- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

How Should Investors Value Alphabet Amid AI Surge and Recent 9% Stock Jump?

Reviewed by Bailey Pemberton

- Ever wondered if Alphabet’s current price really matches what it’s worth? You’re not alone. Figuring out a fair value is the question on every savvy investor’s mind these days.

- Alphabet’s stock has been on a tear recently, jumping 9.3% over the last week, 18.8% in the past month, and boasting an impressive 89.9% gain over the past year.

- Recent headlines highlight the company’s renewed momentum in artificial intelligence, as well as ongoing regulatory scrutiny both in the US and abroad. These stories are shaping expectations and fueling some of the largest moves in Alphabet’s share price this year.

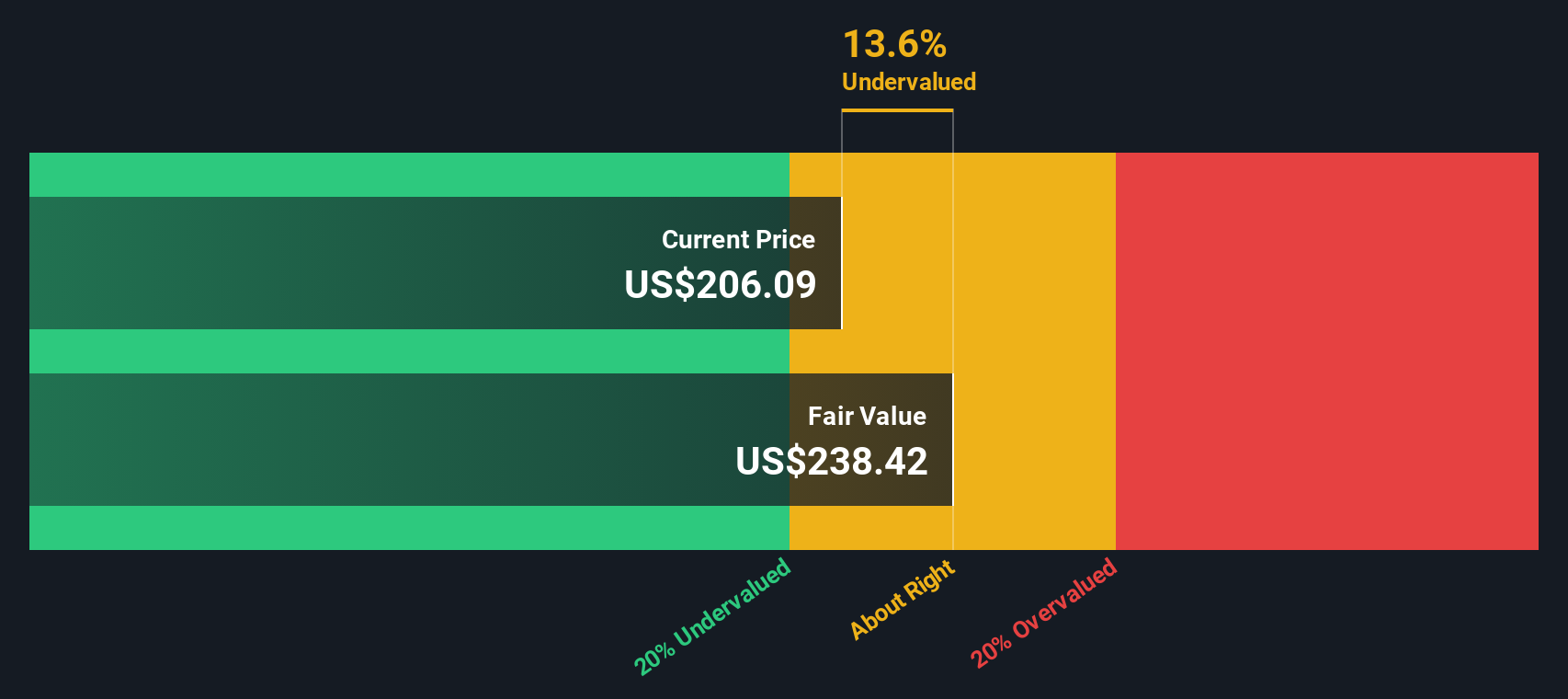

- But when it comes to valuation, Alphabet scores just 2 out of 6 on our value checks so far. In the next sections, we’ll break down what drives this rating by looking at different valuation methods, plus reveal a smarter way to think about a stock’s real worth.

Alphabet scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Alphabet Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) valuation model estimates a company’s fair value by projecting its future cash flows and then discounting them back to today’s dollars. This approach helps determine what Alphabet is really worth, based solely on its ability to generate cash in the years ahead.

Alphabet’s latest reported Free Cash Flow stands at $92.6 billion, a massive figure that highlights the scale of its operation. Analyst forecasts expect this number to keep climbing, with projections reaching $158.9 billion by 2029. While analysts provide forward estimates for the next five years, further projections out to 2035 are based on systematically extrapolated growth rates by Simply Wall St.

After crunching the numbers, the DCF model assigns Alphabet a fair value of $289.80 per share. However, with the current share price sitting about 10.4% above this estimate, it suggests Alphabet is trading at a slight premium today. In other words, markets are bidding it up beyond what its discounted future cash flows would justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alphabet may be overvalued by 10.4%. Discover 928 undervalued stocks or create your own screener to find better value opportunities.

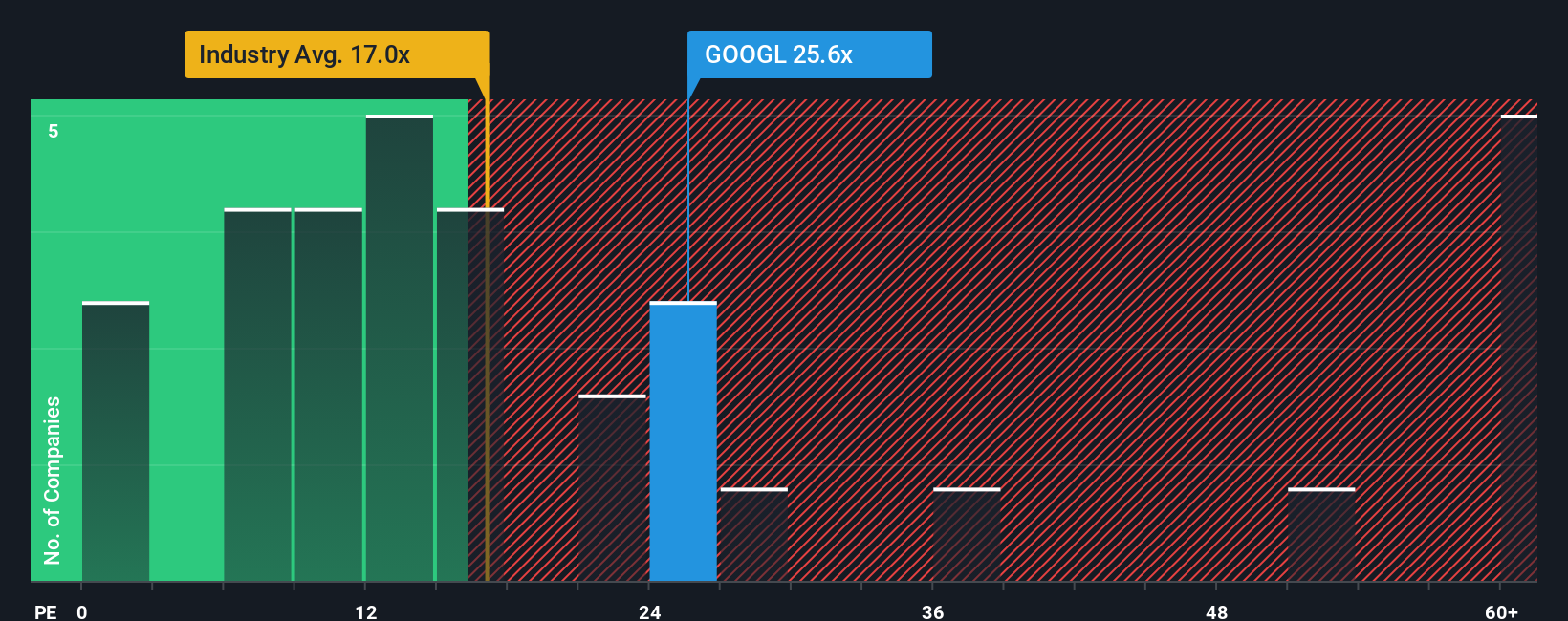

Approach 2: Alphabet Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a classic and reliable gauge for valuing profitable companies like Alphabet. It tells investors how much they are paying for each dollar of the company’s earnings, making it handy for companies with consistent profits and established track records.

Growth expectations and risk levels play a big role in what counts as a "normal" or "fair" PE ratio. Companies with faster earnings growth or lower risk generally warrant higher multiples, since investors are willing to pay more for future gains or for stability. Conversely, slower growth or greater risk typically pushes the fair PE ratio lower.

Currently, Alphabet trades at a PE ratio of 31.07x. To put this in perspective, this is above the interactive media and services industry average of 19.47x, but noticeably below the average of major peers at 45.57x. While these benchmarks are useful, they do not tell the full story, as they lack company-specific nuance.

This is where Simply Wall St’s "Fair Ratio" comes in. For Alphabet, the Fair PE Ratio is estimated at 41.29x. Unlike industry or peer averages, the Fair Ratio factors in Alphabet’s own growth outlook, profit margins, risk profile, market cap, and other unique business traits, delivering a more tailored assessment of what the stock should reasonably trade at.

Comparing Alphabet’s actual PE of 31.07x to its Fair Ratio of 41.29x suggests that the stock is undervalued by this measure, especially given its strong earnings power and fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alphabet Narrative

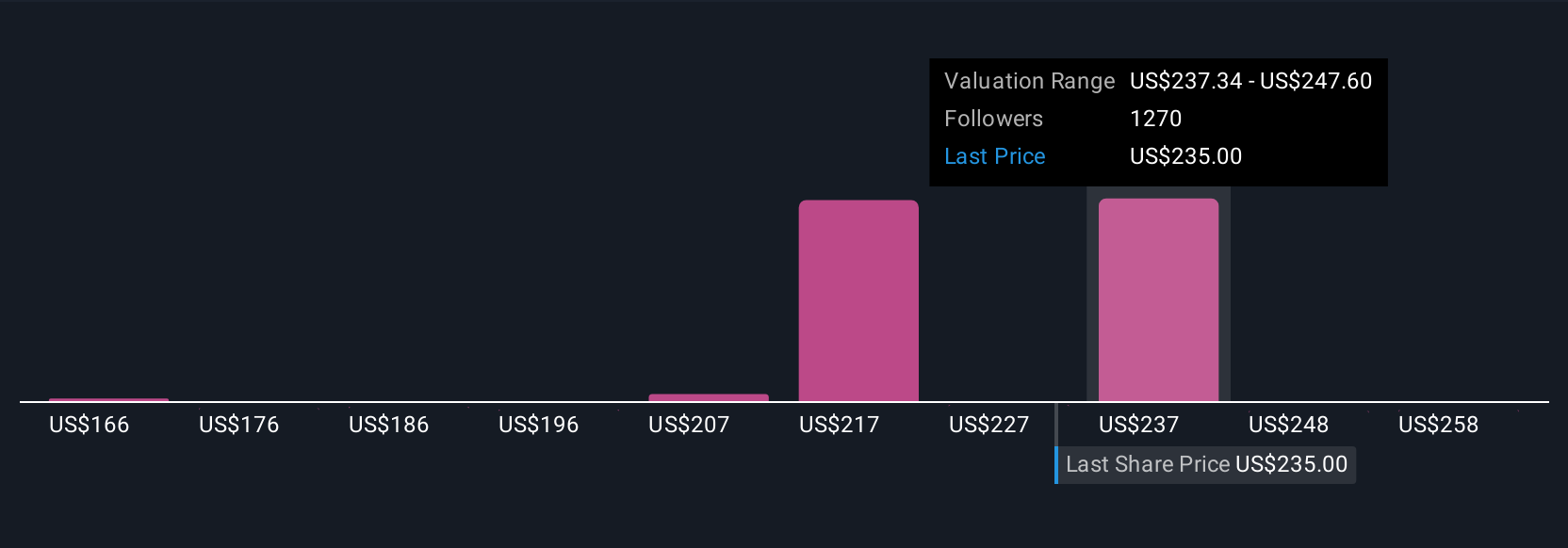

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives, an innovative approach that lets you craft and share your personal perspective on a company, connecting its story to your financial forecasts and fair value estimates.

In simple terms, a Narrative is the story behind the numbers. It weaves together your assumptions about Alphabet’s future, such as expected revenue growth, profit margins, or the impact of AI, with a calculated fair value and clear reasoning for your outlook.

Narratives are easy to use and accessible to everyone on Simply Wall St’s Community page. Millions of investors compare their outlooks and see how quickly the stories evolve as new data, news, or earnings come in.

They help you decide when to buy or sell by showing how your estimated fair value compares to today’s market price. Narratives update dynamically whenever the facts change, ensuring your decisions are always based on the latest information rather than static ratios or old forecasts.

For example, some investors see Alphabet as worth $340 because of rapid cloud growth, high cash flow, and a durable ad business. Others set a much lower fair value around $171, expecting margin pressures or slower AI monetization. Your investment decision can be built around the Narrative (and numbers) you believe in most.

For Alphabet, we’ll make it really easy for you with previews of two leading Alphabet Narratives:

- 🐂 Alphabet Bull Case

Fair value: $340.00

Current price is undervalued by approximately 5.87%

Revenue growth rate: 17.36%

- Alphabet’s digital ad leadership continues to generate substantial, reliable free cash flow, with YouTube and Cloud driving further growth.

- AI capabilities are deeply embedded throughout the business, turning cutting-edge research into monetizable products. Google Cloud is now profitable.

- A fortress balance sheet, active share buybacks, and “Buffett endorsement” support a future where investors may assign Alphabet a higher earnings multiple.

- 🐻 Alphabet Bear Case

Fair value: $212.34

Current price is overvalued by approximately 50.65%

Revenue growth rate: 13.47%

- Google’s dominance in search and ads remains on solid ground, but growth in digital advertising and Cloud is projected to moderate and slow over time.

- Generative AI integration is likely to be steady but gradual, with high costs limiting profitability and market share changes occurring more slowly than the hype suggests.

- Cost-cutting and operational efficiencies will provide margin improvements, but substantial risks remain from regulatory scrutiny and ongoing competition in core markets.

Do you think there's more to the story for Alphabet? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success