- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GTM

ZoomInfo (GTM): Assessing Valuation as Competitive Pressures Slow New Growth and Revenue Outlook

Reviewed by Simply Wall St

ZoomInfo Technologies (GTM) is drawing attention after recent commentary pointed to tougher competition weighing on its ability to secure new customers and prevent churn. This shift is evident in softer billings and a more subdued revenue outlook.

See our latest analysis for ZoomInfo Technologies.

Shares of ZoomInfo Technologies have seen some ups and downs lately. A recent bounce delivered a 7-day share price return of 6.4%, even as the stock remains well below its historical highs. Looking at the bigger picture, the company’s 1-year total shareholder return sits at just 3.7%, while its 3-year total return is still deep in negative territory. Momentum appears muted as ongoing competitive pressures are met with only modest long-term gains.

If you’re looking to spot other opportunities in the tech landscape, now’s a great moment to discover See the full list for free.

With valuations still at a modest discount but profit growth showing only gradual improvement, investors are left to wonder: is ZoomInfo Technologies a potential bargain at current levels, or is the market already accounting for future risks?

Most Popular Narrative: 4.4% Undervalued

With ZoomInfo Technologies closing at $11.14 and the narrative fair value sitting at $11.65, analysts currently see modest upside potential. This viewpoint brings into focus the drivers behind the company’s value proposition and what might prove decisive in the coming years.

"Enterprises are prioritizing digital transformation and high-quality, unified data as essential for enabling successful AI initiatives and workflow automation. This is pushing customers to increase reliance on ZoomInfo's integrated solutions (Data as a Service, Copilot, Go-To-Market Studio), which is strengthening customer retention rates and positioning the company for rising recurring revenues and improved net revenue retention."

Want the full playbook behind this valuation? The real story reveals ambitious targets for profit margin expansion and market leadership in AI-powered enterprise sales tech. Find out which assumptions support this premium and what future scenario could unlock even more upside.

Result: Fair Value of $11.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising customer concentration and ongoing declines in downmarket revenues could challenge ZoomInfo Technologies’ growth story if these issues are not addressed in the coming quarters.

Find out about the key risks to this ZoomInfo Technologies narrative.

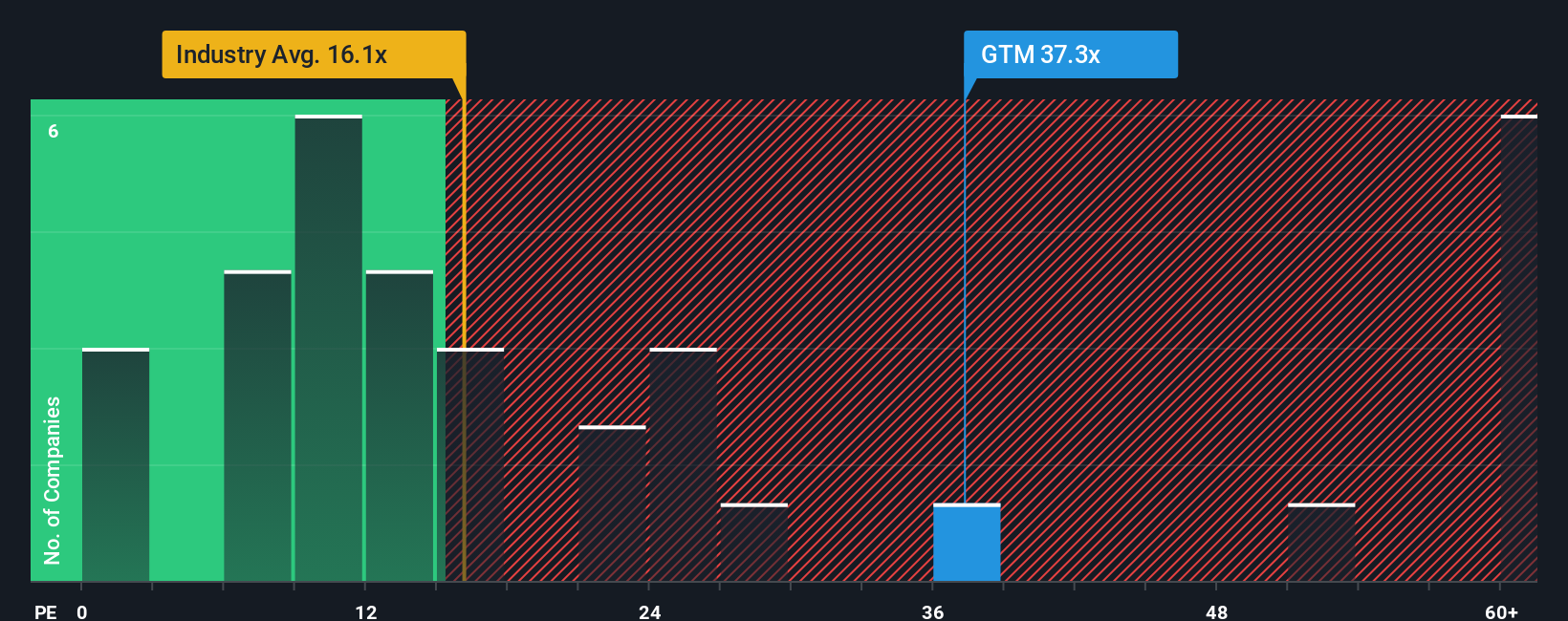

Another View: Earnings Ratio Signals Caution

Taking a different approach, ZoomInfo Technologies’ valuation using its price-to-earnings ratio calls for a closer look. The company currently trades at 39.8 times earnings, which is far above both its industry average of 15.5 and the peer group’s 9.6. The market’s fair ratio estimate is 23.4, which means ZoomInfo’s valuation is stretched compared to both peers and its own fundamentals. For investors, this signals possible valuation risk if expectations moderate or sector momentum shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ZoomInfo Technologies Narrative

If you prefer a different perspective or want hands-on insights, you can dive into the numbers and craft your own take in just minutes with Do it your way.

A great starting point for your ZoomInfo Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Set yourself up for market-beating opportunities by checking out these powerful stock picks. Don’t let the next big winner pass you by. See where other investors are focusing now.

- Spot income potential as you browse these 17 dividend stocks with yields > 3% that consistently deliver yields above 3% and bring reliability to your portfolio.

- Join the AI revolution and get ahead of the crowd with these 27 AI penny stocks primed for rapid growth in artificial intelligence and automation.

- Uncover hidden value and act early on these 872 undervalued stocks based on cash flows before they get noticed by the broader market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZoomInfo Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTM

ZoomInfo Technologies

Provides go-to-market intelligence and engagement platform for sales, marketing, operations, and recruiting professionals in the United States and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives