- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

Is Google’s AI Momentum Driving Real Value After the 50% Rally in 2025?

Reviewed by Bailey Pemberton

- Wondering if Alphabet is a smart buy at today’s price? You’re not alone, especially if you’re trying to spot real value beneath the headlines.

- Despite a bumpy recent week with a 2.4% dip, Alphabet stock has bounced back 12.2% over the past month and is up an outstanding 50.1% year-to-date.

- Big stories driving these moves include Alphabet's ongoing advancements in artificial intelligence and recent antitrust headlines. These have sparked fresh debate about its long-term prospects and are fueling both excitement and caution among investors trying to figure out what the future holds for the company.

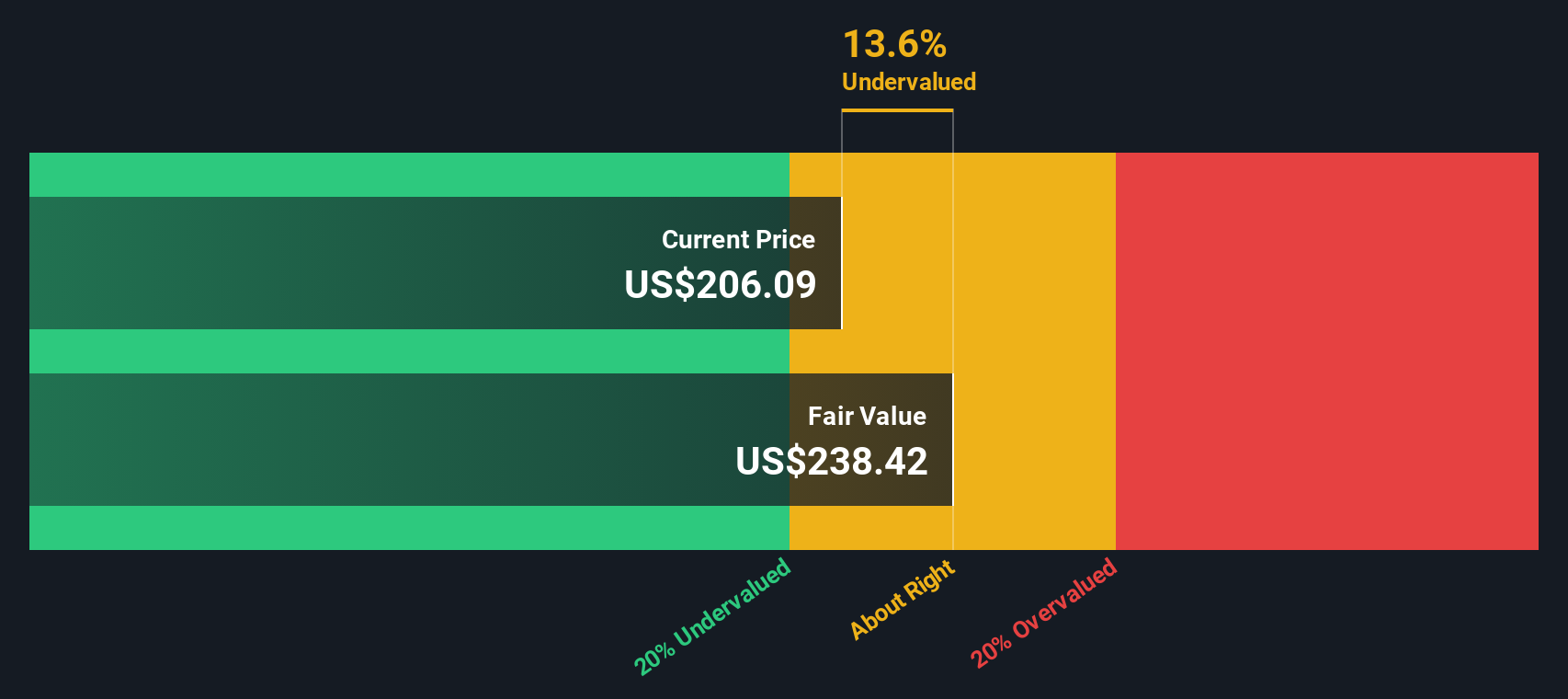

- On our 6-point valuation scale, Alphabet scores a 3 out of 6 for being undervalued, which means half the signals suggest its price could be fair or even offer an opportunity. Next, we’ll break down what that actually means, and at the end, we’ll introduce a more holistic way to size up if Alphabet is really a bargain or not.

Approach 1: Alphabet Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting them back to today's dollars. This gives investors an idea of what the business is really worth based on its future earning potential.

Alphabet's current Free Cash Flow sits at $92.6 billion. Analysts project this figure will continue to grow, reaching around $157.6 billion by 2029. It is worth noting that while analyst estimates cover the next 5 years, further forward-looking numbers are extrapolated to round out the 10-year outlook. These projections provide a clearer sense of where Alphabet's underlying business is headed.

Using this approach, the estimated intrinsic value lands at $285.65 per share. At today’s price, this implies Alphabet is trading for roughly 0.5% less than its calculated value, making it about fairly valued by the model's measure.

Result: ABOUT RIGHT

Alphabet is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Alphabet Price vs Earnings

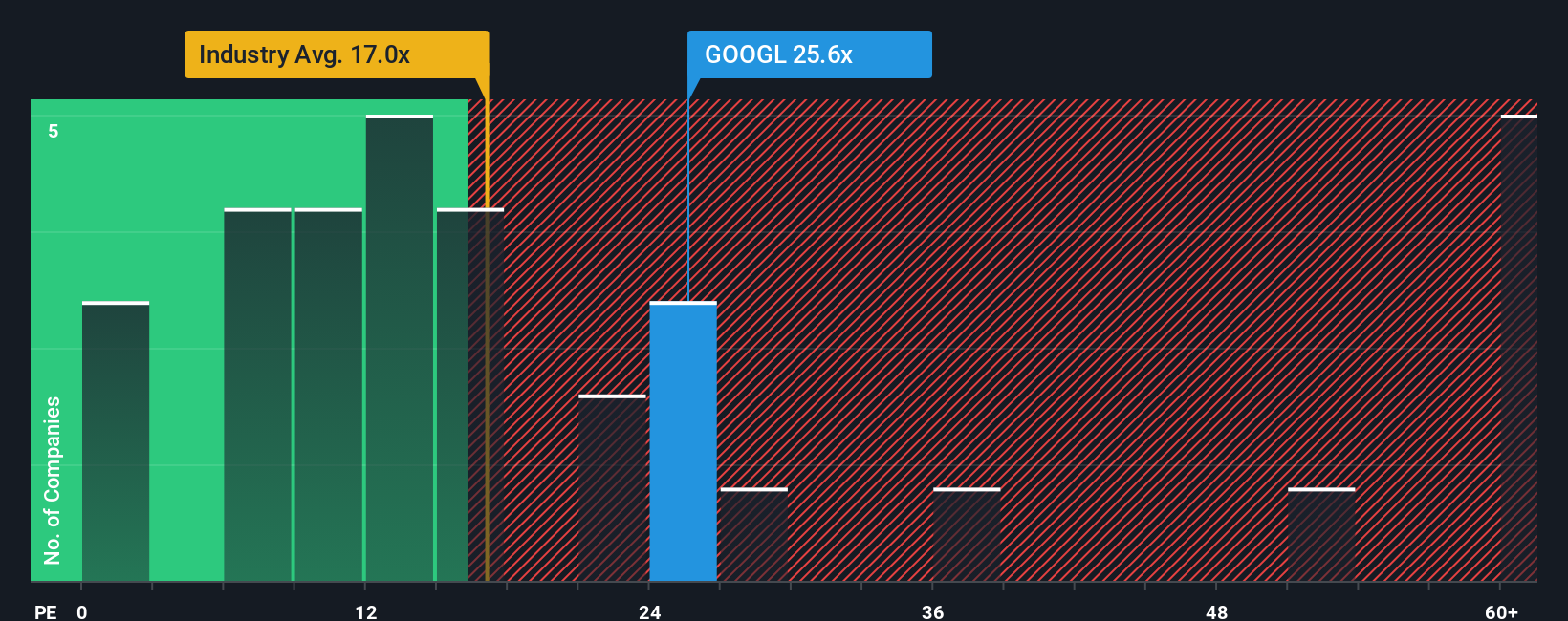

The Price-to-Earnings (PE) ratio is widely recognized as the go-to valuation metric for profitable companies like Alphabet. This ratio tells investors how much they are paying for each dollar of the company’s earnings, offering a quick snapshot of how the market currently values its profit potential.

The "right" PE ratio for a given company is influenced by a number of factors, such as expected earnings growth, stability of those earnings, and the inherent risks involved. Higher growth prospects and stronger competitive positioning generally justify a higher PE, while risk or uncertainty would usually pull that number down.

Alphabet’s current PE ratio sits at 27.6x, putting it above the broader Interactive Media and Services industry average of 16.4x, but below the average of its peers at 36.5x. Simply Wall St’s proprietary Fair Ratio for Alphabet is 40.5x, which incorporates not only traditional benchmarks but also factors like profitability, market cap, growth rate, and company risk profile.

The Fair Ratio stands out because it looks deeper than a simple industry or peer comparison and captures nuances like Alphabet’s exceptional margins, scale, and growth profile. This makes it a more tailored benchmark for what a reasonable multiple might look like for Alphabet itself.

With the actual PE ratio of 27.6x sitting well below the Fair Ratio of 40.5x, the data suggests Alphabet is currently undervalued on this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1416 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alphabet Narrative

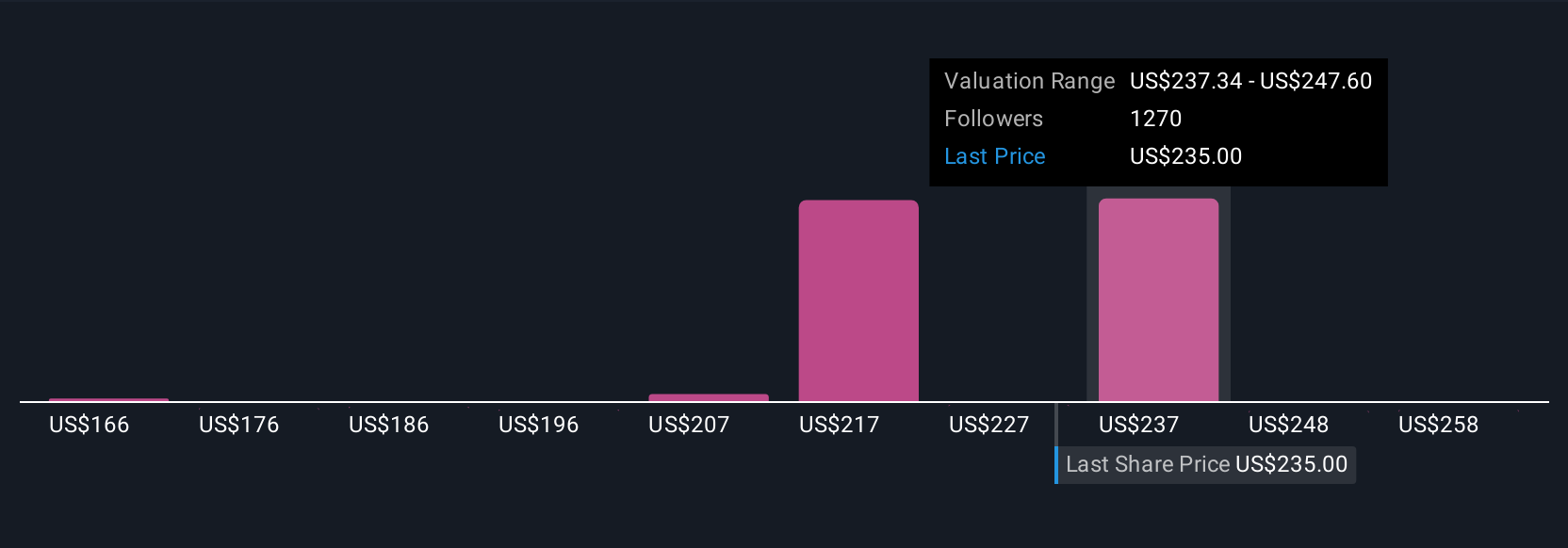

Earlier, we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives, a new approach that connects a company's story, your expectations about its future (such as revenue, earnings, and margins), and your own sense of fair value into a dynamic investing framework.

A Narrative is simply your perspective, a story about Alphabet's future backed up by concrete financial assumptions like growth rates, profitability, and the fair price you believe the stock is worth. The power of Narratives is that they let you clearly lay out the why behind your numbers, and instantly see how your story translates to potential upside or downside based on the current share price.

Available right inside the Simply Wall St Community page and used by millions of investors, Narratives help you make more informed decisions by directly comparing your fair value estimate to today's market price, clearly showing when you believe it's time to buy, hold, or sell. Better still, Narratives update proactively as news, earnings, or industry events occur, keeping your investment thesis aligned with reality in real time.

For example, some investors recently valued Alphabet as high as $340 (expecting rapid AI-driven growth and margin expansion), while others see a fair value closer to $171 (anticipating slower revenue growth and regulatory impact). Narratives help you place your own view along this spectrum and update it as the story unfolds.

For Alphabet, however, we'll make it really easy for you with previews of two leading Alphabet Narratives:

Fair value estimate: $318.24

Current price vs fair value: 10.7% undervalued

Projected revenue growth: 12.7%

- Analysts see Alphabet’s future profitability driven by surging AI adoption, innovation across Search and Cloud, and diversification into new services and global markets.

- Strong momentum in AI-powered offerings, Google Cloud record growth, and new subscription models are expected to boost revenue and improve margins. These factors may offset risks from heavy capital spending and a shifting regulatory landscape.

- Consensus forecasts indicate steady earnings growth and resilient margins, resulting in a fair valuation near $318. Sustained execution and prudent investment remain crucial for long-term upside.

Fair value estimate: $212.34

Current price vs fair value: 33.9% overvalued

Projected revenue growth: 13.5%

- Alphabet’s growth will remain anchored by digital advertising and cloud computing, but monetizing generative AI at scale faces near-term cost and profitability challenges.

- Though Google’s ecosystem and cost initiatives are strong, margins and valuation may be stretched if generative AI expenses remain high and competition in search and AI increases.

- The bear case expects that market optimism is ahead of realized execution and that Alphabet could be at risk of overvaluation if disruptive innovation or tighter regulation impact growth and profits.

Do you think there's more to the story for Alphabet? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives