- United States

- /

- Media

- /

- NasdaqGS:FOXA

Can Fox’s (FOXA) Podcast Bet Reveal the Next Phase of Its Digital Strategy?

Reviewed by Sasha Jovanovic

- In late October 2025, Tubi Media Group announced a multi-year deal with Audiochuck for exclusive distribution and advertising rights on popular true crime podcasts, expanding Fox's streaming and podcast offerings through Tubi and FOX One platforms, alongside an update on Fox’s share repurchase program and its release of first quarter earnings showing increased sales but a lower net income year-over-year.

- This collaboration leverages Audiochuck’s top-ranked podcasts, including Crime Junkie, and signals Fox's increased focus on building digital content and multi-platform reach.

- We'll examine how Fox's multi-year audio streaming expansion with Audiochuck may affect its investment outlook and digital transformation narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Fox Investment Narrative Recap

To be a shareholder in Fox today, you need conviction in its ability to profit from both traditional media strengths in news and sports and ongoing digital transformation efforts. The recent Audiochuck podcast deal expands Fox’s streaming footprint, but it does not materially alter the most important short-term catalyst, continued momentum in digital growth, or the key risk, which remains audience migration away from linear TV platforms.

Among the latest company developments, Fox’s Q1 2026 financial update showed rising sales to US$3,738 million but lower net income and diluted earnings per share versus last year. This result, occurring alongside investments like the Audiochuck partnership, speaks to the ongoing challenge of profitably scaling new digital businesses in the face of linear TV headwinds.

However, the risk that younger audiences may increasingly avoid traditional broadcast content is one investors should be aware of, as it could impact...

Read the full narrative on Fox (it's free!)

Fox's outlook anticipates $16.4 billion in revenue and $1.9 billion in earnings by 2028. This scenario assumes a 0.3% annual revenue decline and a $0.4 billion decrease in earnings from the current $2.3 billion.

Uncover how Fox's forecasts yield a $70.50 fair value, a 9% upside to its current price.

Exploring Other Perspectives

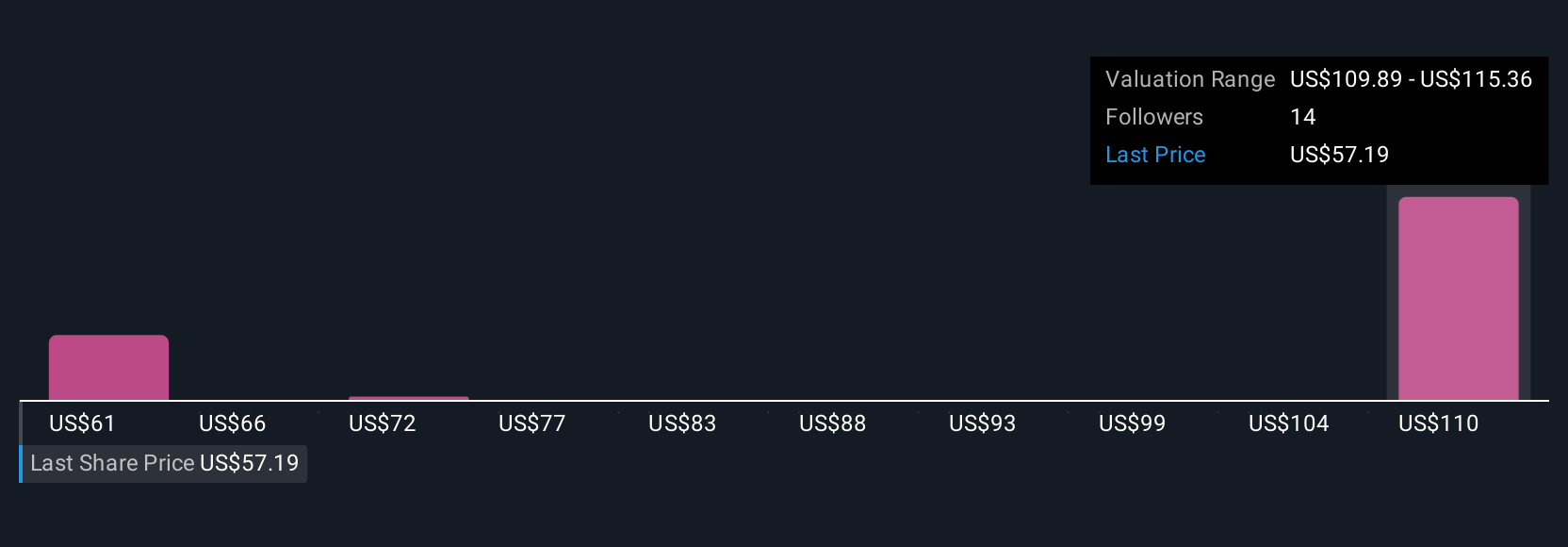

Fair value estimates from the Simply Wall St Community span a narrow range, with 3 investors setting US$70.50 to US$73.46. While opinions vary, uncertainty around Fox’s ability to counter declining linear audiences stands out as a key challenge. Explore what others think and see how views differ.

Explore 3 other fair value estimates on Fox - why the stock might be worth as much as 13% more than the current price!

Build Your Own Fox Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fox research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fox research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fox's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FOXA

Fox

Operates as a news, sports, and entertainment company in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives