- United States

- /

- Media

- /

- OTCPK:EMMS

Should You Use Emmis Communications's (NASDAQ:EMMS) Statutory Earnings To Analyse It?

As a general rule, we think profitable companies are less risky than companies that lose money. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. Today we'll focus on whether this year's statutory profits are a good guide to understanding Emmis Communications (NASDAQ:EMMS).

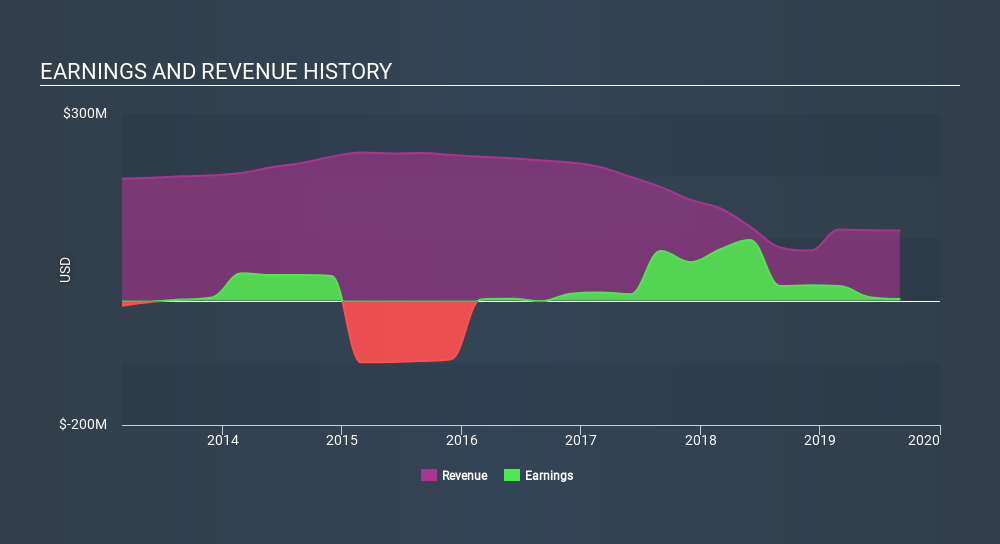

While Emmis Communications was able to generate revenue of US$112.6m in the last twelve months, we think its profit result of US$2.67m was more important. Even though revenue is down over the last three years, you can see in the chart below that the company has moved from loss-making to profitable.

View our latest analysis for Emmis Communications

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. As a reuslt, we think it's important to consider how unusual items and the recent tax benefit have influenced Emmis Communications's statutory profit. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Emmis Communications.

The Impact Of Unusual Items On Profit

To properly understand Emmis Communications's profit results, we need to consider the US$4.5m expense attributed to unusual items. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If Emmis Communications doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

An Unusual Tax Situation

Having already discussed the impact of the unusual items, we should also note that Emmis Communications received a tax benefit of US$3.4m. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. Of course, prima facie it's great to receive a tax benefit. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On Emmis Communications's Profit Performance

In its last report Emmis Communications received a tax benefit which might make its profit look better than it really is on a underlying level. Having said that, it also had a unusual item reducing its profit. After taking into account all these factors, we think that Emmis Communications's statutory results are a decent reflection of its underlying earnings power. While earnings are important, another area to consider is the balance sheet. If you're interestedwe have a graphic representation of Emmis Communications's balance sheet.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OTCPK:EMMS

Emmis

A diversified media company, engages in radio broadcasting activities in the United States.

Low with weak fundamentals.

Market Insights

Community Narratives