- United States

- /

- Chemicals

- /

- NYSE:TROX

Why We're Not Concerned About Tronox Holdings plc's (NYSE:TROX) Share Price

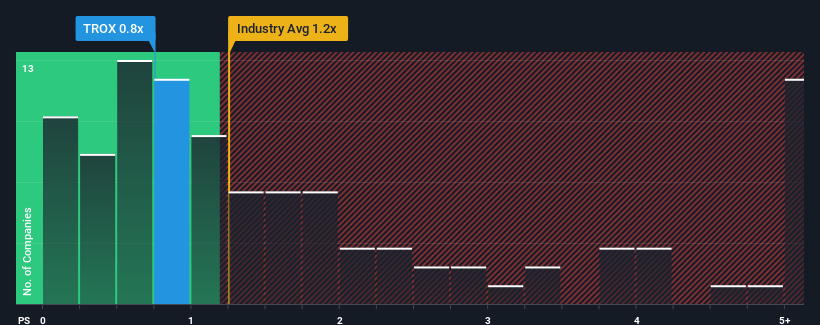

It's not a stretch to say that Tronox Holdings plc's (NYSE:TROX) price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" for companies in the Chemicals industry in the United States, where the median P/S ratio is around 1.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Tronox Holdings

What Does Tronox Holdings' Recent Performance Look Like?

With revenue that's retreating more than the industry's average of late, Tronox Holdings has been very sluggish. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. You'd much rather the company improve its revenue if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think Tronox Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Tronox Holdings would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 24%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 5.4% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 7.9% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 8.7% per year, which is not materially different.

With this in mind, it makes sense that Tronox Holdings' P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at Tronox Holdings' revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Tronox Holdings that you should be aware of.

If these risks are making you reconsider your opinion on Tronox Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Tronox Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TROX

Tronox Holdings

Operates as a vertically integrated manufacturer of TiO2 pigment in North America, South and Central America, Europe, the Middle East, Africa, and the Asia Pacific.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives