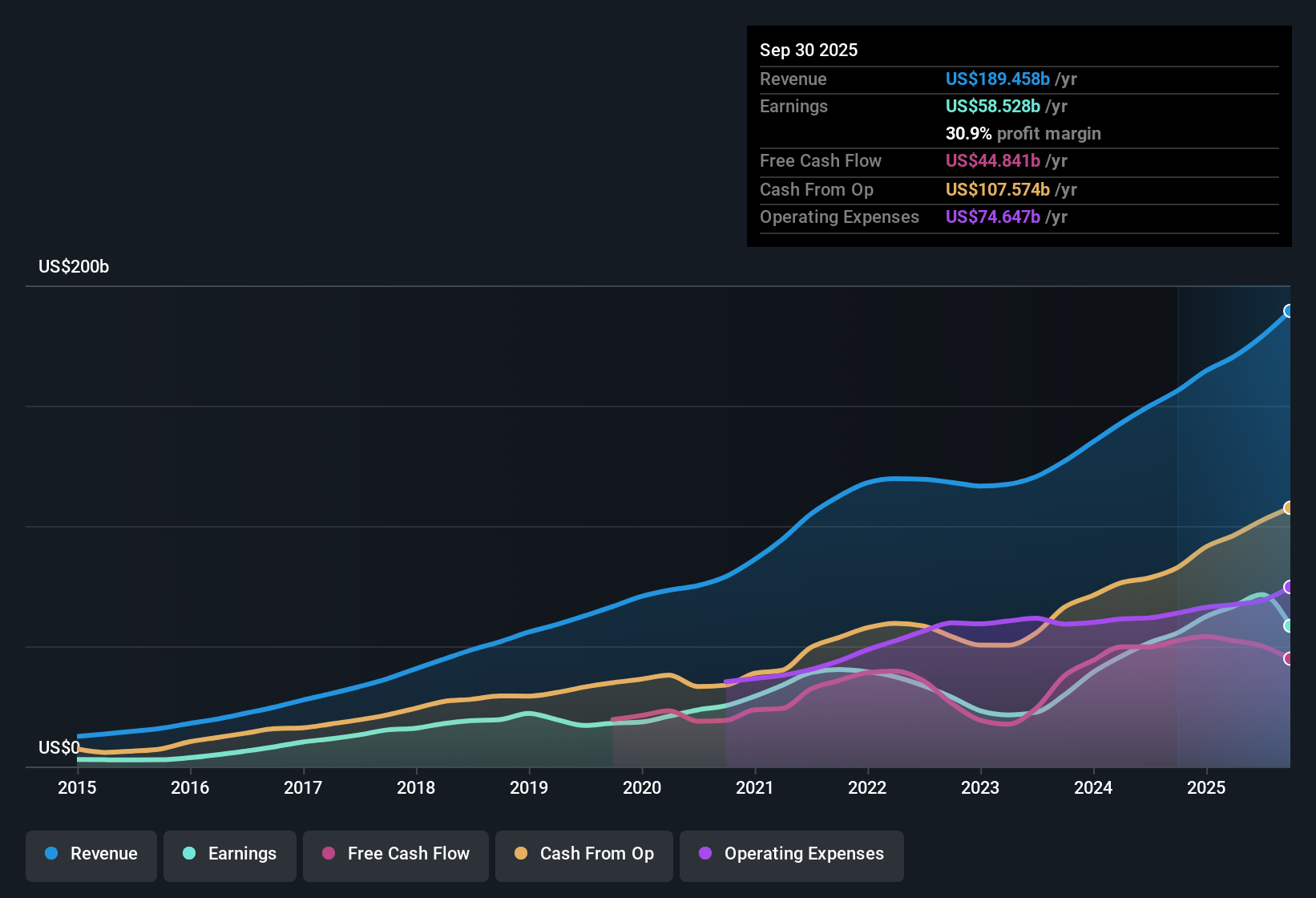

Meta Platforms (META) reported earnings that have grown by 17.2% annually over the past five years, but recent annual earnings growth slowed to 5.4%, falling below the company’s five-year average. Revenue is projected to grow at 13.7% per year, outpacing the broader US market’s expected rate of 10.3%. Earnings are forecast to rise at 13.8% annually, slightly behind the US market’s 15.9% pace. Net profit margins sit at 30.9%, down from 35.6% last year, reflecting moderating profitability yet strong overall quality and ongoing growth drivers for investors to weigh.

See our full analysis for Meta Platforms.Now let's see how this latest performance measures up against the most widely discussed analyst and community narratives for Meta. Some long-held beliefs could get reinforced, while others might face new questions.

See what the community is saying about Meta Platforms

Advertising ROI Surges on AI Enhancements

- AI-driven ad targeting and content delivery have led to a 5% increase in ad conversions on Instagram and a 3% bump on Facebook. This has materially improved advertiser ROI and diversified Meta’s revenue streams.

- Analysts' consensus view sees these technical upgrades fueling long-term revenue growth. Platform ecosystem advantages and higher engagement support expanded monetization and help defend market share.

- Consensus narrative notes Meta’s investment in AI infrastructure is driving a global increase in video engagement, with time spent on Instagram and Facebook video up over 20% year-over-year.

- The story deepens as business messaging and click-to-message ad formats open incremental revenue, while messaging platform monetization efforts ramp up.

- For the full picture on how analysts are weighing Meta’s AI and advertising strategy, see the complete consensus narrative. 📊 Read the full Meta Platforms Consensus Narrative.

Margin Pressures Amid Rising Operating Costs

- Net profit margins declined to 30.9% from 35.6% last year as rapid increases in operating expenses and capital expenditures tied to AI and metaverse projects begin to compress profitability.

- Consensus narrative flags risks that expense growth could outpace revenue.

- Storylines from Reality Labs show $4.5 billion in operating losses for Q2 alone. The uncertain monetization timeline for these initiatives worries analysts about margin rebound and long-term net income quality.

- Regulatory headwinds in the EU and global scrutiny over digital advertising business models may further weigh on costs and margin sustainability going forward.

P/E Discount to Analyst Targets and DCF Fair Value

- Meta trades at a Price-to-Earnings ratio of 28.6x, comfortably below the blended analyst price target of $848.43 and noticeably under the DCF fair value estimate of $1,001.23, even though its valuation is above the broader industry average PE of 15.2x.

- According to the consensus narrative, Meta’s valuation tension will hinge on durable revenue growth and willingness to accept premium multiples.

- Consensus points out that for the price to reach analyst targets, Meta needs to maintain its current momentum and justify an industry-leading PE of 29.2x by 2028 on estimated $92.1 billion earnings.

- The market’s implicit 11.3% upside to target price is set against mixed signals, with share price already strong at $666.47.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Meta Platforms on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an angle others might miss? Share your perspective and craft a unique narrative in just a few moments with Do it your way.

A great starting point for your Meta Platforms research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Meta’s shrinking profit margins and uncertain expense trends raise concerns about maintaining steady earnings and consistent long-term financial outperformance.

If stable results matter to you, check out stable growth stocks screener (2111 results) to quickly spot companies with proven records of resilient, reliable growth and performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives