- United States

- /

- Media

- /

- NasdaqGS:CMCSA

Should Investors Rethink Comcast After Shares Tumble Over 33% in the Past Year?

Reviewed by Bailey Pemberton

- Thinking about whether Comcast stock could be undervalued right now? You are not alone, as plenty of investors are asking if this well-known media giant might actually be offering bargain potential.

- Comcast’s shares recently slid, dropping 6.3% in the last week and 11.2% over the past month, compounding a Year-to-Date decline of 26.7%. The stock is down 33.1% over the last year, raising questions about whether the market is missing something or properly pricing in new risks.

- Market chatter has focused on changes in the streaming landscape and ongoing broadband competition, both of which have generated headwinds for media conglomerates like Comcast. Increased regulatory scrutiny and evolving consumer habits have also featured widely in the news, further fueling investor debate about the company’s long-term value.

- Despite this negativity, Comcast racks up a 6 out of 6 score on our valuation checks, indicating strength across every metric we track for undervaluation. Next, we will break down exactly how these valuation methods work. Stay tuned, as we will also discuss a smarter way to size up fair value by the end of the article.

Find out why Comcast's -33.1% return over the last year is lagging behind its peers.

Approach 1: Comcast Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today, providing an intrinsic fair value for investors. For Comcast, this DCF uses a 2 Stage Free Cash Flow to Equity approach, focusing on cash flows generated for shareholders.

Comcast's current Free Cash Flow stands at $17.6 Billion. Analysts provide Free Cash Flow projections for the next five years, after which long-term forecasts are extrapolated. For example, projected cash flow in 2026 is $15.5 Billion, with an expected 2029 value of $14.8 Billion. These numbers are calculated by aggregating insights from numerous industry analysts and long-term estimates by Simply Wall St. This process aims to ensure a robust projection even beyond the range of formal analyst coverage.

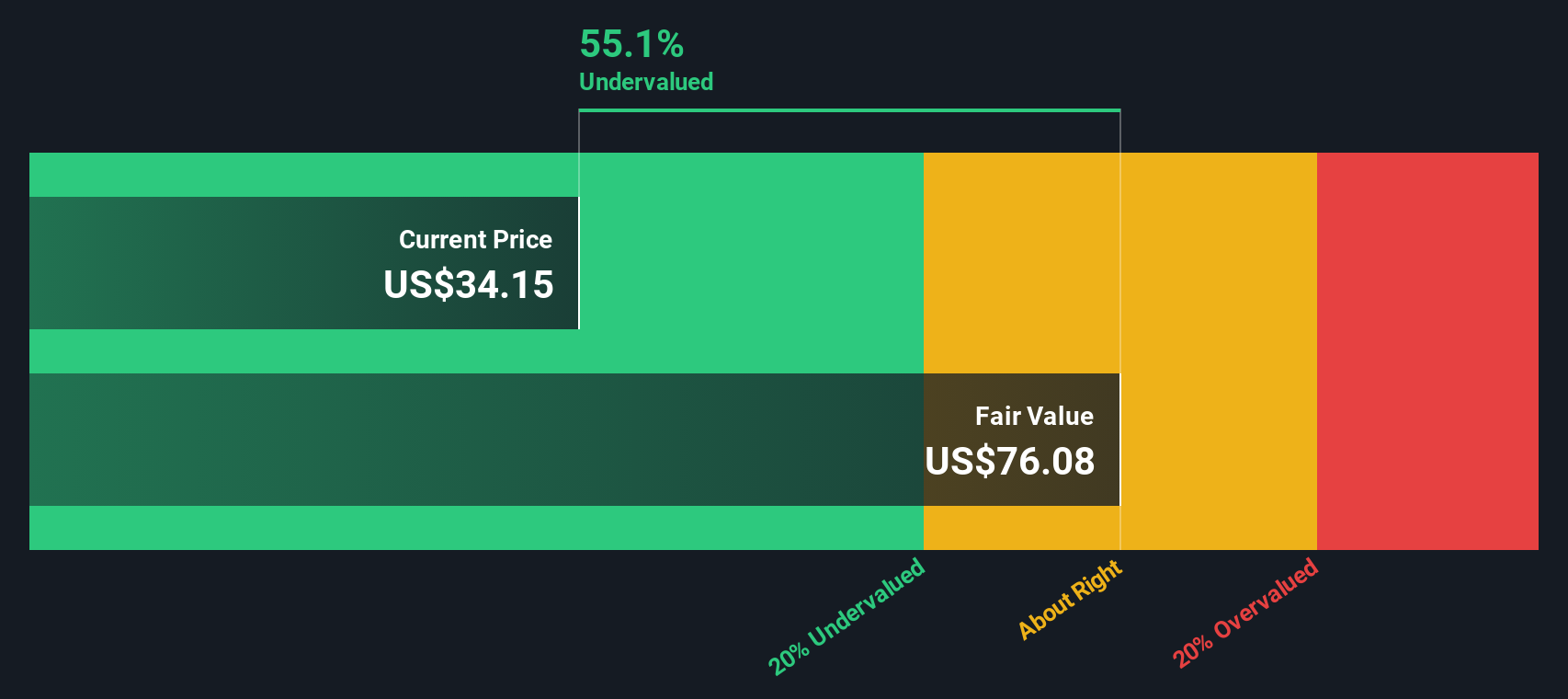

Based on this DCF analysis, the model calculates an estimated intrinsic value per share of $73.05. This implies the stock is trading at a significant discount, with a 62.4% gap between the current share price and its calculated fair value. This analysis suggests that the market may be undervaluing Comcast's long-term earnings potential at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Comcast is undervalued by 62.4%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

Approach 2: Comcast Price vs Earnings

The Price-to-Earnings (PE) ratio is the most widely used valuation metric for profitable companies like Comcast, as it ties the current share price directly to the company’s ongoing earnings power. For investors, the PE ratio helps gauge market expectations, with higher ratios often signaling optimism about future growth and lower ones reflecting caution or risk concerns.

Growth expectations and risk play a major role in what is considered a “fair” PE ratio. Fast-growing or stable companies often justify higher multiples. In contrast, greater risk, slower growth, or market headwinds can compress the ratio investors are willing to pay.

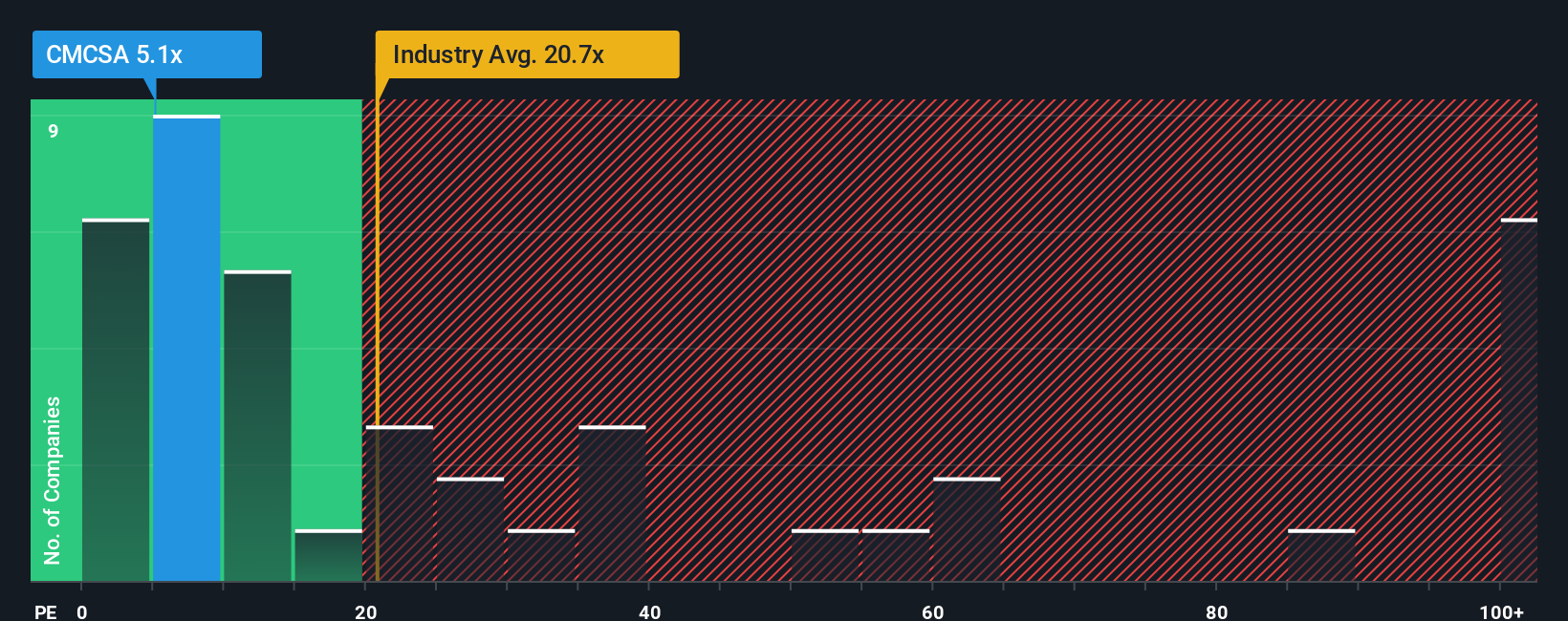

Currently, Comcast trades at a PE ratio of just 4.42x, which is noticeably below both the Media industry average of 16.09x and the peer group average of 36.27x. That makes the stock look inexpensive at first glance. However, rather than rely solely on broad averages that may not reflect Comcast’s unique characteristics, Simply Wall St calculates a proprietary “Fair Ratio” for the company, set at 16.05x, based on factors such as Comcast’s earnings growth profile, risk level, profit margin, industry context, and market capitalization.

The Fair Ratio approach is more comprehensive than using simple peer or industry benchmarks because it incorporates key business drivers specific to Comcast. This gives a deeper picture of what the market should reasonably pay for its shares.

Comparing Comcast’s actual PE of 4.42x with the Fair Ratio of 16.05x highlights a clear gap. This supports the view that the stock is meaningfully undervalued on this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Comcast Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a smarter, story-driven approach available on Simply Wall St’s Community page, used by millions of investors.

A Narrative is your personalized view of a company’s future; it links the big picture (like Comcast’s industry trends, strategic moves, or new risks) with your own financial assumptions and expectations for revenue, margins, and earnings to create a fair value that reflects your story about the business.

Unlike pure number crunching, Narratives help you connect what you believe will drive Comcast’s future with a forecast and valuation, making investment decisions more intuitive and tailored to your perspective.

The platform makes it easy to choose or adjust a Narrative, see how your fair value compares to the current price, and get dynamic updates as new information (for example, news or earnings reports) arrives, so your analysis is always relevant.

For example, one investor might believe Comcast’s investments in streaming and theme parks will power long-term growth, supporting a fair value as high as $49.43 per share, while another might see rising costs and competition as limiting upside, justifying a fair value closer to $31.00.

Do you think there's more to the story for Comcast? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMCSA

Very undervalued 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives