- United States

- /

- Media

- /

- NasdaqGS:CHTR

Has the 50% Drop in Charter Communications Created an Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Charter Communications stock is a hidden gem or a value trap? You are not alone, and we are about to dig into whether its current price is as attractive as it looks.

- After a sharp move down, Charter’s shares have dropped 8.8% in the past week and a striking 22.8% over the last month. This brings its year-to-date return to a steep -44.4% and deepens its 1-year decline to -50.1%.

- Recent headlines have focused on industry shifts, competitive pressure from streaming and wireless providers, and ongoing regulatory discussions affecting broadband. These stories help explain some of the volatility, but they also raise questions about whether the market has overreacted or simply adjusted for new risks.

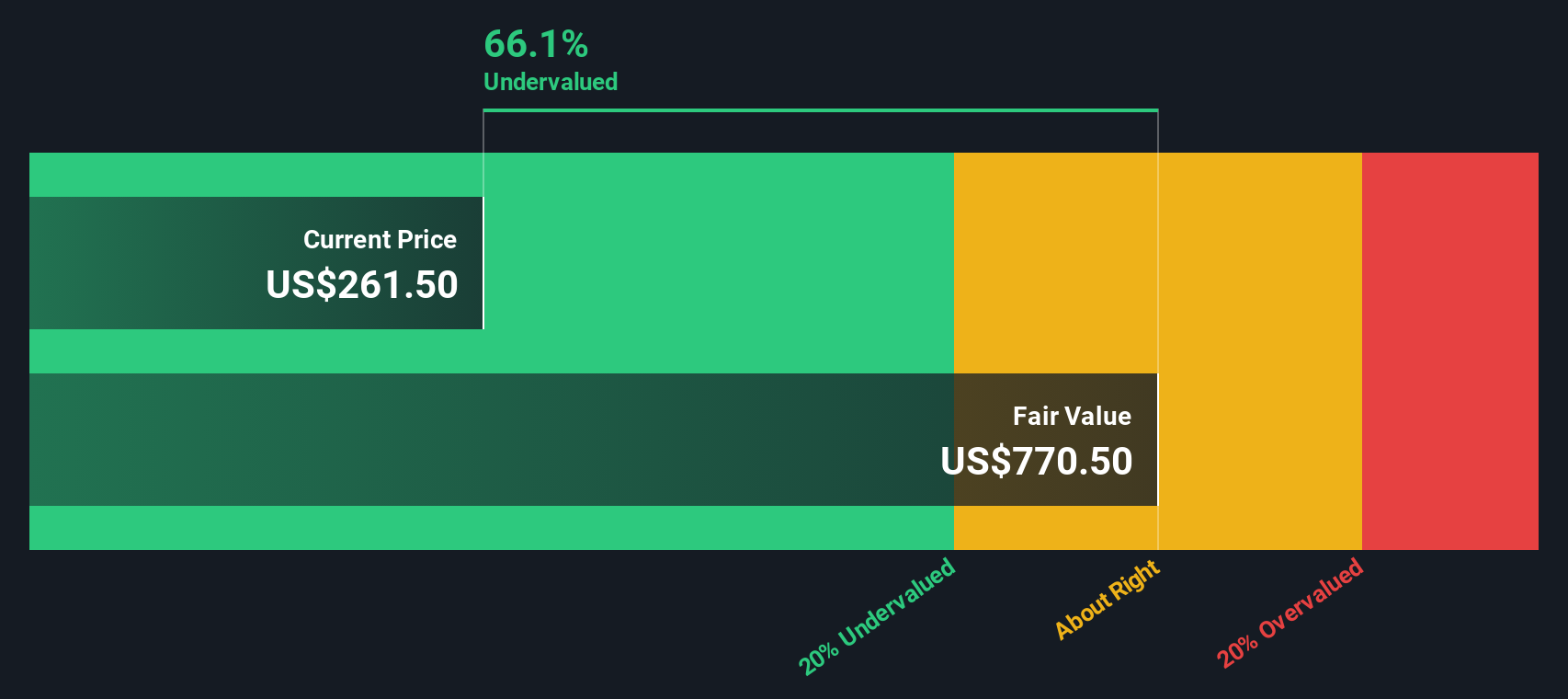

- On our valuation checks, Charter Communications currently scores 5 out of 6, suggesting it may be undervalued on several fronts. We will break down what this score means according to different methodologies, and touch on an even more insightful way to think about valuation at the end of the article.

Find out why Charter Communications's -50.1% return over the last year is lagging behind its peers.

Approach 1: Charter Communications Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. The idea is to determine how much the money Charter Communications is expected to generate in the future is truly worth now, given the risks and time involved.

Charter's latest reported Free Cash Flow is $4.5 Billion. Analyst estimates point to steady growth, with cash flows forecast to rise from $5.2 Billion in 2026 to $9.2 Billion by 2029. Beyond the fifth year, Simply Wall St extrapolates further and forecasts Free Cash Flow to top $14.8 Billion by 2035. All these figures are in US dollars.

After performing the calculations using the 2 Stage Free Cash Flow to Equity model, Charter's estimated intrinsic value comes out at $818 per share. This implies a 76.2% discount, indicating the stock trades well below what the company's projected future cash flows suggest it is worth.

In summary, based on DCF analysis, Charter Communications appears deeply undervalued compared to its intrinsic potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Charter Communications is undervalued by 76.2%. Track this in your watchlist or portfolio, or discover 895 more undervalued stocks based on cash flows.

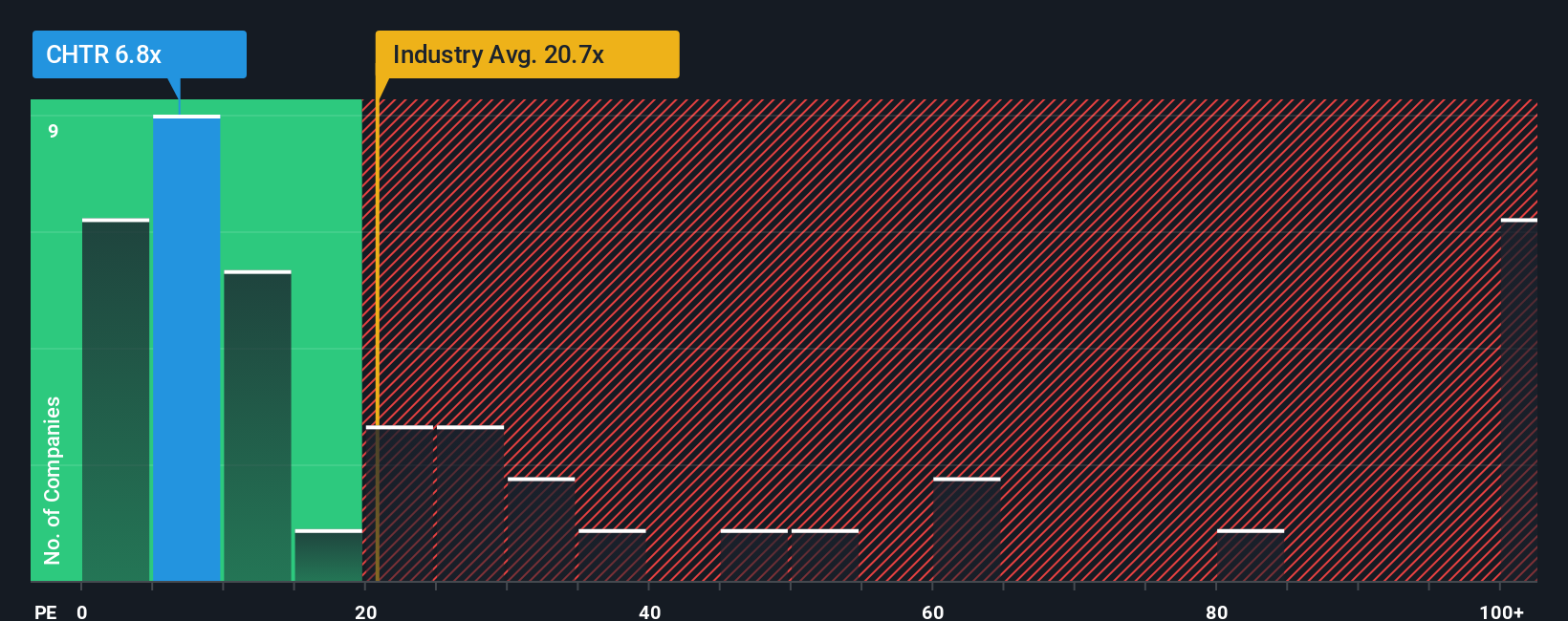

Approach 2: Charter Communications Price vs Earnings (PE)

The price-to-earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies like Charter Communications. It tells investors how much they are paying for each dollar of earnings and is especially relevant when a company has positive earnings, offering a window into both market sentiment and potential value.

What constitutes a “fair” PE ratio depends on factors like the company’s future earnings growth, stability, and risks. Higher expected growth usually supports a higher PE, while more risk or lower growth pushes that number down. Comparing Charter’s PE to competitors and the broader industry helps show where it sits in the current landscape.

Right now, Charter Communications trades at just 4.91x earnings. This is much lower than the Media industry average of 16.06x and even further below the peer group average of 22.43x. On the surface, this discount can look attractive, but headline multiples can miss some important context.

That is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio, for Charter, is 20.06x and is calculated using a range of data including earnings growth forecasts, industry norms, margins, company size, and risk profile. Unlike simple peer or industry comparisons, the Fair Ratio aims to reflect what the “right” multiple should be given Charter’s unique fundamentals, not just market averages.

With Charter’s PE of 4.91x well below its Fair Ratio of 20.06x, the stock screens as notably undervalued by this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1417 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Charter Communications Narrative

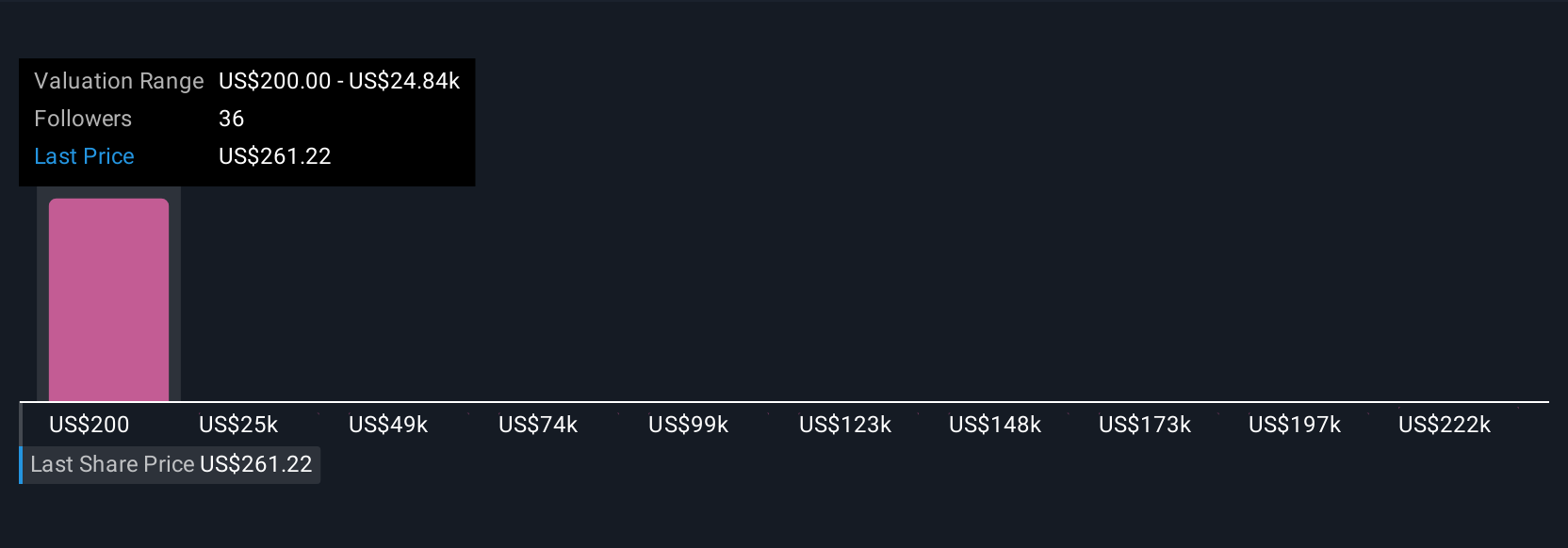

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. In investing, a Narrative is simply your personal story or thesis about a company. It's why you believe Charter Communications will perform a certain way in the future, backed up by your own assumptions for its revenue, earnings, and margins.

A Narrative bridges the gap between big-picture stories and specific financial predictions, helping you build a fair value forecast that fits your unique perspective. Narratives are available on Simply Wall St’s Community page, used by millions of investors, and make it easy to connect your views about market changes, business strengths, or risks directly to the numbers.

This means you can quickly see how your scenario stacks up against the current market price and decide if now is the right time to buy, hold, or sell. What’s more, Narratives update automatically as fresh news, analyst forecasts, or earnings are released, so your view always stays relevant.

For example, one investor might be optimistic, forecasting Charter’s fair value at $500 per share due to strong mobile growth, while a more cautious investor may see $223 as fair value given competitive pressures. Narratives let you easily compare both, so your investment decisions are grounded in both story and numbers.

Do you think there's more to the story for Charter Communications? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHTR

Charter Communications

Operates as a broadband connectivity and cable operator company serving residential and commercial customers in the United States.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives