Trinseo PLC (NYSE:TSE) is reducing its dividend from last year's comparable payment to $0.01 on the 20th of July. However, the dividend yield of 9.7% is still a decent boost to shareholder returns.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Trinseo's stock price has reduced by 37% in the last 3 months, which is not ideal for investors and can explain a sharp increase in the dividend yield.

Check out our latest analysis for Trinseo

Trinseo's Earnings Easily Cover The Distributions

A big dividend yield for a few years doesn't mean much if it can't be sustained. Even though Trinseo is not generating a profit, it is still paying a dividend. The company is also yet to generate cash flow, so the dividend sustainability is definitely questionable.

Analysts expect a massive rise in earnings per share in the next year. Assuming the dividend continues along recent trends, we think the payout ratio will be 2.5%, which makes us pretty comfortable with the sustainability of the dividend.

Trinseo's Dividend Has Lacked Consistency

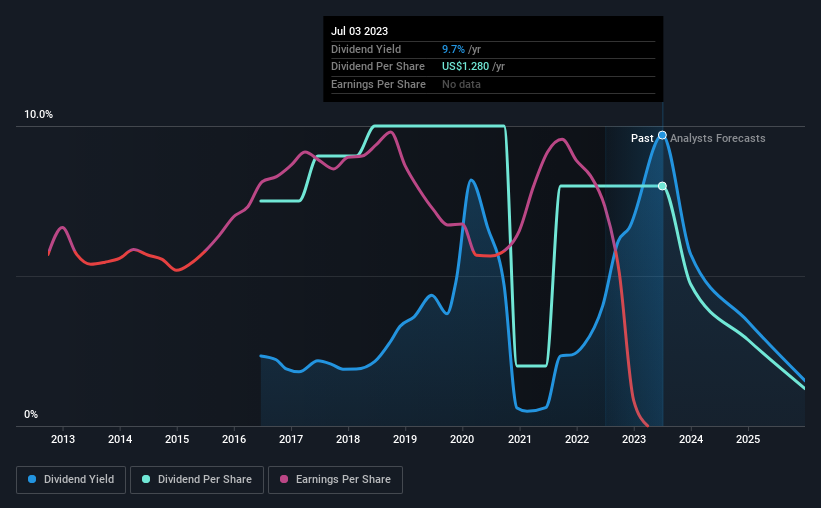

Looking back, Trinseo's dividend hasn't been particularly consistent. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. The annual payment during the last 7 years was $1.20 in 2016, and the most recent fiscal year payment was $1.28. Dividend payments have grown at less than 1% a year over this period. It's encouraging to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth anyway, which makes this less attractive as an income investment.

The Dividend Has Limited Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Earnings per share has been sinking by 41% over the last five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Trinseo's Dividend Doesn't Look Great

To sum up, we don't like when dividends are cut, but in this case the dividend may have been too high to begin with. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. We don't think that this is a great candidate to be an income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 2 warning signs for Trinseo that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Trinseo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TSE

Trinseo

Provides specialty material solutions in the United States, Europe, the Asia-Pacific, and internationally.

Moderate risk and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026