- United States

- /

- Media

- /

- NasdaqCM:BBGI

Should Shareholders Reconsider Beasley Broadcast Group, Inc.'s (NASDAQ:BBGI) CEO Compensation Package?

Shareholders will probably not be too impressed with the underwhelming results at Beasley Broadcast Group, Inc. (NASDAQ:BBGI) recently. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 27 May 2021. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. The data we present below explains why we think CEO compensation is not consistent with recent performance.

See our latest analysis for Beasley Broadcast Group

How Does Total Compensation For Barbara Beasley Compare With Other Companies In The Industry?

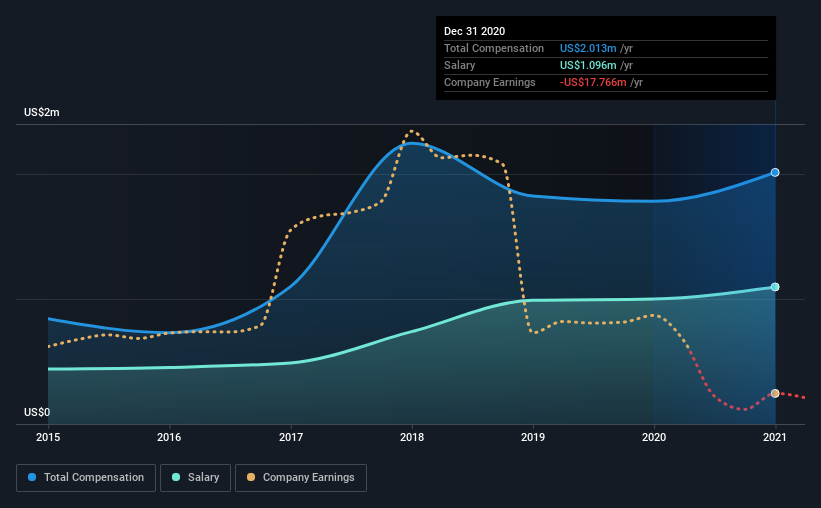

According to our data, Beasley Broadcast Group, Inc. has a market capitalization of US$79m, and paid its CEO total annual compensation worth US$2.0m over the year to December 2020. We note that's an increase of 13% above last year. In particular, the salary of US$1.10m, makes up a fairly large portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$690k. Accordingly, our analysis reveals that Beasley Broadcast Group, Inc. pays Barbara Beasley north of the industry median. Moreover, Barbara Beasley also holds US$3.6m worth of Beasley Broadcast Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$1.1m | US$1.0m | 54% |

| Other | US$916k | US$782k | 46% |

| Total Compensation | US$2.0m | US$1.8m | 100% |

On an industry level, roughly 22% of total compensation represents salary and 78% is other remuneration. Beasley Broadcast Group pays out 54% of remuneration in the form of a salary, significantly higher than the industry average. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Beasley Broadcast Group, Inc.'s Growth

Beasley Broadcast Group, Inc. has reduced its earnings per share by 120% a year over the last three years. It saw its revenue drop 25% over the last year.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Beasley Broadcast Group, Inc. Been A Good Investment?

With a total shareholder return of -71% over three years, Beasley Broadcast Group, Inc. shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 3 warning signs for Beasley Broadcast Group (of which 1 doesn't sit too well with us!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Beasley Broadcast Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beasley Broadcast Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:BBGI

Beasley Broadcast Group

A multi-platform media company, owns and operates radio stations in the United States.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion