- United States

- /

- Entertainment

- /

- NasdaqCM:BHAT

It's Down 25% But Blue Hat Interactive Entertainment Technology (NASDAQ:BHAT) Could Be Riskier Than It Looks

Unfortunately for some shareholders, the Blue Hat Interactive Entertainment Technology (NASDAQ:BHAT) share price has dived 25% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 77% share price decline.

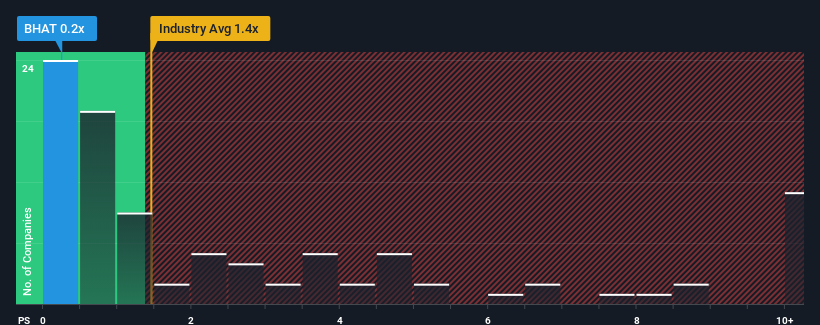

Since its price has dipped substantially, Blue Hat Interactive Entertainment Technology may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Entertainment industry in the United States have P/S ratios greater than 1.4x and even P/S higher than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Blue Hat Interactive Entertainment Technology

How Blue Hat Interactive Entertainment Technology Has Been Performing

Recent times have been quite advantageous for Blue Hat Interactive Entertainment Technology as its revenue has been rising very briskly. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Blue Hat Interactive Entertainment Technology will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Blue Hat Interactive Entertainment Technology will help you shine a light on its historical performance.How Is Blue Hat Interactive Entertainment Technology's Revenue Growth Trending?

Blue Hat Interactive Entertainment Technology's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. The latest three year period has also seen an excellent 200% overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 11% shows it's noticeably more attractive.

With this information, we find it odd that Blue Hat Interactive Entertainment Technology is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does Blue Hat Interactive Entertainment Technology's P/S Mean For Investors?

Blue Hat Interactive Entertainment Technology's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We're very surprised to see Blue Hat Interactive Entertainment Technology currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Blue Hat Interactive Entertainment Technology (of which 2 shouldn't be ignored!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Blue Hat Interactive Entertainment Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BHAT

Blue Hat Interactive Entertainment Technology

Engages in bulk commodity trading business in the People’s Republic of China.

Adequate balance sheet with low risk.

Market Insights

Community Narratives