- United States

- /

- Metals and Mining

- /

- NYSEAM:GORO

Gold Resource (GORO): Losses Worsen at 66.7% Annually, Undercutting Turnaround Narratives

Reviewed by Simply Wall St

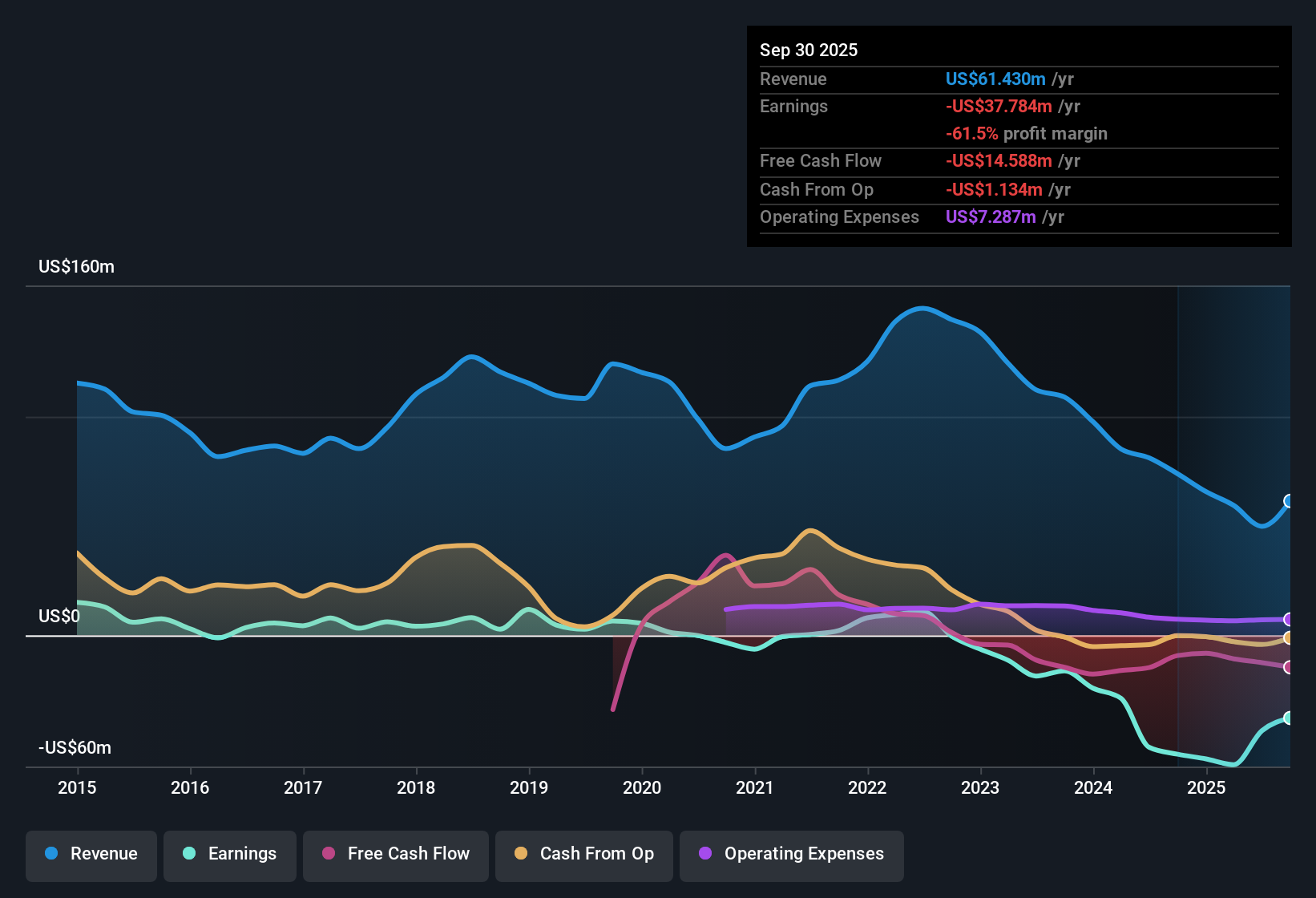

Gold Resource (GORO) remains unprofitable, with net losses worsening at a rate of 66.7% per year over the past five years, and profit margins still in negative territory. Revenue is forecast to grow 8.2% annually, which is slower than the US market average of 10.5%. For investors, the company’s faster-increasing losses and underwhelming revenue outlook put pressure on sentiment this earnings season.

See our full analysis for Gold Resource.Next, we will see how these headline results stack up against the key narratives circulating in the market and where perceptions might diverge from reality.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Outpace Revenue Gains at 66.7% Per Year

- Over the past five years, Gold Resource’s annual net losses have grown at a rapid 66.7% per year. This far exceeds its projected 8.2% revenue growth rate and leaves the company’s margins deeply negative compared to peers.

- The prevailing market view emphasizes that this widening gap between losses and modestly growing sales puts pressure on any potential turnaround story.

- Market watchers suggest that persistently negative profit margins, with no improvement noted in regulatory filings, make it tough to justify optimism about bottom-line recovery because operating scale hasn’t translated to profitability.

- With revenue growth trailing the US market average of 10.5% and losses rising much faster, investors face an uphill climb convincing the market of near-term progress.

Valuation Sits Between Industry and Peer Benchmarks

- Gold Resource’s 2.3x Price-to-Sales Ratio falls below the US Metals and Mining industry average of 2.7x, but trades at a premium to immediate peers at 1.8x. This reflects ongoing debate over whether its business justifies a higher multiple.

- The prevailing market view turns skeptical when a premium to peers is paired with persistent unprofitability.

- Some investors notice that despite not diluting shareholders in the past year, GORO’s higher trading multiple has not attracted rerating. Its ongoing operating losses are likely the main reason.

- Since the company’s share price has also remained unstable over the past three months, there is little evidence that the valuation alone is enough to shift sentiment positively.

Risks Heavily Outweigh Noted Rewards

- EDGAR filings and risk disclosures highlight no reward statements in the period under review, while the roster of risks includes unprofitability, a volatile share price, and peer-relative valuation concerns.

- The prevailing market view points to an overwhelmingly cautious stance on Gold Resource given the absence of clear upside drivers.

- With no rewards articulated and major flagged risks still unresolved, market sentiment suggests most investors are waiting for hard evidence of progress before re-rating the stock.

- As a result, GORO’s current positioning is characterized by ongoing skepticism rather than enthusiasm around any single catalyst.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Gold Resource's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

With accelerating losses, weak revenue growth, and persistent unprofitability, Gold Resource is struggling to deliver the steady performance investors typically seek.

Concerned by instability and want reliability? Use stable growth stocks screener (2074 results) to quickly pinpoint companies that consistently expand their earnings and revenue, designed for resilience across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:GORO

Gold Resource

Engages in the exploration, development, and production of gold and silver projects.

Adequate balance sheet with low risk.

Market Insights

Community Narratives