- United States

- /

- Entertainment

- /

- NasdaqGS:EA

Electronic Arts (EA): Assessing Current Valuation Following Recent Game Releases and Steady Investor Interest

Reviewed by Simply Wall St

Electronic Arts (EA) stock is on investors’ radar as the company continues to ride the momentum from a wave of game releases and steady live service engagement. The recent buzz reflects overall sentiment about EA’s approach in a competitive gaming landscape.

See our latest analysis for Electronic Arts.

After a strong run earlier this year, Electronic Arts shares have been mostly steady at around $201, with a robust 18% share price return over the past three months and a 24% total shareholder return in the last twelve months. The stock’s sustained performance suggests investors still see growth potential, even as headline-making launches transition to longer-term engagement and earnings momentum.

If you’re intrigued by EA’s recent momentum, it might be the perfect time to see what other game-changers are thriving in technology and AI. Discover See the full list for free.

With EA shares hovering near analysts’ targets and robust one-year returns in the rearview, investors are left wondering if the company’s future growth is already reflected in today’s price, or if there is still room to buy in.

Most Popular Narrative: Fairly Valued

Electronic Arts’ fair value, according to the most widely followed narrative, sits right at $202.36, which is almost identical to the recent closing price of $201.92. Analysts are closely watching the narrow gap, suggesting the stock’s current price largely reflects the projected fundamentals.

EA's strategic focus on expanding live services and new game launches, such as Skate and Battlefield, is expected to drive revenue growth and foster player engagement. The relaunch of American Football and continued success of FC Mobile, particularly in fast-growing markets, are expected to significantly boost net bookings and player base.

What is the secret behind this valuation? It centers on ambitious pipeline launches and a surprisingly bold profit margin outlook, but the real catalyst remains hidden in the narrative’s forward-looking forecasts. See how analysts are justifying today’s fair price with future growth plays that could influence the industry.

Result: Fair Value of $202.36 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing challenges with key titles like Apex Legends and potential shifts in consumer spending could quickly alter the outlook for Electronic Arts’ growth narrative.

Find out about the key risks to this Electronic Arts narrative.

Another View: Contrasting Value Perspectives

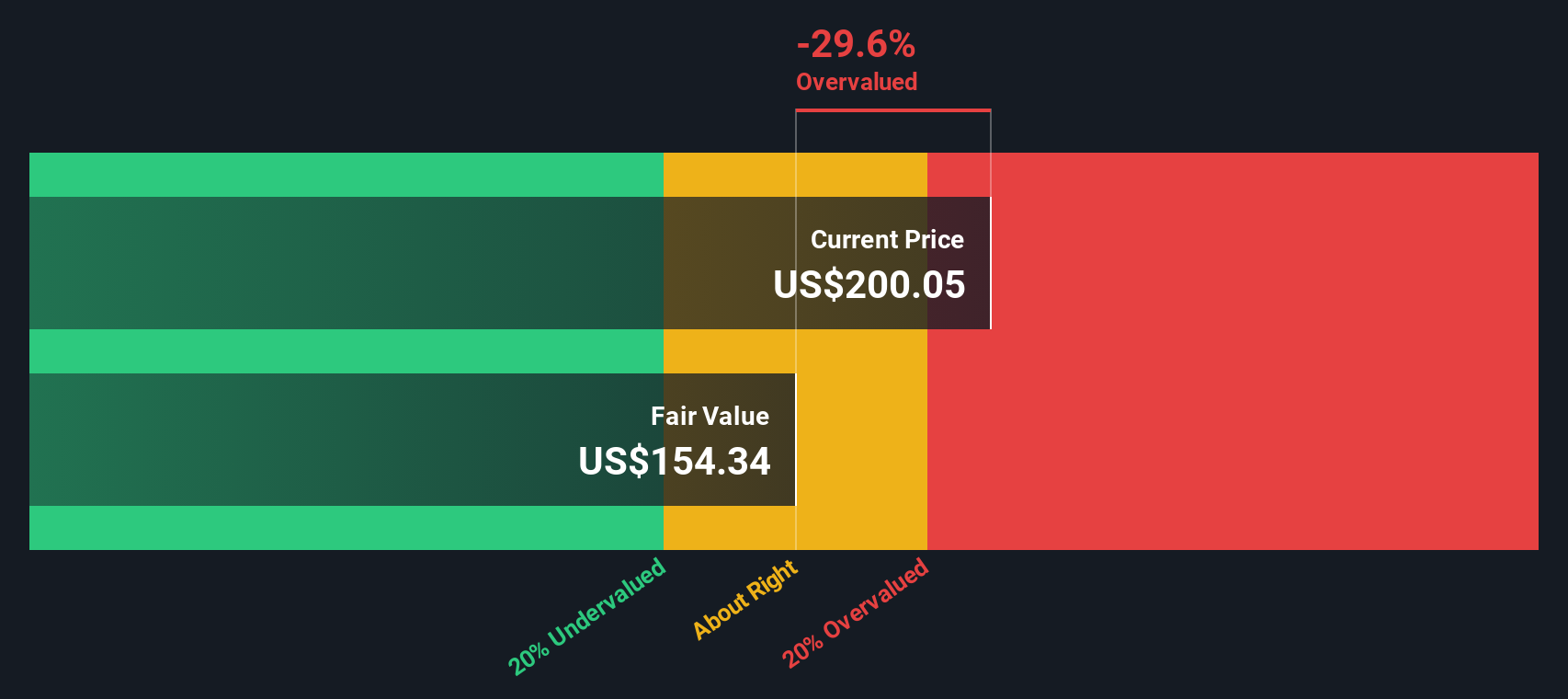

While analysts peg Electronic Arts' fair value at around $202 based on projected fundamentals, our SWS DCF model offers a sharply different view. The model suggests the stock is trading well above its intrinsic value with a considerable discount of roughly 34%. This sizable gap highlights the risk that EA may be overvalued if market expectations prove too optimistic.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Electronic Arts for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 929 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Electronic Arts Narrative

If the current analysis doesn't fit your perspective or you’re eager to dig deeper, you can shape your own Electronic Arts narrative in just a few minutes. Do it your way

A great starting point for your Electronic Arts research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Staying ahead means finding opportunities others might miss. Don’t settle for yesterday’s winners. See what the smart money is watching now, before those trends take off without you.

- Capture income opportunities and unlock steady cash flow when you review these 15 dividend stocks with yields > 3% offering yields above the market average.

- Ride exciting breakthroughs by checking out these 25 AI penny stocks changing the game with artificial intelligence and automation advancements.

- Power up your portfolio with forward-thinking companies by exploring these 27 quantum computing stocks propelling the next wave of quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electronic Arts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EA

Electronic Arts

Develops, markets, publishes, and delivers games, content, and services for game consoles, PCs, and mobile phones worldwide.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success