- United States

- /

- Entertainment

- /

- NasdaqCM:CURI

Optimistic Investors Push CuriosityStream Inc. (NASDAQ:CURI) Shares Up 37% But Growth Is Lacking

Despite an already strong run, CuriosityStream Inc. (NASDAQ:CURI) shares have been powering on, with a gain of 37% in the last thirty days. The last 30 days were the cherry on top of the stock's 302% gain in the last year, which is nothing short of spectacular.

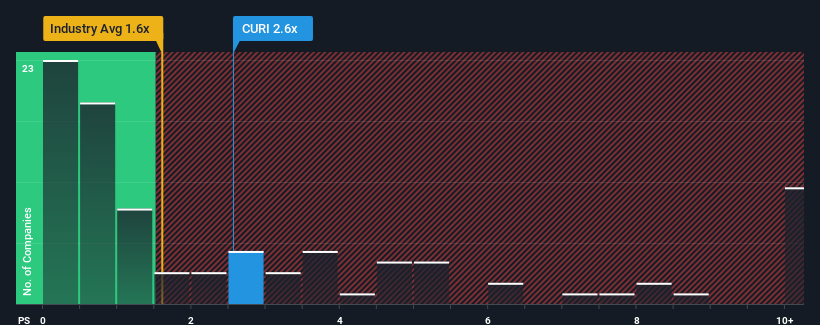

Since its price has surged higher, given close to half the companies operating in the United States' Entertainment industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider CuriosityStream as a stock to potentially avoid with its 2.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for CuriosityStream

How CuriosityStream Has Been Performing

While the industry has experienced revenue growth lately, CuriosityStream's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CuriosityStream.How Is CuriosityStream's Revenue Growth Trending?

In order to justify its P/S ratio, CuriosityStream would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 21% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 6.0% during the coming year according to the dual analysts following the company. That's shaping up to be materially lower than the 11% growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that CuriosityStream's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On CuriosityStream's P/S

CuriosityStream's P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for CuriosityStream, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for CuriosityStream (1 is a bit unpleasant) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CURI

CuriosityStream

A media and entertainment company, provides factual content through multiple channels.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives