WestRock Company (NYSE:WRK) will increase its dividend on the 24th of August to US$0.24. The announced payment will take the dividend yield to 1.8%, which is in line with the average for the industry.

Check out our latest analysis for WestRock

WestRock's Distributions May Be Difficult To Sustain

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. WestRock is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

Recent, EPS has fallen by 13.6%, so this could continue over the next year. This means that the company will be unprofitable, but cash flows are more important when considering the dividend and as the current cash payout ratio is pretty healthy, we don't think there is too much reason to worry.

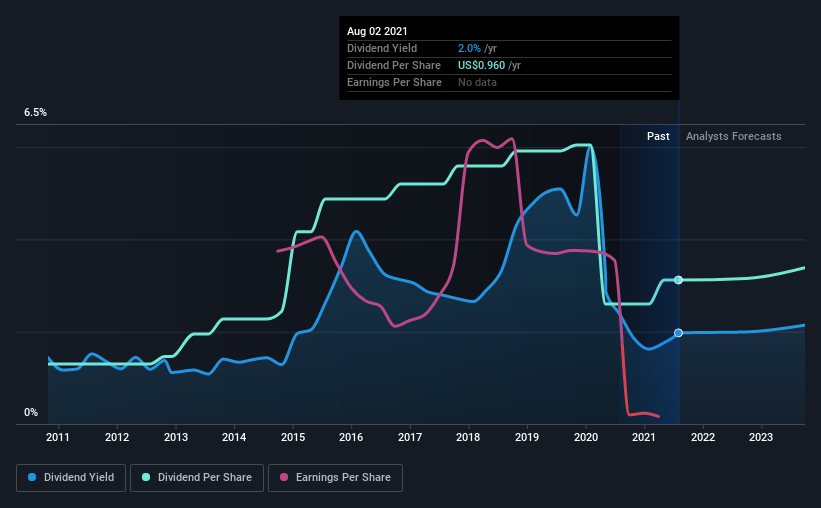

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2011, the first annual payment was US$0.40, compared to the most recent full-year payment of US$0.96. This works out to be a compound annual growth rate (CAGR) of approximately 9.1% a year over that time. We have seen cuts in the past, so while the growth looks promising we would be a little bit cautious about its track record.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Over the past five years, it looks as though WestRock's EPS has declined at around 14% a year. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

The Dividend Could Prove To Be Unreliable

Overall, we always like to see the dividend being raised, but we don't think WestRock will make a great income stock. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 4 warning signs for WestRock that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

When trading WestRock or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if WestRock might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:WRK

WestRock

Provides fiber-based paper and packaging solutions in North America, South America, Europe, Asia, and Australia.

Low with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026