- United States

- /

- Media

- /

- NasdaqCM:DRCT

Direct Digital Holdings, Inc. (NASDAQ:DRCT) Might Not Be As Mispriced As It Looks After Plunging 26%

Unfortunately for some shareholders, the Direct Digital Holdings, Inc. (NASDAQ:DRCT) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 84% loss during that time.

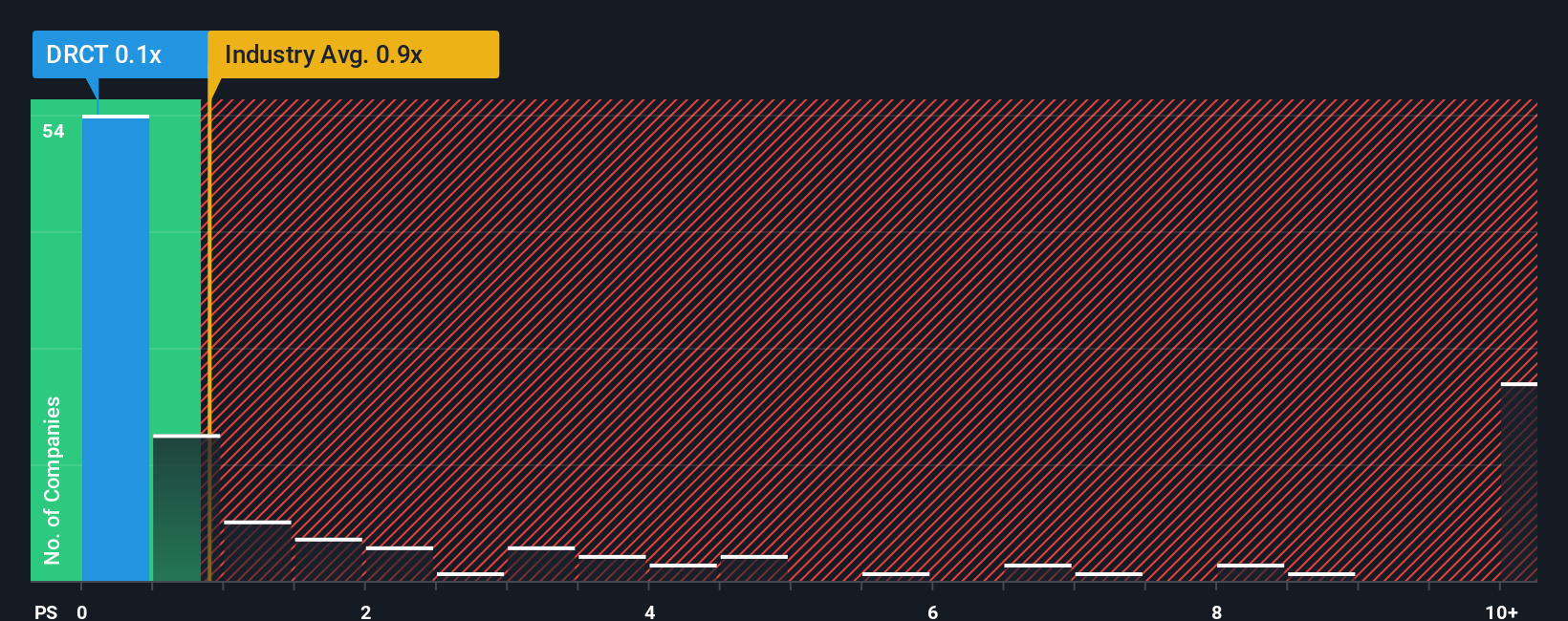

Following the heavy fall in price, Direct Digital Holdings' price-to-sales (or "P/S") ratio of 0.1x might make it look like a buy right now compared to the Media industry in the United States, where around half of the companies have P/S ratios above 0.9x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Direct Digital Holdings

What Does Direct Digital Holdings' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Direct Digital Holdings' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Direct Digital Holdings will help you uncover what's on the horizon.How Is Direct Digital Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Direct Digital Holdings' is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 70%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 9.9% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 104% during the coming year according to the two analysts following the company. With the industry only predicted to deliver 1.0%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Direct Digital Holdings' P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Direct Digital Holdings' P/S

The southerly movements of Direct Digital Holdings' shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To us, it seems Direct Digital Holdings currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Direct Digital Holdings, and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:DRCT

Direct Digital Holdings

Operates as an end-to-end full-service advertising and marketing platform.

Medium-low risk and fair value.

Similar Companies

Market Insights

Community Narratives