- United States

- /

- Basic Materials

- /

- NYSE:VMC

How Investors May Respond To Vulcan Materials (VMC) Leadership Transition Amid Strong Aggregates Momentum

Reviewed by Sasha Jovanovic

- Vulcan Materials recently announced that Chief Strategy Officer Stanley G. Bass will retire on April 30, 2026, with his base salary prorated through that date while his 2026 short- and long-term incentive opportunities as a percentage of salary remain unchanged.

- This executive transition comes shortly after the company reported strong quarterly operating momentum, including double-digit aggregates shipment growth fueled by public construction demand and higher freight-adjusted pricing.

- We’ll now examine how Vulcan’s strong aggregates volume performance and Mr. Bass’s planned retirement affect the company’s existing investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Vulcan Materials Investment Narrative Recap

To own Vulcan Materials, you generally need to believe that sustained infrastructure spending and Sunbelt construction will keep driving aggregates demand and pricing, outweighing softer residential trends and regional weather risk. Mr. Bass’s planned 2026 retirement looks orderly and does not materially change the near term catalyst, which remains public construction driven aggregates volume growth, or the key risk around potential shifts or delays in U.S. infrastructure funding and project timing.

Against this backdrop, Vulcan’s recent report of 12% aggregates shipment growth in Q3 2025, supported by 5% higher freight adjusted pricing and a 31% increase in operating cash flow, matters more to the current narrative than the compensation details around Mr. Bass’s exit. The strong volume and pricing performance reinforce the idea that infrastructure funding and Sunbelt project backlogs are still translating into tangible operating momentum, even as investors watch closely for any signs of funding delays or weather driven disruptions.

But investors should also be aware that if government infrastructure funding were to slow or be delayed, the impact on Vulcan’s volumes and pricing power could...

Read the full narrative on Vulcan Materials (it's free!)

Vulcan Materials' narrative projects $9.6 billion revenue and $1.5 billion earnings by 2028. This requires 8.1% yearly revenue growth and an earnings increase of about $541.9 million from $958.1 million today.

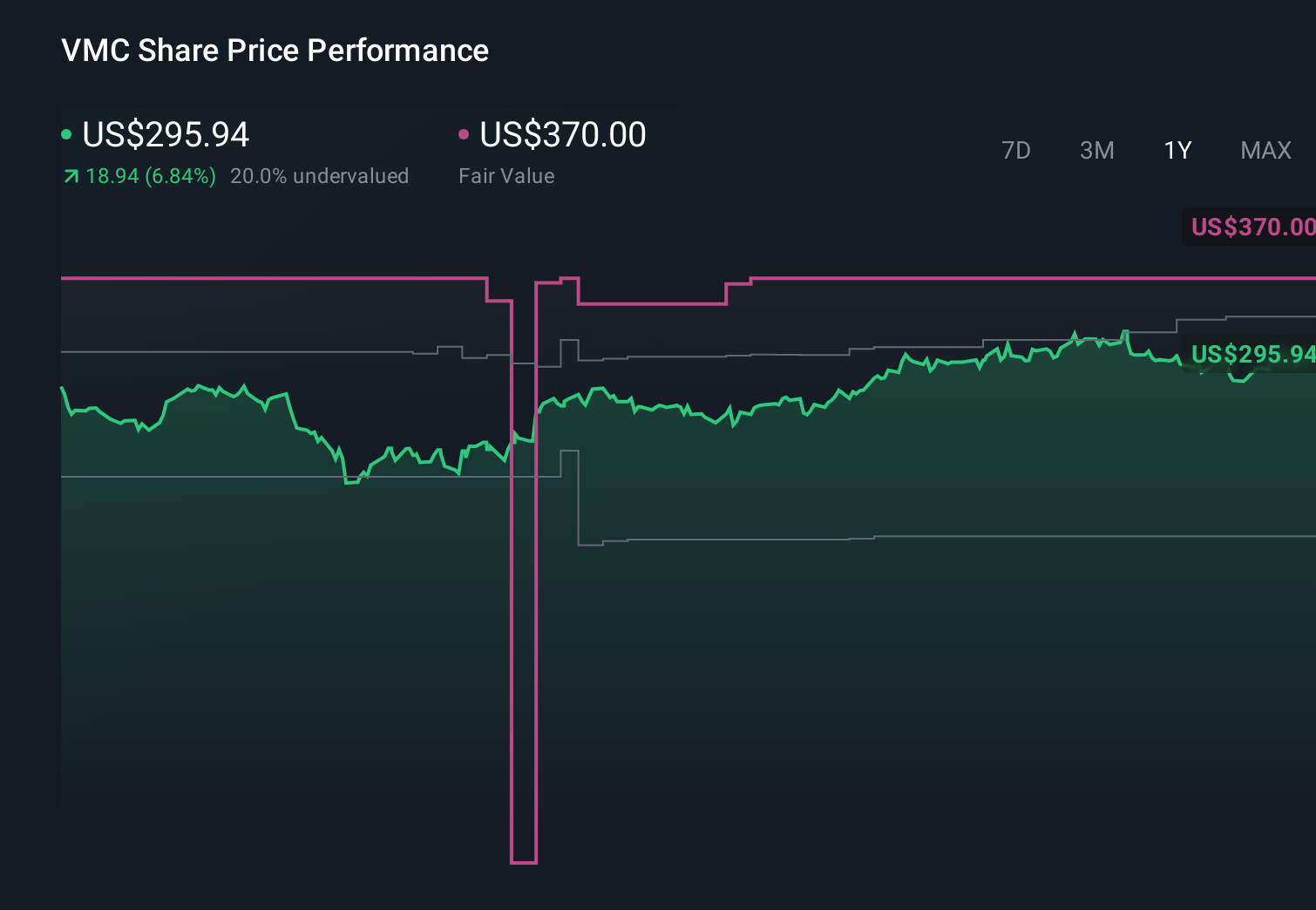

Uncover how Vulcan Materials' forecasts yield a $317.70 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently value Vulcan Materials between US$115 and about US$317.70 per share, highlighting very different expectations for its future. You can weigh those views against the current reliance on sustained U.S. infrastructure funding, and decide how that key risk might influence the company’s ability to maintain recent aggregates volume and pricing momentum.

Explore 4 other fair value estimates on Vulcan Materials - why the stock might be worth less than half the current price!

Build Your Own Vulcan Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vulcan Materials research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Vulcan Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vulcan Materials' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VMC

Vulcan Materials

Produces and supplies construction aggregates in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion