- United States

- /

- Media

- /

- OTCPK:KDOZ.F

3 Promising Penny Stocks With Market Caps Under $200M

Reviewed by Simply Wall St

As the U.S. stock market shows signs of resilience with major indices like the Nasdaq and S&P 500 posting gains, investors are increasingly looking for opportunities beyond the usual tech giants. Penny stocks, a term that might seem outdated, still represent a compelling investment area by offering access to smaller or newer companies at lower price points. When these stocks are supported by strong financials and solid fundamentals, they can provide potential growth opportunities without many of the typical risks associated with this segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.82 | $400.75M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.74 | $622.06M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.02 | $181.28M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.85 | $620.89M | ✅ 4 ⚠️ 1 View Analysis > |

| Global Self Storage (SELF) | $4.97 | $55.95M | ✅ 5 ⚠️ 1 View Analysis > |

| Sensus Healthcare (SRTS) | $3.18 | $52.77M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $2.00 | $24.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.9999 | $7.19M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.40 | $81.57M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 362 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Kidoz (KDOZ.F)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kidoz Inc. is a global AdTech software developer offering a mobile advertising platform aimed at children, teens, and families, with a market cap of €31.38 million.

Operations: The company generates revenue of $14.90 million from its Ad Tech Advertising sales.

Market Cap: $31.38M

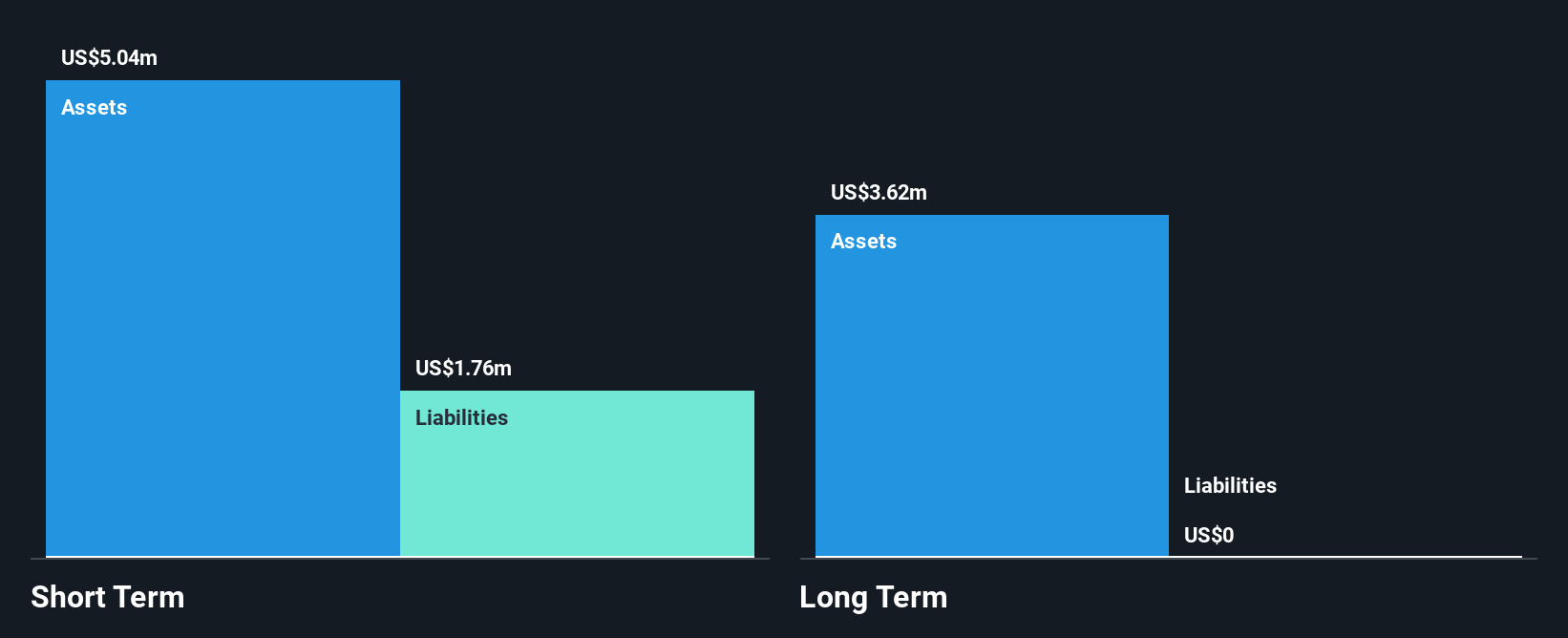

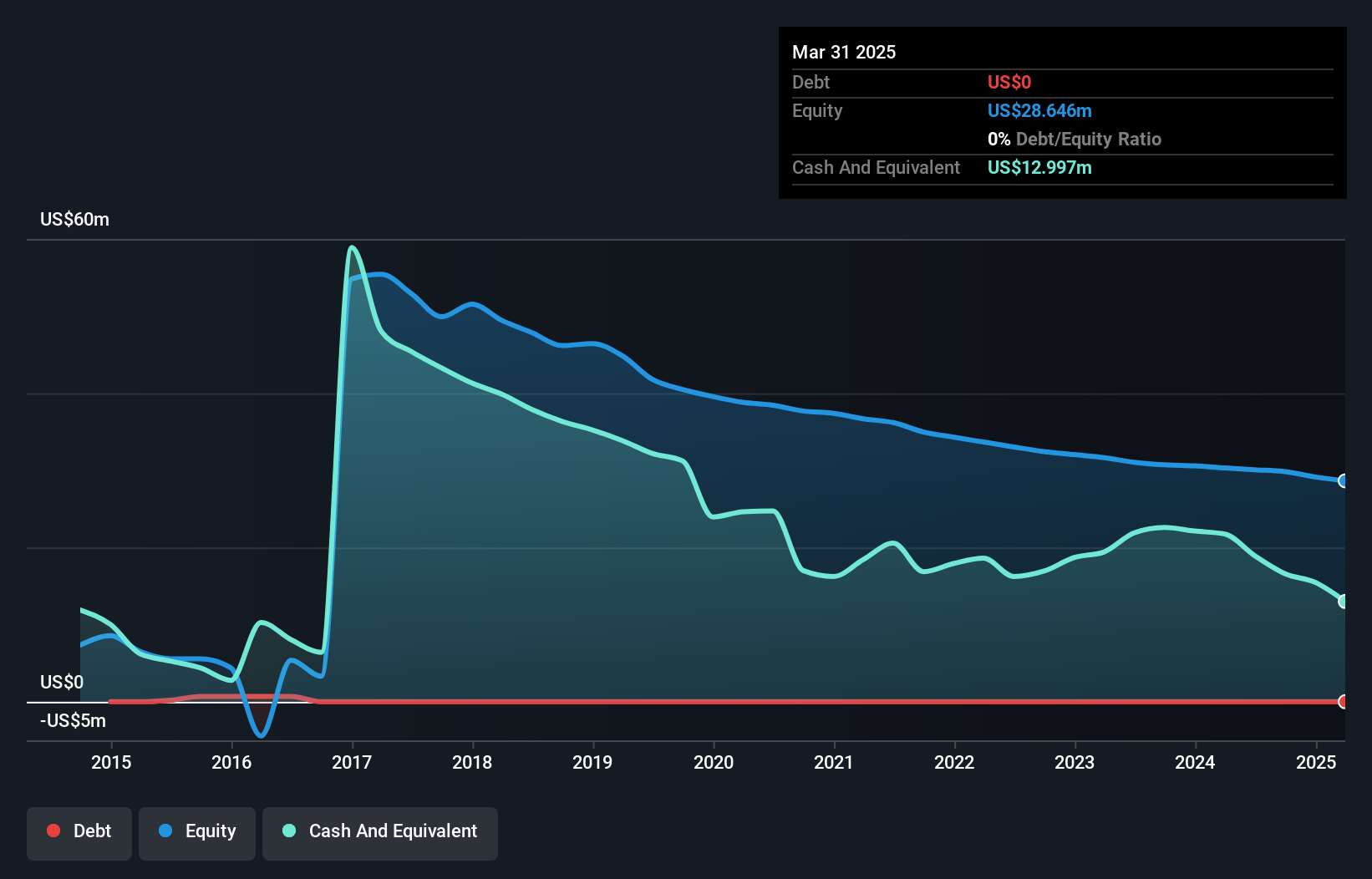

Kidoz Inc., a global AdTech software developer, has shown resilience in the penny stock arena with a market cap of €31.38 million and revenue of US$14.90 million from its advertising platform. The company recently reported second-quarter sales of US$2.43 million, slightly down from the previous year, alongside a net loss increase to US$1.17 million. Despite this, Kidoz has become profitable over the past year and boasts no long-term liabilities or debt, indicating financial prudence. However, its share price remains highly volatile despite trading significantly below estimated fair value. The management team is experienced with an average tenure of 3.4 years.

- Unlock comprehensive insights into our analysis of Kidoz stock in this financial health report.

- Gain insights into Kidoz's outlook and expected performance with our report on the company's earnings estimates.

Liquidmetal Technologies (LQMT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Liquidmetal Technologies, Inc. is a materials technology company that designs, develops, and sells custom products and parts made from bulk amorphous alloys to various industries globally, with a market cap of $131.26 million.

Operations: The company's revenue is primarily derived from developing and manufacturing products and applications using amorphous alloys, amounting to $1.02 million.

Market Cap: $131.26M

Liquidmetal Technologies, Inc. operates within the penny stock domain with a market cap of US$131.26 million and limited revenue streams, generating US$1.02 million primarily from amorphous alloy applications. Despite being pre-revenue and unprofitable, the company has reduced its losses over five years by 15.6% annually and maintains a robust cash runway exceeding three years without debt or long-term liabilities. Recent earnings showed increased net losses despite slight revenue growth in Q2 2025 compared to the previous year. The board is seasoned with an average tenure of nine years, although management experience data is insufficient.

- Get an in-depth perspective on Liquidmetal Technologies' performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Liquidmetal Technologies' track record.

Key Takeaways

- Unlock more gems! Our US Penny Stocks screener has unearthed 359 more companies for you to explore.Click here to unveil our expertly curated list of 362 US Penny Stocks.

- Curious About Other Options? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kidoz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:KDOZ.F

Kidoz

A global AdTech software developer that provides a mobile advertising platform targeting children, teens, and families.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives