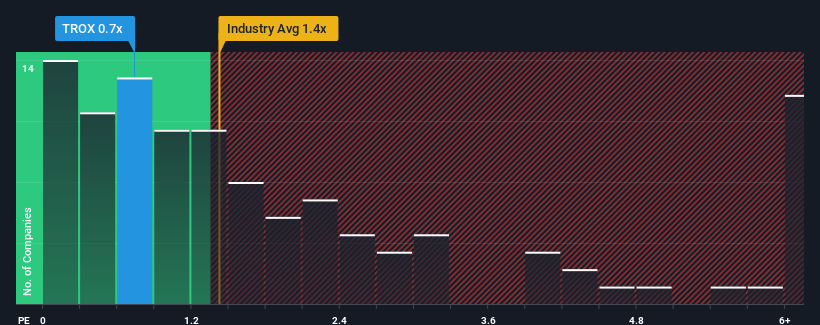

When you see that almost half of the companies in the Chemicals industry in the United States have price-to-sales ratios (or "P/S") above 1.4x, Tronox Holdings plc (NYSE:TROX) looks to be giving off some buy signals with its 0.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Tronox Holdings

How Tronox Holdings Has Been Performing

There hasn't been much to differentiate Tronox Holdings' and the industry's retreating revenue lately. One possibility is that the P/S ratio is low because investors think the company's revenue may begin to slide even faster. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. In saying that, existing shareholders may feel hopeful about the share price if the company's revenue continues tracking the industry.

Keen to find out how analysts think Tronox Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Tronox Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 3.4% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 10% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 11% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 3.6%, which is noticeably less attractive.

With this information, we find it odd that Tronox Holdings is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Tronox Holdings' P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Tronox Holdings' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Tronox Holdings that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Tronox Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TROX

Tronox Holdings

Operates as a vertically integrated manufacturer of TiO2 pigment in North America, South and Central America, Europe, the Middle East, Africa, and the Asia Pacific.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives