Stock Analysis

- United States

- /

- Metals and Mining

- /

- NYSE:X

We Think United States Steel (NYSE:X) Is Taking Some Risk With Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies United States Steel Corporation (NYSE:X) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for United States Steel

How Much Debt Does United States Steel Carry?

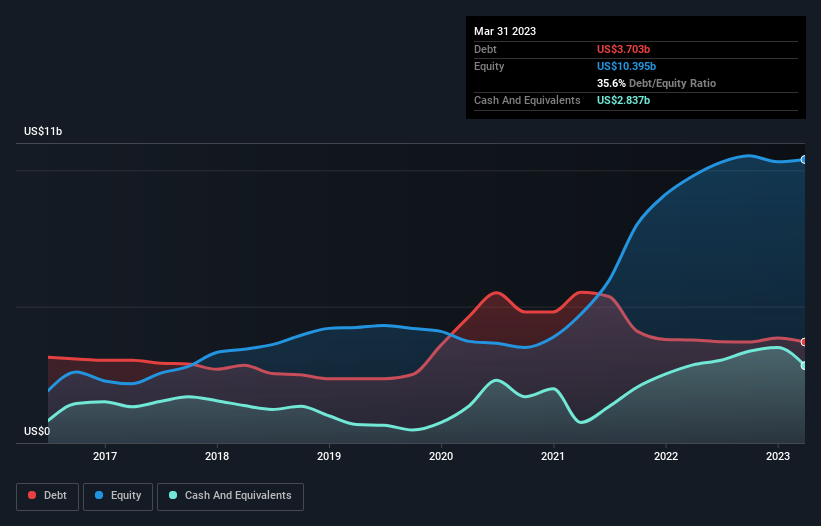

The chart below, which you can click on for greater detail, shows that United States Steel had US$3.70b in debt in March 2023; about the same as the year before. However, because it has a cash reserve of US$2.84b, its net debt is less, at about US$866.0m.

A Look At United States Steel's Liabilities

Zooming in on the latest balance sheet data, we can see that United States Steel had liabilities of US$4.02b due within 12 months and liabilities of US$5.13b due beyond that. Offsetting this, it had US$2.84b in cash and US$1.81b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$4.50b.

This deficit is considerable relative to its market capitalization of US$4.94b, so it does suggest shareholders should keep an eye on United States Steel's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

United States Steel has net debt of just 0.27 times EBITDA, suggesting it could ramp leverage without breaking a sweat. And remarkably, despite having net debt, it actually received more in interest over the last twelve months than it had to pay. So it's fair to say it can handle debt like a hotshot teppanyaki chef handles cooking. The modesty of its debt load may become crucial for United States Steel if management cannot prevent a repeat of the 55% cut to EBIT over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if United States Steel can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent two years, United States Steel recorded free cash flow worth 56% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

While United States Steel's EBIT growth rate has us nervous. To wit both its interest cover and net debt to EBITDA were encouraging signs. When we consider all the factors discussed, it seems to us that United States Steel is taking some risks with its use of debt. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that United States Steel is showing 3 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're helping make it simple.

Find out whether United States Steel is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NYSE:X

United States Steel

United States Steel Corporation produces and sells flat-rolled and tubular steel products primarily in North America and Europe.

Very undervalued with flawless balance sheet.