- United States

- /

- Media

- /

- NasdaqGS:CHTR

Charter Communications (CHTR): Margin Growth Reinforces Value Narrative Despite Debt Concerns

Reviewed by Simply Wall St

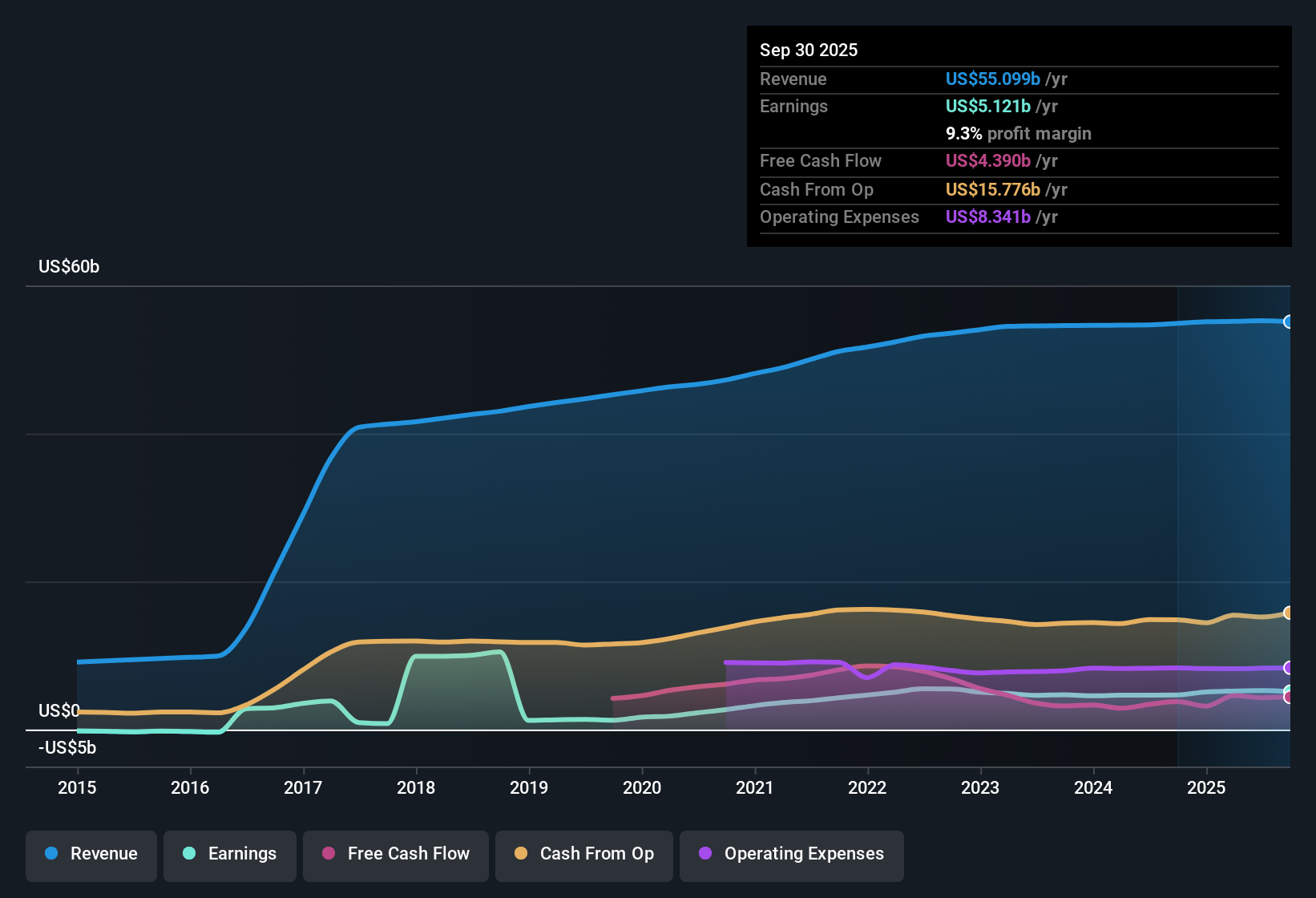

Charter Communications (CHTR) reported net profit margins of 9.5%, up from 8.5% last year, signaling a step up in profitability. Earnings have grown 7.1% per year over the past five years, with the most recent year seeing profit growth accelerate to 13.2%. Future annual revenue and earnings gains are forecast at 1.3% and 4.2% per year respectively, both below broader US market expectations. While topline and earnings projections are somewhat subdued, high-quality past earnings and an attractive price-to-earnings ratio relative to peers frame the results as a positive story for value-focused investors, though there remains some caution due to the company’s financial position.

See our full analysis for Charter Communications.The next step is seeing how these results compare with prevailing market narratives. Some perspectives may get reinforced, while others could be reconsidered in light of the latest numbers.

See what the community is saying about Charter Communications

Margin Growth Outpaces Industry Concerns

- Profit margins are expected to rise from 9.5% to 10.7% over the next three years, even as revenue is projected to decline by 0.9% per year. This underscores operational improvements.

- Analysts' consensus view highlights that

- Leveraging network upgrades and AI-driven efficiencies is expected to help Charter defend and potentially grow margins. This would support stability in customer satisfaction and retention, despite slower revenue expansion.

- This margin outlook counters bearish concerns about competitive pressure and cost inflation. It suggests that management is successfully offsetting headwinds through technology investments and service improvements.

Debt Load and Financial Flexibility Risks

- Charter carries a high debt burden of $93.6 billion, and management intends to increase leverage further. This could constrain flexibility if growth slows or conditions worsen.

- Analysts' consensus view calls out meaningful risk that

- Rising competition from fiber and mobile could challenge revenue, while heavy debt limits Charter’s ability to invest or buffer downturns. This raises the stakes for continued margin expansion and cost control.

- If cost increases such as tariffs on equipment materialize, high leverage may amplify the impact on cash flows and could slow down network upgrades.

Discounted Valuation Versus Peers and DCF

- Trading at a price-to-earnings multiple of 6.1x, Charter stands at a steep discount versus the US media industry average of 18.3x and peer average of 24.8x. It also remains well below its DCF fair value estimate of $692.32 per share based on a current price of $233.84.

- Analysts' consensus view flags that

- This discount creates a situation where investors could benefit if execution matches margin and efficiency gains. However, downside risks remain if growth or financial flexibility disappoints.

- The large gap between current price, average peer valuation, and DCF fair value means the stock price could react rapidly in either direction as market sentiment shifts on Charter’s ability to deliver.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Charter Communications on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think these figures tell a different story? Share your unique take and shape a narrative in just a few minutes: Do it your way.

A great starting point for your Charter Communications research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Charter’s heavy debt load and limited financial flexibility expose investors to heightened risk if growth stalls or if market conditions deteriorate.

Seeking companies with more robust financial footing? Tap into solid balance sheet and fundamentals stocks screener (1971 results) to find those with lower debt and stronger balance sheets that add confidence in uncertain times.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHTR

Charter Communications

Operates as a broadband connectivity and cable operator company serving residential and commercial customers in the United States.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives