- United States

- /

- Entertainment

- /

- NasdaqGS:BATR.K

If You Had Bought Liberty Braves Group (NASDAQ:BATR.K) Stock Three Years Ago, You Could Pocket A 60% Gain Today

By buying an index fund, investors can approximate the average market return. But if you pick the right individual stocks, you could make more than that. For example, the The Liberty Braves Group (NASDAQ:BATR.K) share price is up 60% in the last three years, clearly besting the market return of around 34% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 4.4%.

Check out our latest analysis for Liberty Braves Group

While Liberty Braves Group made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 3 years Liberty Braves Group saw its revenue grow at 21% per year. That's well above most pre-profit companies. The share price rise of 17% per year throughout that time is nice to see, and given the revenue growth, that gain seems somewhat justified. So now might be the perfect time to put Liberty Braves Group on your radar. A window of opportunity may reveal itself with time, if the business can trend to profitability.

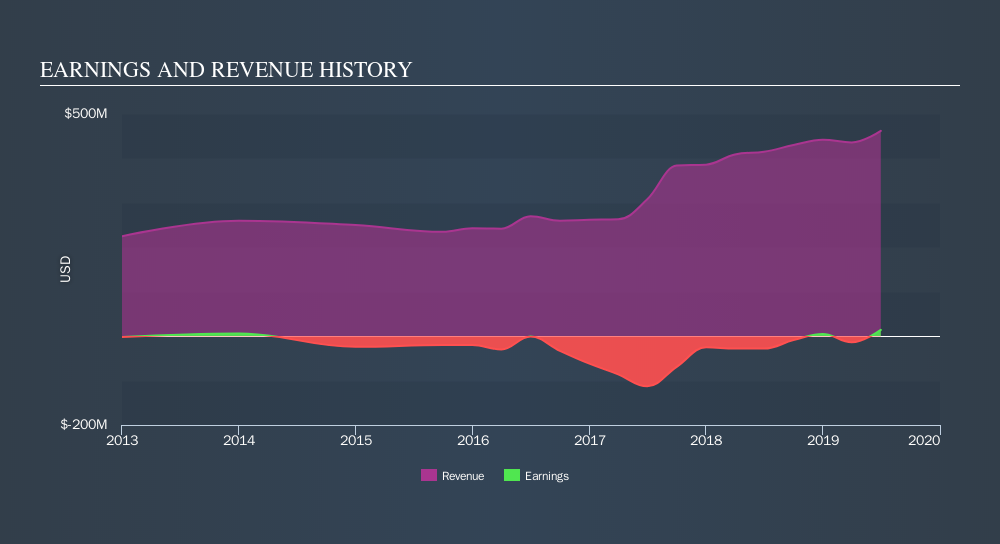

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Liberty Braves Group has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Pleasingly, Liberty Braves Group's total shareholder return last year was 4.4%. But the three year TSR of 17% per year is even better. You could get a better understanding of Liberty Braves Group's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course Liberty Braves Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:BATR.K

Atlanta Braves Holdings

Through its subsidiary, Braves Holdings, LLC, owns and operates the Atlanta Braves Major League Baseball Club in the United States.

Moderate growth potential with imperfect balance sheet.

Market Insights

Community Narratives