- United States

- /

- Basic Materials

- /

- NYSE:TTAM

Titan America (TTAM): Assessing Valuation Following Recent Pullback in Share Price

Reviewed by Simply Wall St

Titan America (TTAM) shares have moved lower recently, with a drop of nearly 2% at the latest close. Investors are watching to see how the company’s fundamentals might influence its valuation in the current environment.

See our latest analysis for Titan America.

After a mild pullback in the share price this week, Titan America’s short-term momentum has softened, even after a 3.5% climb over the past month. Looking at the bigger picture, however, the stock’s performance remains cautious for the year and reflects shifting investor sentiment around growth potential and valuation.

If you’re searching for what else is on the move, this could be the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership.

With Titan America trading just below analysts’ price targets and showing improving fundamentals, investors must ask whether the stock is currently undervalued or if the market has already factored in its future growth prospects. Is this a buying opportunity, or is everything priced in?

Price-to-Earnings of 16.8x: Is it justified?

Titan America currently trades at a price-to-earnings (P/E) ratio of 16.8x, which is above the broader basic materials industry average of 15.1x. At the last close price of $15.50, the stock appears modestly expensive relative to its sector peers.

The price-to-earnings ratio measures how much investors are paying for each dollar of reported earnings. In the basic materials industry, this multiple offers a quick snapshot of how the market values future profitability and growth prospects. For a company like Titan America, with a track record of earnings growth but recent deceleration, the P/E ratio provides insight into whether expectations are too high or simply reflective of stable fundamentals.

Notably, while the stock's P/E ratio is above the global industry average, it still sits below the peer group average of 20.2x. This means that although Titan America is arguably priced at a premium to the sector, it is not the most expensive among its closest competitors. Furthermore, when compared to its estimated fair P/E ratio of 18.6x, the current valuation may be below where the market could move if sentiment improves.

Explore the SWS fair ratio for Titan America

Result: Price-to-Earnings of 16.8x (OVERVALUED)

However, if revenue growth continues to slow or if there is a shift in industry sentiment, the current valuation outlook for Titan America could be challenged.

Find out about the key risks to this Titan America narrative.

Another View: Discounted Cash Flow Shows a Different Picture

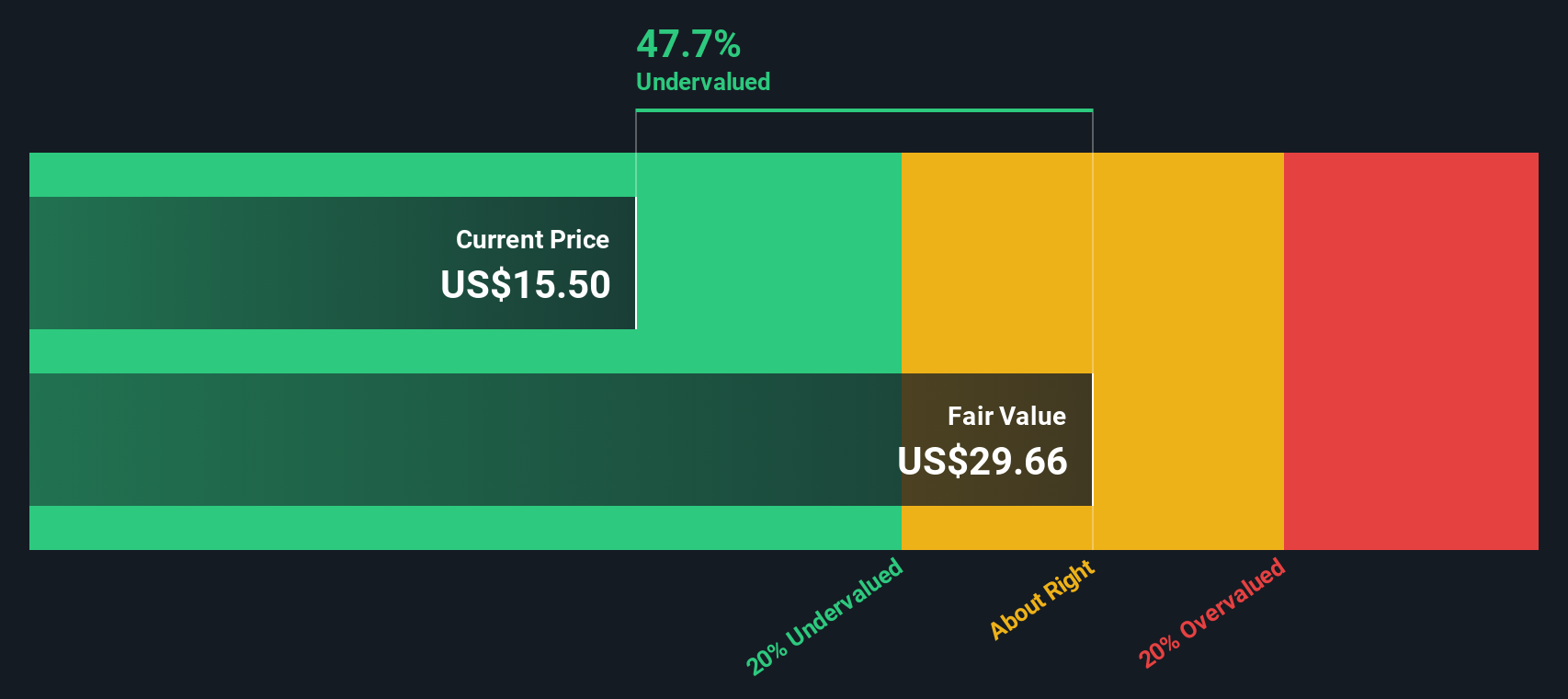

While the price-to-earnings ratio suggests Titan America may be overvalued versus industry averages, our DCF model paints a contrasting picture. According to this approach, the shares are trading a substantial 47.8% below their estimated fair value. Could this gap indicate an overlooked opportunity, or is the market pricing in other risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Titan America for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Titan America Narrative

If you have your own take on Titan America’s story or want to dig into the numbers yourself, you can blend insights and data to craft your outlook in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Titan America.

Looking for more investment ideas?

Level up your decision-making and be the first to spot new opportunities that could shape your portfolio this year. These screens are tailor-made for forward thinkers.

- Seize the chance to tap into companies unlocking high yields and consistent income by checking out these 16 dividend stocks with yields > 3% with yields over 3%.

- Jump ahead of the curve in transformative tech by browsing these 25 AI penny stocks, featuring AI innovators poised for future growth.

- Accelerate your hunt for overlooked value with these 878 undervalued stocks based on cash flows that highlight stocks trading below what their cash flow is worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Titan America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TTAM

Titan America

Through its subsidiaries, manufactures and supplies heavy building materials and services in the United States.

Good value with proven track record.

Market Insights

Community Narratives