- United States

- /

- Basic Materials

- /

- NYSE:VMC

Stronger Earnings and CEO Succession Could Be a Game Changer for Vulcan Materials (VMC)

Reviewed by Sasha Jovanovic

- Vulcan Materials recently reported stronger-than-expected third quarter earnings and announced that Ronnie Pruitt will succeed as CEO in 2026, highlighting a well-structured leadership transition.

- This combination of operational outperformance and clear succession planning underpins market confidence in Vulcan Materials’ management depth and ongoing business stability.

- We'll explore how the positive market response to Vulcan's upcoming CEO transition may further strengthen the company's investment case.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Vulcan Materials Investment Narrative Recap

Vulcan Materials shareholders generally need to believe in sustained infrastructure investment and a strong recovery in key Sunbelt and public project markets. The recent CEO succession plan and outperformance in Q3 support the short-term catalyst of infrastructure-driven growth, while persistent residential construction headwinds remain the largest risk; these developments do not materially alter the current risk/reward balance for near-term business drivers. Among recent announcements, Vulcan's Q3 earnings beat, delivering higher sales and net income than the prior year, reinforces positive sentiment around operational efficiency and ongoing cost discipline. This is especially relevant as government infrastructure spending continues to serve as a primary growth engine, supporting both volume and margin expansion even as the residential market remains challenging. But in contrast, investors should be aware that Vulcan’s growing reliance on public funding raises questions about what happens if highway bill renewals or IIJA money slow down...

Read the full narrative on Vulcan Materials (it's free!)

Vulcan Materials' projections anticipate $9.6 billion in revenue and $1.5 billion in earnings by 2028. This outlook is based on an 8.1% annual revenue growth rate and a $541.9 million increase in earnings from the current level of $958.1 million.

Uncover how Vulcan Materials' forecasts yield a $317.70 fair value, a 7% upside to its current price.

Exploring Other Perspectives

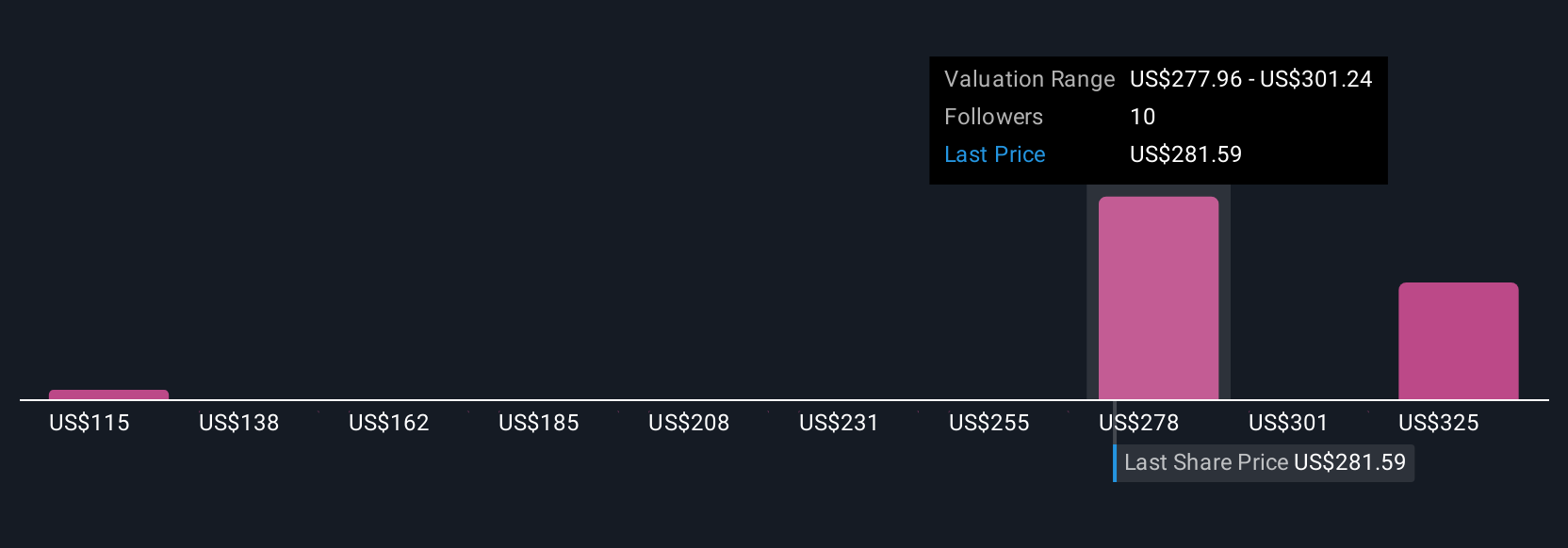

Fair value estimates from the Simply Wall St Community span from US$115 to US$317.70 based on 4 different forecasts. With public infrastructure growth central to Vulcan’s outlook, you can see how future government funding discussions may influence opinions and outcomes.

Explore 4 other fair value estimates on Vulcan Materials - why the stock might be worth as much as 7% more than the current price!

Build Your Own Vulcan Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vulcan Materials research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Vulcan Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vulcan Materials' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VMC

Vulcan Materials

Produces and supplies construction aggregates in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026