- United States

- /

- Media

- /

- NasdaqGS:CHTR

Is There an Opportunity in Charter Communications After Its 34% Price Drop in 2025?

Reviewed by Bailey Pemberton

- Wondering if Charter Communications stock is finally a value opportunity or just another value trap? You are not alone. Let’s dig into what the numbers really say.

- The share price has taken a hit lately, dropping 5.3% over the past week, 16.1% in a month, and is down 33.9% year-to-date. This puts its 1-year decline at nearly 30%.

- Recent headlines have highlighted Charter’s ongoing infrastructure investments and regulatory challenges. These developments are fueling both hopes for future growth and worries about rising costs. Investors seem divided as the company’s strategic moves spark both optimism and skepticism among market watchers.

- Charter currently scores 5 out of 6 on our valuation checks, indicating it appears undervalued by most metrics. Let’s look deeper at how this score is calculated and why there may be an even clearer perspective on valuation by the article’s end.

Find out why Charter Communications's -29.5% return over the last year is lagging behind its peers.

Approach 1: Charter Communications Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the true worth of a company by projecting its future cash flows and discounting them back to their present value. For Charter Communications, this involves looking ahead to what the company might earn in the coming years and assessing what that is worth today, all expressed in dollars.

Charter's current Free Cash Flow stands at approximately $4.1 Billion. Analyst forecasts suggest robust growth, with Free Cash Flow expected to reach about $5.6 Billion in 2026 and climb as high as $8.5 Billion by the end of 2028. Beyond five years, these projections are extended by financial models, ultimately forecasting more than $13.5 Billion in Free Cash Flow by 2035. These figures indicate strong potential for increasing cash generation in the years ahead.

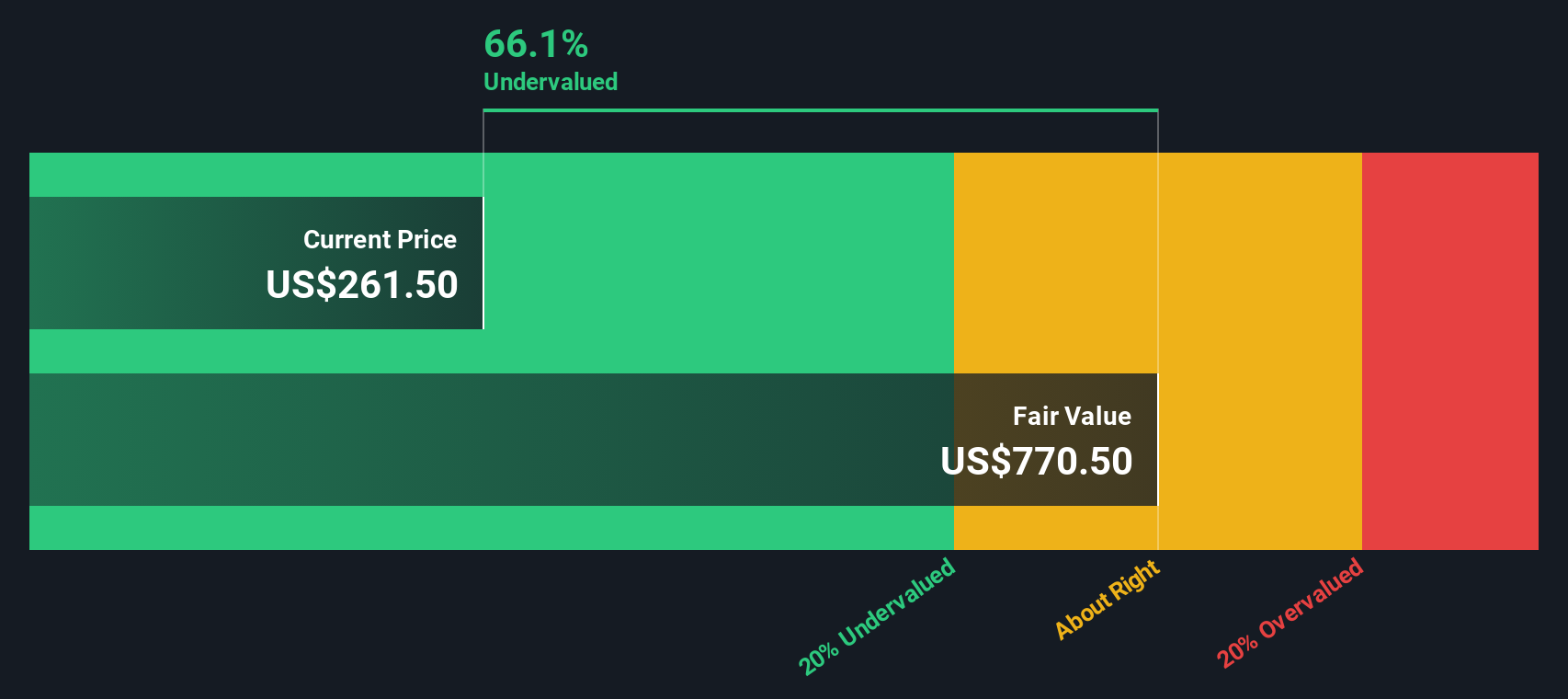

Based on this DCF analysis, the estimated intrinsic value for Charter Communications is $779.32 per share. This is nearly 70.4% higher than the current share price, which suggests that the stock is significantly undervalued according to the model's projection.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Charter Communications is undervalued by 70.4%. Track this in your watchlist or portfolio, or discover 831 more undervalued stocks based on cash flows.

Approach 2: Charter Communications Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular valuation metric, especially for profitable companies like Charter Communications. This ratio helps investors understand how much they are paying for each dollar of current earnings, making it a useful snapshot of value when a company is generating consistent profits.

It is important to remember that what constitutes a “normal” or “fair” PE ratio depends on factors such as the company’s future growth prospects and risk profile. Companies expected to grow faster are often valued at a higher PE ratio, while riskier businesses might trade at discounted multiples to reflect greater uncertainty.

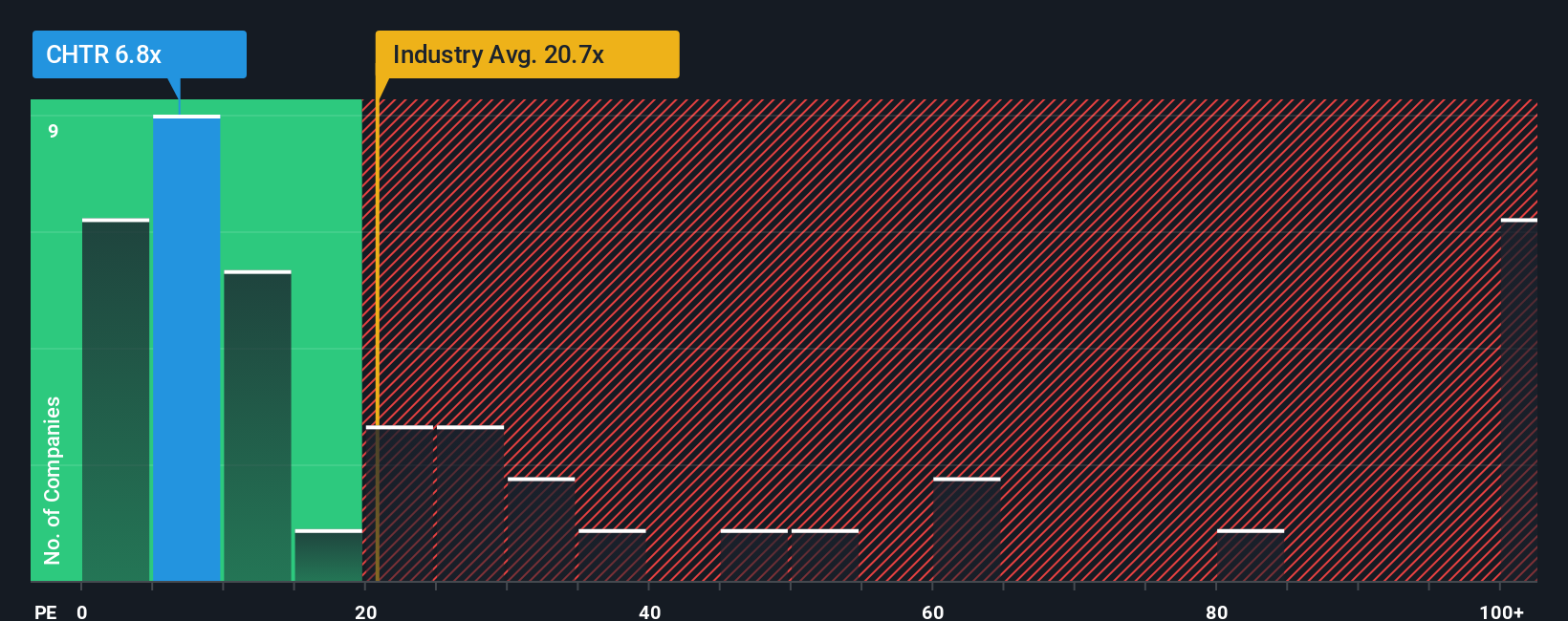

Charter currently trades at a PE ratio of 6.0x, which is significantly below the industry average of 18.9x and the peer average of 24.4x. On the surface, this low PE might make the stock look unusually cheap compared to its competitors in the Media industry.

Simply Wall St’s Fair Ratio takes this analysis a step further by factoring in Charter's growth outlook, risks, profit margins, market cap and industry characteristics to define a more accurate benchmark. Unlike simple comparisons to peers or industry averages, the Fair Ratio offers a proprietary perspective on what a reasonable PE multiple should be, given all the relevant factors unique to Charter.

In Charter’s case, the Fair Ratio is 23.5x. This means the current 6.0x PE is well below what would be considered fair for the company based on its fundamentals and sector dynamics. This suggests Charter is undervalued using this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1394 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Charter Communications Narrative

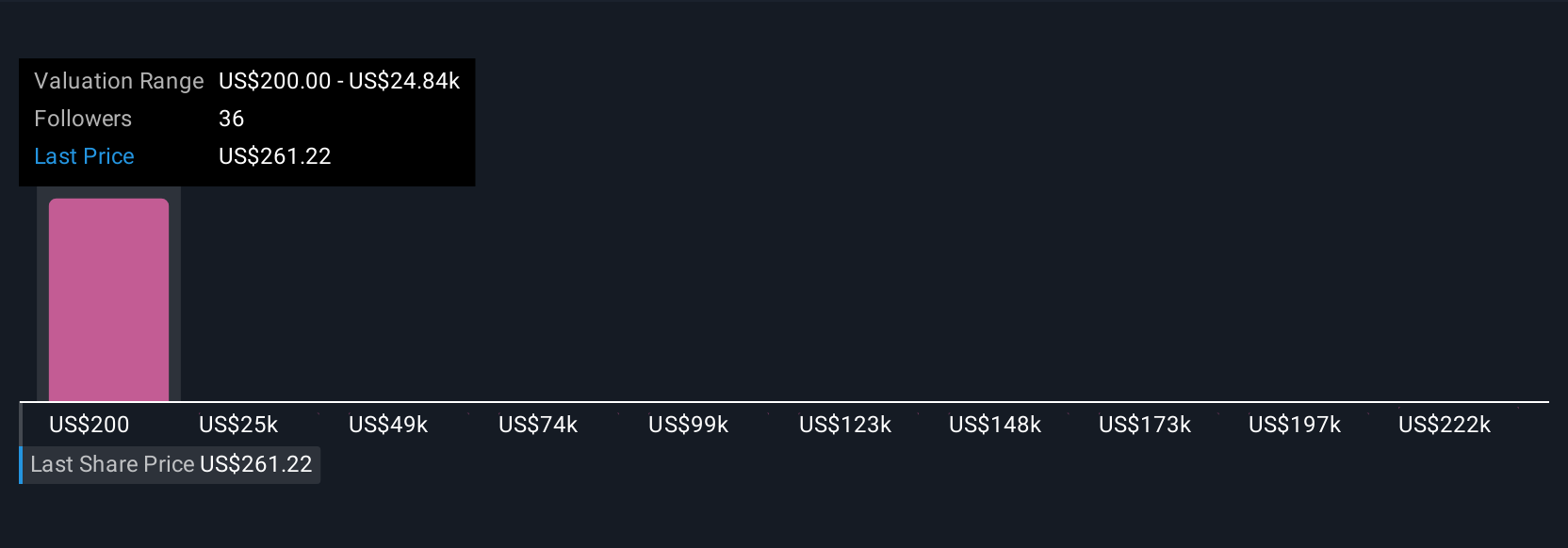

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company, combining your outlook for its business, such as expected revenue, earnings, and profit margins, with the financial forecast you believe is most likely.

Rather than just relying on traditional metrics, a Narrative ties together what is happening at Charter Communications, your assumptions about its future, and the resulting fair value per share. Creating Narratives is easy and accessible on Simply Wall St’s Community page, which is used by millions of investors.

With Narratives, you can quickly see if Charter’s current share price offers an opportunity or a risk by comparing your calculated Fair Value to the actual market price. Narratives are kept up-to-date in real time as fresh news, earnings, or developments are reported, so your view can evolve with new information.

For example, some investors’ Narratives for Charter are quite bullish, with fair values as high as $500 per share based on positive outlooks for revenue growth and profit margins. Others are more cautious, estimating a fair value as low as $223. This demonstrates how much your perspective and assumptions shape your investment decision.

Do you think there's more to the story for Charter Communications? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHTR

Charter Communications

Operates as a broadband connectivity and cable operator company serving residential and commercial customers in the United States.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives