- United States

- /

- Media

- /

- NasdaqGS:FOXA

Fox (FOXA) Profit Margin Surges; Recent Earnings Growth Reinforces Bullish Narratives

Reviewed by Simply Wall St

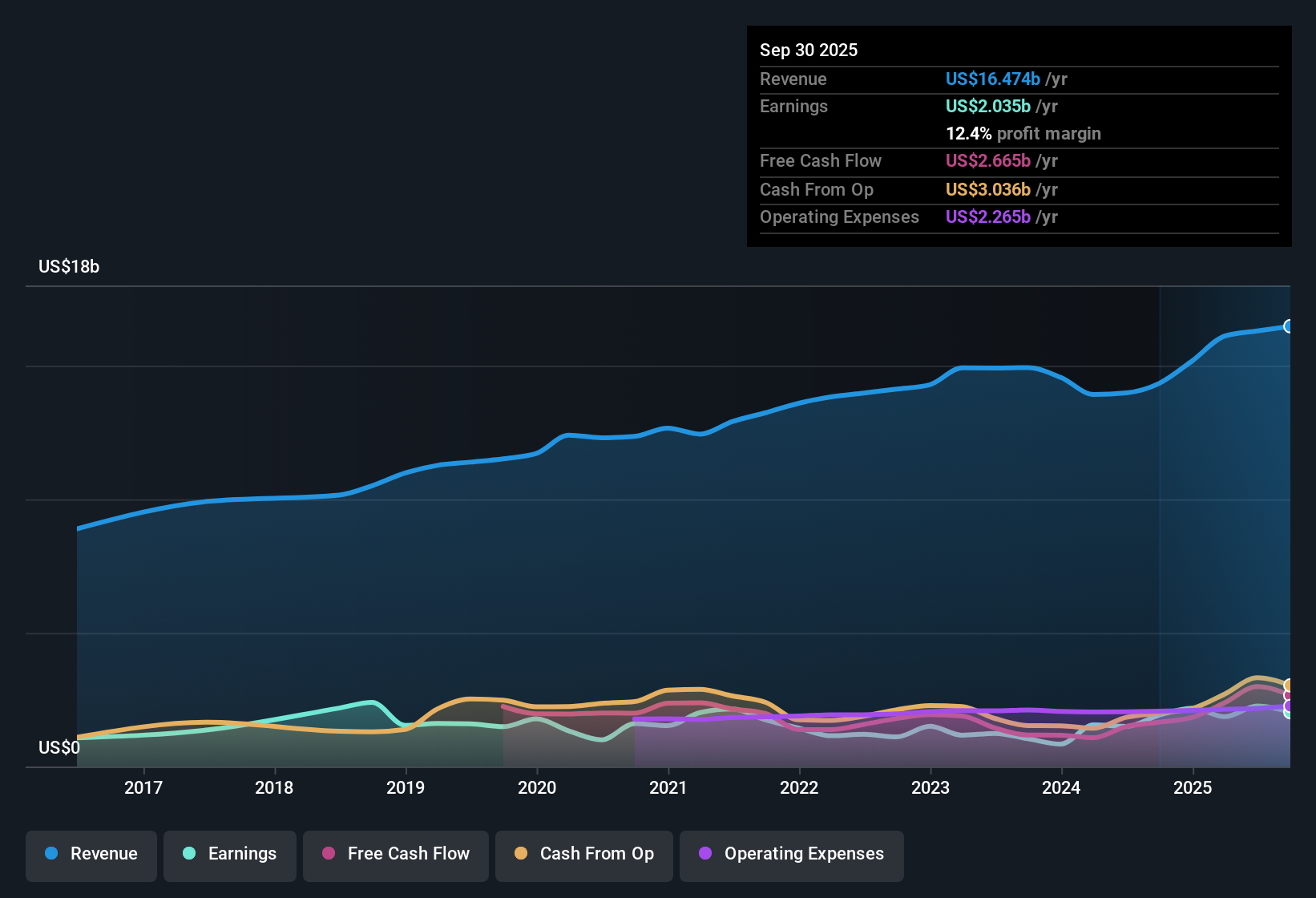

Fox (FOXA) posted standout earnings growth this year, with EPS jumping 50.8% and net profit margins climbing to 13.9% from last year's 10.7%. However, revenue is forecast to rise at just 1.5% per year, lagging the broader US market's 10.3% annual pace. Earnings are expected to decline by 2.1% annually over the next three years. With high-quality earnings but muted growth prospects, investors are weighing solid profitability against slower revenue momentum.

See our full analysis for Fox.The next section puts these headline numbers to the test, comparing Fox's results with the widely held narratives shaping investor expectations.

See what the community is saying about Fox

Profit Margin Expands to 13.9%, but Analysts Foresee Compression

- Fox's net profit margin increased to 13.9%, a notable jump from 10.7% last year. However, analysts project it will shrink to 11.4% within three years.

- According to the analysts' consensus narrative, expectations are for margin pressure to continue as content costs accelerate and revenue growth slows.

- Escalating sports rights fees are likely to outpace growth from advertising and affiliate deals, which would directly weigh on future margins.

- Consensus highlights the dual challenge of higher programming costs and declining traditional TV viewership. These factors are cited as primary headwinds for profitability.

- Analysts' consensus view is that these margin shifts reflect the ongoing tension between rising expenses and Fox’s core strengths in live content and pricing power. 📊 Read the full Fox Consensus Narrative.

Valuation: Discount to Industry, Premium to Peers

- Fox trades at a 12.9x price-to-earnings ratio, which is well below the US Media industry average of 19.1x but above the 9.6x PE found among its closest peers.

- Consensus narrative emphasizes that while Fox appears to be a relative bargain compared to the industry, this valuation premium over nearby competitors raises the stakes for management to deliver on future digital growth and margin stability.

- With a current share price of $64.69 and DCF fair value at $113.50, the long-term valuation gap is large. In the near term, analyst price targets are much closer to market, suggesting fair pricing for the time being.

- Analysts note that muted revenue prospects and expected earnings declines may justify the company's lower market multiple when compared to industry leaders.

Share Count Shrinks, Offsetting EPS Pressure

- Fox is expected to reduce its shares outstanding by 2.45% per year over the next three years, which may help soften the impact of anticipated EPS declines.

- According to the analysts' consensus, steady buyback activity and operational discipline help defend shareholder value even as near-term growth prospects remain underwhelming:

- Management's $5 billion repurchase program and robust free cash flow indicate a focus on returning capital, supporting EPS even in the face of weaker profit outlooks.

- However, consensus cautions that with revenue forecast to dip by 0.3% per year and earnings projected to fall from $2.3 billion to $1.9 billion, buybacks alone may not fully counteract the downward earnings trend.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Fox on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the figures? In just a few minutes, you can share your unique angle and shape the story your way: Do it your way.

A great starting point for your Fox research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Fox faces uncertainty as analysts project revenue decline and shrinking profit margins, which challenges the company’s ability to sustain consistent long-term growth.

For investors seeking steady and reliable expansion, use stable growth stocks screener (2102 results) to find companies that consistently deliver solid revenue and earnings, even when others slow down.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FOXA

Fox

Operates as a news, sports, and entertainment company in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives