- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GTM

Assessing ZoomInfo (GTM) Valuation After Launch of AI-Powered Copilot Workspace for Revenue Teams

Reviewed by Kshitija Bhandaru

ZoomInfo Technologies (GTM) has just rolled out its new Copilot Workspace, an AI-powered platform aimed at upgrading how revenue teams execute their go-to-market strategies. This launch brings together multiple sales tools, automates routine tasks, and focuses on actionable intelligence for teams.

See our latest analysis for ZoomInfo Technologies.

While the Copilot Workspace launch highlights ZoomInfo's push for innovation in sales tech, the share price has seen turbulence lately, with a 30-day share price return of -11.8% and a year-to-date return of -1.7%. Long-term momentum remains a concern because the total shareholder return over both three and five years has fallen more than 76% despite revenue growth and periodic product updates.

If this shift toward AI-powered solutions has you thinking about where the next wave of tech opportunities might surface, check out See the full list for free..

With shares lagging despite steady revenue gains and ambitious AI launches, the big question now is whether ZoomInfo is trading at a bargain or if the market has already factored in all its potential growth.

Most Popular Narrative: 11.8% Undervalued

ZoomInfo Technologies' most widely followed narrative sees fair value at $11.65 per share, tipping the scales above the latest close of $10.28. Valuation optimism is set against a backdrop of persistent revenue growth and new AI products, suggesting some upside may remain underappreciated by the market.

Accelerating adoption of AI and automation by enterprise sales and marketing teams is driving more organizations to standardize ZoomInfo as their core go-to-market data foundation. This is demonstrated by record upmarket deals, increased platform embedding, and growing average contract values, which are factors likely to support durable revenue growth and eventual margin expansion.

Want to see which financial levers could lift this stock? The narrative builds on pivotal forecast shifts and margin ambitions no one is talking about yet. Dive in and uncover the bold projections behind the headline valuation.

Result: Fair Value of $11.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks with large enterprise clients or challenges from stricter global data regulations could quickly shift the growth story for ZoomInfo Technologies.

Find out about the key risks to this ZoomInfo Technologies narrative.

Another View: Price Tag Still Looks Steep

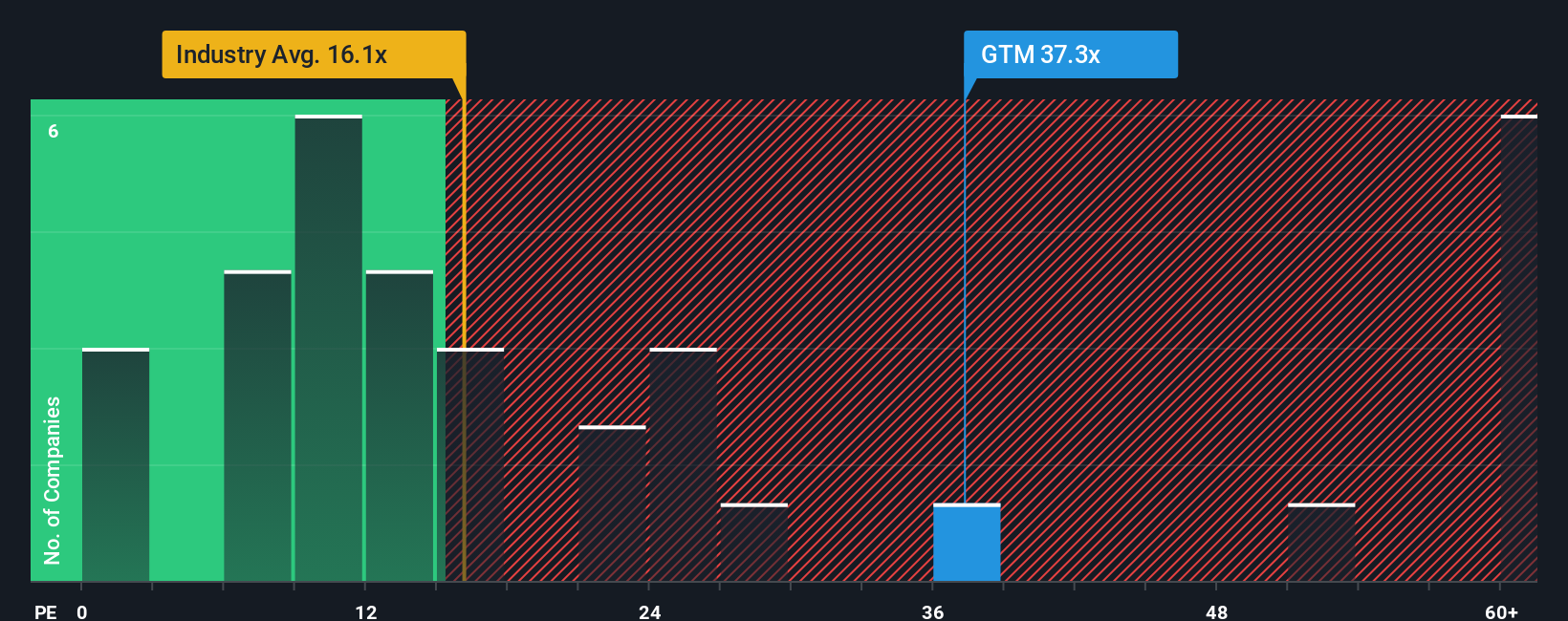

Stepping back from growth narratives, ZoomInfo Technologies’ current price-to-earnings ratio stands at 36.7 times, which is much higher than both the industry average of 15.3 and its closest peers at 9.8. Even compared to the fair ratio of 23.1 that the market could gravitate toward, shares look expensive. Does this premium leave enough upside for value-focused investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ZoomInfo Technologies Narrative

If you want to dig into the data yourself or bring a different perspective to the table, it’s fast and easy to craft your own view in just a few minutes. Do it your way.

A great starting point for your ZoomInfo Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

You don’t need to settle for just one opportunity when the market is full of standout stocks. Make sure you’re not missing tomorrow’s leaders by harnessing the power of these tailored lists:

- Accelerate your search for exceptional growth with these 25 AI penny stocks as they make breakthroughs in artificial intelligence and transform entire industries.

- Collect reliable income and benefit from resilient yields by reviewing these 18 dividend stocks with yields > 3% that consistently pay over 3% each year.

- Get ahead of the pack by uncovering value with these 891 undervalued stocks based on cash flows, where strong fundamentals could signal the next market winners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if ZoomInfo Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTM

ZoomInfo Technologies

Provides go-to-market intelligence and engagement platform for sales, marketing, operations, and recruiting professionals in the United States and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion