- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:JOYY

Why JOYY’s (JOYY) AI-Driven Ad Gains and Dividends Matter for Its Long-Term Strategy

Reviewed by Sasha Jovanovic

- JOYY Inc. recently reported its third quarter 2025 results, highlighting sequential growth in livestreaming revenue, a 29.2% year-over-year increase in advertising revenue, and reaffirmed its commitment to shareholder returns through dividends and share repurchases.

- A unique detail is that JOYY’s BIGO Ads business and accelerated AI-powered advertising initiatives are driving revenue growth across developed markets, supporting the company’s dual focus on livestreaming and advertising technology for sustained operational performance.

- We will examine how JOYY’s robust expansion in advertising and renewed dividend commitment shape its updated investment narrative and future outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

JOYY Investment Narrative Recap

For investors considering JOYY, the big picture hinges on the company’s ability to sustain growth in both livestreaming and ad tech, while managing competition and navigating regulatory uncertainty. The latest earnings and dividend increase reinforce JOYY’s focus on returning capital to shareholders, but they do not materially change the most important near-term catalyst, executing on its advertising technology momentum, or the key risk posed by evolving regional regulations.

The newly announced fourth quarter dividend of US$0.97 per ADS stands out, underlining JOYY’s ongoing commitment to returning capital despite recent year-over-year revenue declines. This move is particularly relevant as the share repurchase program, which completed a tranche worth US$88.6 million, aligns with shareholder value strategies at a time when market participants remain focused on the impact of regulatory changes on JOYY’s overseas revenue prospects.

In contrast, investors should also be mindful of tightening regulation and its potential to...

Read the full narrative on JOYY (it's free!)

JOYY's outlook forecasts $2.4 billion in revenue and $267.8 million in earnings by 2028. This scenario assumes 4.0% annual revenue growth but a sharp decrease in earnings, down $1.43 billion from the current $1.7 billion.

Uncover how JOYY's forecasts yield a $62.56 fair value, in line with its current price.

Exploring Other Perspectives

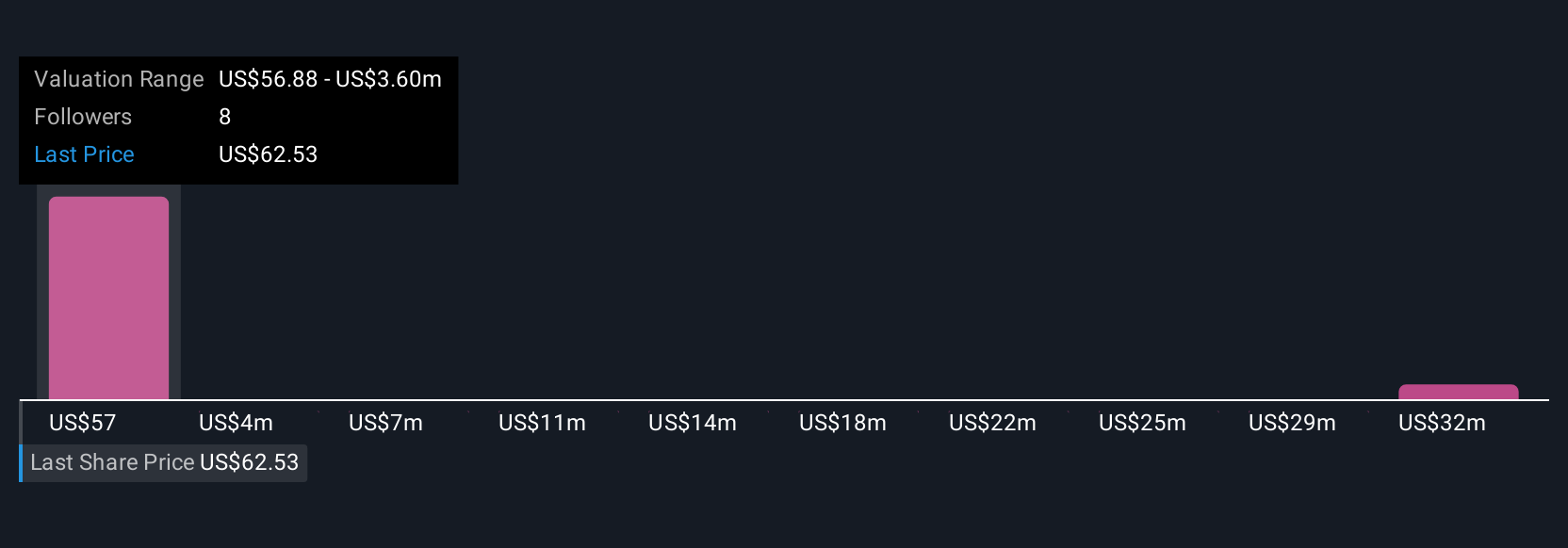

Fair value estimates from four Simply Wall St Community members range from US$37.18 to US$235.32 per share. These wide-ranging views come as many expect JOYY’s international growth efforts to face increased regulatory challenges impacting potential future revenue expansion.

Explore 4 other fair value estimates on JOYY - why the stock might be worth 40% less than the current price!

Build Your Own JOYY Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JOYY research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free JOYY research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JOYY's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JOYY

JOYY

Engages in the provision of social product matrix and communication technology.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives