- United States

- /

- Chemicals

- /

- NYSE:WLK

Westlake (WLK): Assessing Value After Quarterly Loss and $727M Goodwill Impairment

Reviewed by Simply Wall St

Westlake (WLK) reported third quarter results showing a net loss, with sales coming in lower than the previous year. The figures were impacted by a $727 million goodwill impairment and softer demand conditions.

See our latest analysis for Westlake.

Westlake's latest quarter was a tough one, and the share price has reflected that. After results missed expectations and a significant goodwill impairment was revealed, the stock quickly shed momentum. The year-to-date share price return is -38.6%. Despite scattered positive news like the Ethylene Sales Agreement renewal, the 1-year total shareholder return sits at -46.8%, highlighting persistent headwinds and a cautious outlook in the building materials space.

If you're weighing your next move, this could be a smart time to broaden your search and discover fast growing stocks with high insider ownership.

With shares now trading at a notable discount to analyst targets and recent turbulence factored in, investors may be wondering whether Westlake is a bargain in disguise or if markets are already accounting for any future turnaround.

Most Popular Narrative: 22.2% Undervalued

Compared to its last close at $68.81, the most prominent narrative places Westlake’s fair value at $88.43. This represents a substantial gap that could make value-seekers take notice. The drivers behind this valuation go well beyond short-term performance.

Demographic trends and the long-term undersupply of homes are expected to drive a recovery in residential construction. This positions Westlake’s balanced exposure to both new construction and repair/remodel markets to benefit from secular urbanization and infrastructure development, leading to sustained mid-single-digit organic HIP revenue growth and high EBITDA margins.

Curious what aggressive mid-term growth rates and margin rebound form the foundation for this pricing? Lift the lid on the profit blueprint and find out which financial levers analysts believe tip the scales in Westlake’s favor. The story behind the fair value might surprise you.

Result: Fair Value of $88.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global oversupply in key chemicals and weak recovery in core markets could offset Westlake's anticipated margin and earnings rebound.

Find out about the key risks to this Westlake narrative.

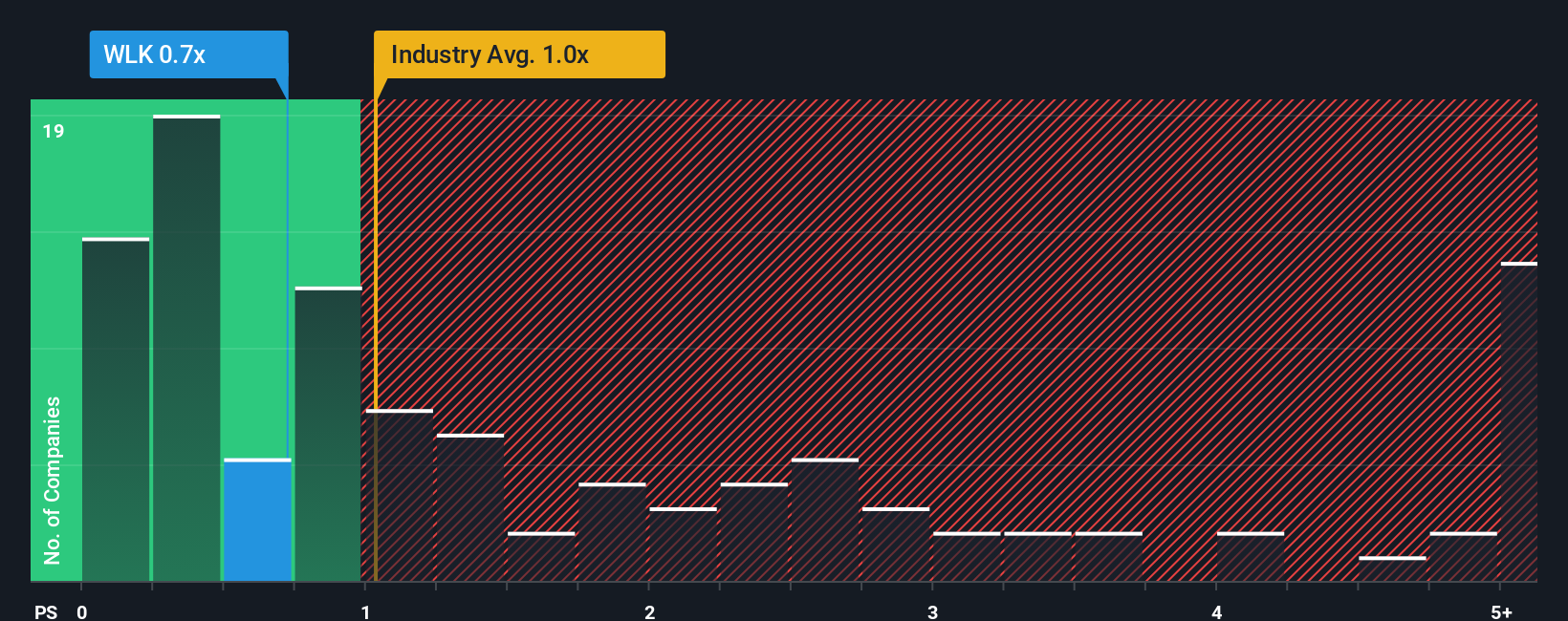

Another View: Let’s Check the Ratios

While our estimate of Westlake's fair value signals a significant discount, the price-to-sales ratio (0.8x) puts things in a different light. This metric is lower than the US Chemicals industry average of 1.2x and aligns perfectly with its fair ratio of 0.8x. This suggests the stock isn’t deeply mispriced relative to peers. Does this lessen the margin of safety here, or is the market already factoring in risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Westlake Narrative

If you see the story differently or want to chart your own path, you can dive into the data and craft a narrative of your own in just a few minutes. Do it your way

A great starting point for your Westlake research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio to just one opportunity. Move ahead of the market by checking out other stocks that could fit your strategy right now.

- Target unbeatable long-term gains and unlock possibilities among these 832 undervalued stocks based on cash flows that analysts believe are trading at attractive prices.

- Tap into tomorrow’s breakthroughs and spot game-changers with these 26 AI penny stocks leveraging artificial intelligence across industries.

- Capture reliable passive income streams by evaluating these 22 dividend stocks with yields > 3% offering yields above 3% and robust payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westlake might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WLK

Westlake

Manufactures and markets performance and essential materials, and housing and infrastructure products in the United States, Canada, Germany, China, Mexico, Brazil, France, Italy, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives