- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GTM

ZoomInfo (GTM) Net Margin Jumps to 8.4%, Challenging Profitability Concerns

Reviewed by Simply Wall St

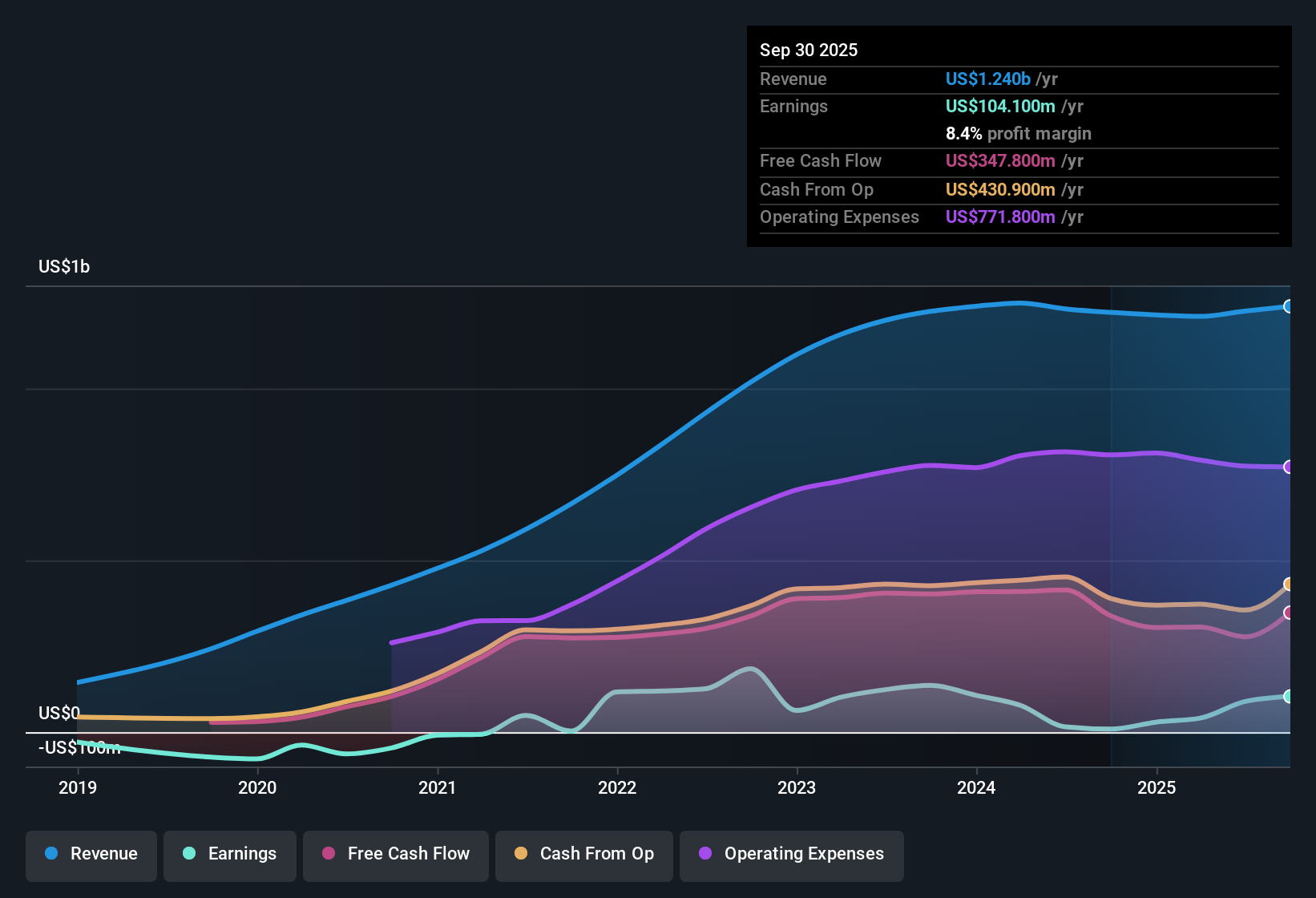

ZoomInfo Technologies (GTM) posted a net profit margin of 8.4%, a substantial jump from last year’s 0.7%, even after absorbing a hefty one-off loss of $101.6 million over the last twelve months through September 30, 2025. Earnings are projected to grow at 19.6% per year, outpacing the US market's expected 16% annual growth, while revenue is set to rise at a slower 3.7% annually versus the market average of 10.5%. With sustained profitability gains and a discounted cash flow suggesting shares could be undervalued at the current $11.69 price point, investors see plenty to assess regarding future growth and valuation sentiment.

See our full analysis for ZoomInfo Technologies.The next step is setting those headline numbers against the wider market stories. We will break down how the latest results compare with the biggest narratives and where they diverge.

See what the community is saying about ZoomInfo Technologies

Margin Expansion Outpaces Industry Peers

- ZoomInfo’s net profit margin has reached 8.4%, well above last year’s 0.7% and now exceeding many comparable industry players. While the sector’s average PE sits at 16.9x, ZoomInfo’s is substantially higher at 35x.

- In the analysts' consensus view, accelerating adoption of AI-powered solutions and a successful focus on upmarket clients are credited as driving this margin expansion.

- Consensus narrative notes strategic upmarket moves and product innovation have led to improved operating leverage and recurring high-value contracts. This is reflected in more durable and increased margins compared to prior years.

- What is surprising is that despite these strong margins, ZoomInfo’s pricing power and client concentration mean profitability will increasingly depend on retaining large enterprise contracts, as flagged in consensus risk discussions.

- Consensus narrative links the sharp uptick in profitability to business model shifts and AI, highlighting both upside and a pivot in key risks. See how the consensus perspective weighs long-term growth and ongoing risks in our in-depth analysis. 📊 Read the full ZoomInfo Technologies Consensus Narrative.

Recurring Revenue Underpins Growth Story

- Five-year earnings growth has averaged 13.2% per year, supporting forecasts for a continued 19.6% annual increase, which is much faster than the broader US market’s 16% estimate.

- According to the consensus narrative, a combination of upmarket expansion and product integration is driving improved retention and higher-value, recurring contracts.

- Consensus narrative calls out the shift toward sophisticated, embedded data and analytics solutions, enabling customers to double annual spend and deepening account value. This is identified as a key factor in sustaining upward earnings momentum.

- Still, consensus notes long-term revenue growth will require stable international expansion and protection against commoditization, especially as downmarket revenues drop 11% year-over-year.

Valuation Discount Versus Fair Value

- Despite trading at a 35x PE, which is significantly above sector averages, ZoomInfo’s $11.69 share price remains far below its DCF fair value of $21.28. This points to possible undervaluation by cash flow metrics.

- The consensus narrative notes that even with improving earnings and margin trends, the fair value gap will narrow only if recurring growth and margin gains hold amid risks such as client concentration and regulatory pressures.

- The tension is clear: while DCF analysis signals the shares could be a bargain, the premium PE and industry risks mean investors must watch closely for sustained execution before rerating occurs.

- Consensus perspective encourages investors to evaluate both operating improvements and valuation in tandem, as analyst price targets only moderately exceed the current share price at $12.35.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for ZoomInfo Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these figures? Shape your own view in just minutes and add your perspective to the ongoing story. Do it your way

A great starting point for your ZoomInfo Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite accelerating earnings and margin improvements, ZoomInfo’s revenue growth is faltering, especially with an 11% drop in downmarket revenues and elevated reliance on large clients.

If consistency matters more to you than potential swings, use stable growth stocks screener (2083 results) to pinpoint companies demonstrating reliable revenue and earnings growth through any market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if ZoomInfo Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTM

ZoomInfo Technologies

Provides go-to-market intelligence and engagement platform for sales, marketing, operations, and recruiting professionals in the United States and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion