- United States

- /

- Entertainment

- /

- NasdaqGS:DOYU

DouYu International Holdings Limited (NASDAQ:DOYU) Held Back By Insufficient Growth Even After Shares Climb 30%

DouYu International Holdings Limited (NASDAQ:DOYU) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 23% in the last twelve months.

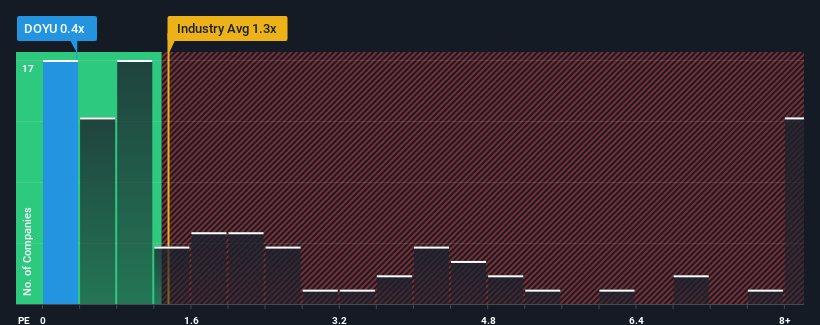

Although its price has surged higher, DouYu International Holdings may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Entertainment industry in the United States have P/S ratios greater than 1.3x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for DouYu International Holdings

What Does DouYu International Holdings' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, DouYu International Holdings' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on DouYu International Holdings will help you uncover what's on the horizon.How Is DouYu International Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like DouYu International Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 42% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 7.1% per year as estimated by the four analysts watching the company. That's not great when the rest of the industry is expected to grow by 9.7% each year.

With this in consideration, we find it intriguing that DouYu International Holdings' P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On DouYu International Holdings' P/S

Despite DouYu International Holdings' share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's clear to see that DouYu International Holdings maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 1 warning sign for DouYu International Holdings that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DOYU

DouYu International Holdings

Operates a platform on PC and mobile apps that provides interactive games and entertainment live streaming services in the People’s Republic of China.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives