- United States

- /

- Entertainment

- /

- NasdaqCM:CURI

CuriosityStream Inc. (NASDAQ:CURI) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

CuriosityStream Inc. (NASDAQ:CURI) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 83% in the last year.

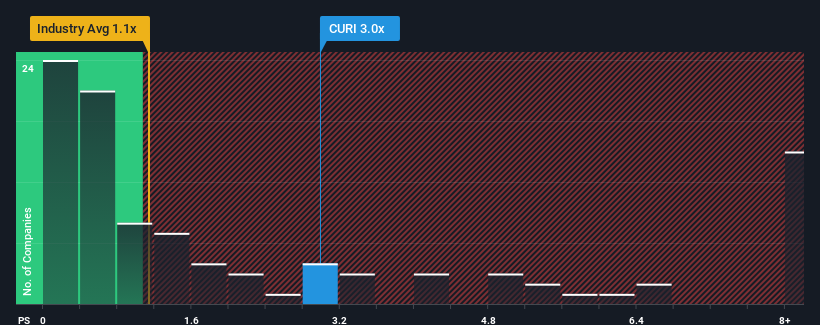

After such a large jump in price, you could be forgiven for thinking CuriosityStream is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3x, considering almost half the companies in the United States' Entertainment industry have P/S ratios below 1.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for CuriosityStream

How CuriosityStream Has Been Performing

While the industry has experienced revenue growth lately, CuriosityStream's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on CuriosityStream will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For CuriosityStream?

CuriosityStream's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 10%. This means it has also seen a slide in revenue over the longer-term as revenue is down 28% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 11% per year over the next three years. With the industry predicted to deliver 12% growth per annum, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that CuriosityStream's P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What Does CuriosityStream's P/S Mean For Investors?

The large bounce in CuriosityStream's shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Analysts are forecasting CuriosityStream's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 3 warning signs for CuriosityStream (of which 1 is a bit unpleasant!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CURI

CuriosityStream

A media and entertainment company, provides factual content through multiple channels.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives