- United States

- /

- Entertainment

- /

- NasdaqGM:GDEV

GDEV Inc.'s (NASDAQ:GDEV) 38% Share Price Surge Not Quite Adding Up

The GDEV Inc. (NASDAQ:GDEV) share price has done very well over the last month, posting an excellent gain of 38%. Taking a wider view, although not as strong as the last month, the full year gain of 22% is also fairly reasonable.

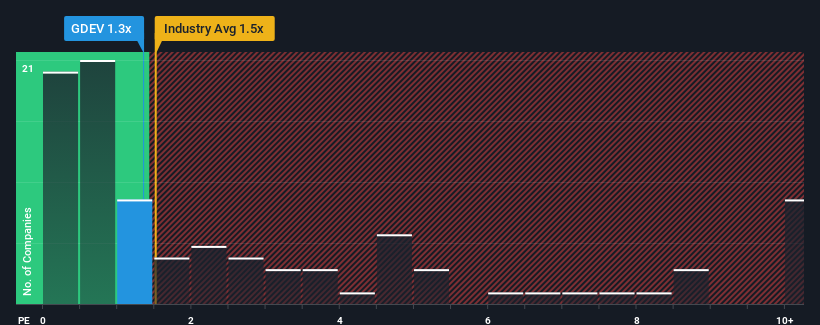

In spite of the firm bounce in price, it's still not a stretch to say that GDEV's price-to-sales (or "P/S") ratio of 1.3x right now seems quite "middle-of-the-road" compared to the Entertainment industry in the United States, where the median P/S ratio is around 1.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for GDEV

How Has GDEV Performed Recently?

GDEV could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think GDEV's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For GDEV?

The only time you'd be comfortable seeing a P/S like GDEV's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.9%. Even so, admirably revenue has lifted 32% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 0.04% during the coming year according to the two analysts following the company. Meanwhile, the broader industry is forecast to expand by 11%, which paints a poor picture.

With this information, we find it concerning that GDEV is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

Its shares have lifted substantially and now GDEV's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

While GDEV's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for GDEV that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:GDEV

GDEV

Develops and publishes online games in the United States, Europe, Asia, and internationally.

Proven track record and fair value.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Zero One +Tive report on Anime & $CTW

ICOP S.p.A. – Investment Narrative and Multibagger Monitoring Framework

The Power Behind the Brain: Why Schneider Electric is the Undisputed Infrastructure King of the 2026 AI Build-out

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026