- United States

- /

- Media

- /

- NasdaqCM:CNET

ZW Data Action Technologies (NASDAQ:CNET) shareholders are up 10% this past week, but still in the red over the last three years

ZW Data Action Technologies Inc. (NASDAQ:CNET) shareholders should be happy to see the share price up 10% in the last week. But that doesn't help the fact that the three year return is less impressive. After all, the share price is down 30% in the last three years, significantly under-performing the market.

The recent uptick of 10% could be a positive sign of things to come, so let's take a lot at historical fundamentals.

Check out our latest analysis for ZW Data Action Technologies

ZW Data Action Technologies isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, ZW Data Action Technologies' revenue dropped 12% per year. That is not a good result. The annual decline of 9% per year in that period has clearly disappointed holders. And with no profits, and weak revenue, are you surprised? Of course, sentiment could become too negative, and the company may actually be making progress to profitability.

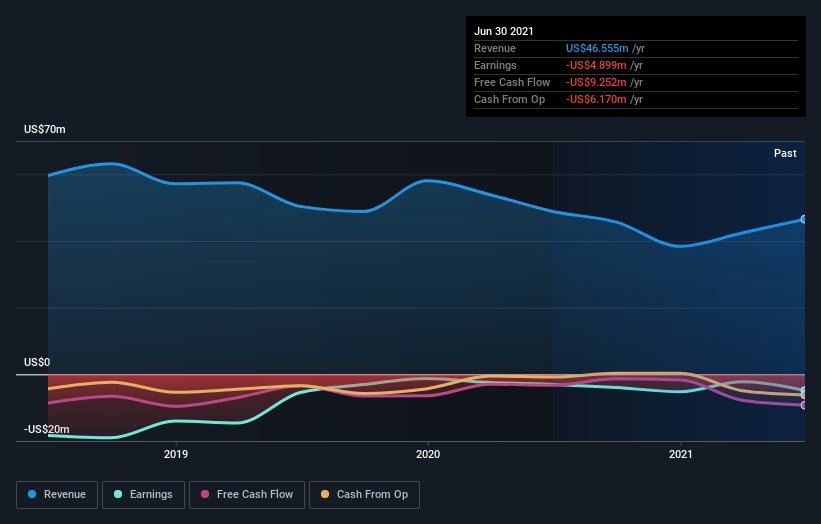

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on ZW Data Action Technologies' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

ZW Data Action Technologies shareholders are up 20% for the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 4% endured over half a decade. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that ZW Data Action Technologies is showing 3 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading ZW Data Action Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if ZW Data Action Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:CNET

ZW Data Action Technologies

Provides omni-channel advertising, precision marketing, and data analysis management systems in the People’s Republic of China.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives