- United States

- /

- Chemicals

- /

- NYSE:TREC

Trecora Resources (NYSE:TREC) Takes On Some Risk With Its Use Of Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Trecora Resources (NYSE:TREC) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Trecora Resources

What Is Trecora Resources's Debt?

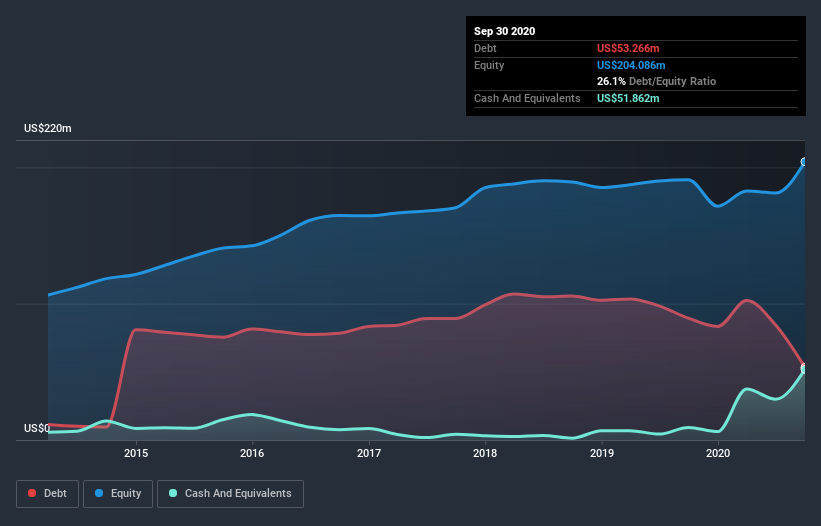

The image below, which you can click on for greater detail, shows that Trecora Resources had debt of US$53.3m at the end of September 2020, a reduction from US$89.3m over a year. However, it also had US$51.9m in cash, and so its net debt is US$1.40m.

A Look At Trecora Resources' Liabilities

According to the last reported balance sheet, Trecora Resources had liabilities of US$33.8m due within 12 months, and liabilities of US$84.4m due beyond 12 months. Offsetting this, it had US$51.9m in cash and US$39.5m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$26.9m.

Given Trecora Resources has a market capitalization of US$157.1m, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Carrying virtually no net debt, Trecora Resources has a very light debt load indeed.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Trecora Resources's debt of just 0.065 times EBITDA is clearly modest. But strangely, EBIT was only 1.7 times interest expenses, suggesting the that may paint an overly pretty picture of the stock. Importantly, Trecora Resources's EBIT fell a jaw-dropping 33% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Trecora Resources's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Trecora Resources's free cash flow amounted to 23% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

On the face of it, Trecora Resources's interest cover left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its net debt to EBITDA is a good sign, and makes us more optimistic. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Trecora Resources stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Trecora Resources, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Trecora Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:TREC

Trecora Resources

Trecora Resources manufactures and sells various specialty petrochemicals products and specialty waxes in the United States.

Flawless balance sheet with poor track record.

Similar Companies

Market Insights

Community Narratives