- United States

- /

- Chemicals

- /

- NYSE:SXT

Can Sensient Technologies’ (SXT) Steady Guidance Reveal More About Its Long-Term Growth Ambitions?

Reviewed by Sasha Jovanovic

- Sensient Technologies Corporation recently reported improved third-quarter earnings, with sales rising to US$412.11 million and net income increasing to US$36.96 million, while management affirmed its 2025 full-year guidance for mid-single-digit growth in local currency revenue and diluted EPS between US$3.13 and US$3.23.

- The company's continued dividend payout and the reiteration of its annual outlook may offer stakeholders reassurance about business performance and management's confidence amid ongoing market developments.

- We'll examine how Sensient's reaffirmed earnings guidance and solid quarterly results may influence expectations around its future growth path.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Sensient Technologies Investment Narrative Recap

Owning Sensient Technologies hinges on believing in the company's ability to capture growth from the global transition to natural colors, supported by its vertically integrated supply chain. The newly reaffirmed 2025 guidance and solid Q3 earnings provide little change to the near-term outlook, with the main catalyst, the regulatory-driven shift to natural ingredients, still ahead, while the biggest risk of margin pressure due to volatile production costs remains present and unaffected by this update.

Among recent announcements, the declaration of a US$0.41 per share quarterly dividend on October 30, 2025 is most relevant here, signaling ongoing cash generation and management’s ongoing confidence despite sector-specific challenges. Consistent dividend payments may be reassuring, but they do not offset the industry-wide risks of agricultural cost and supply variability tied to Sensient’s business model.

However, investors should also keep in mind that persistent margin pressures from rising crop costs can quickly become a hurdle for future earnings if...

Read the full narrative on Sensient Technologies (it's free!)

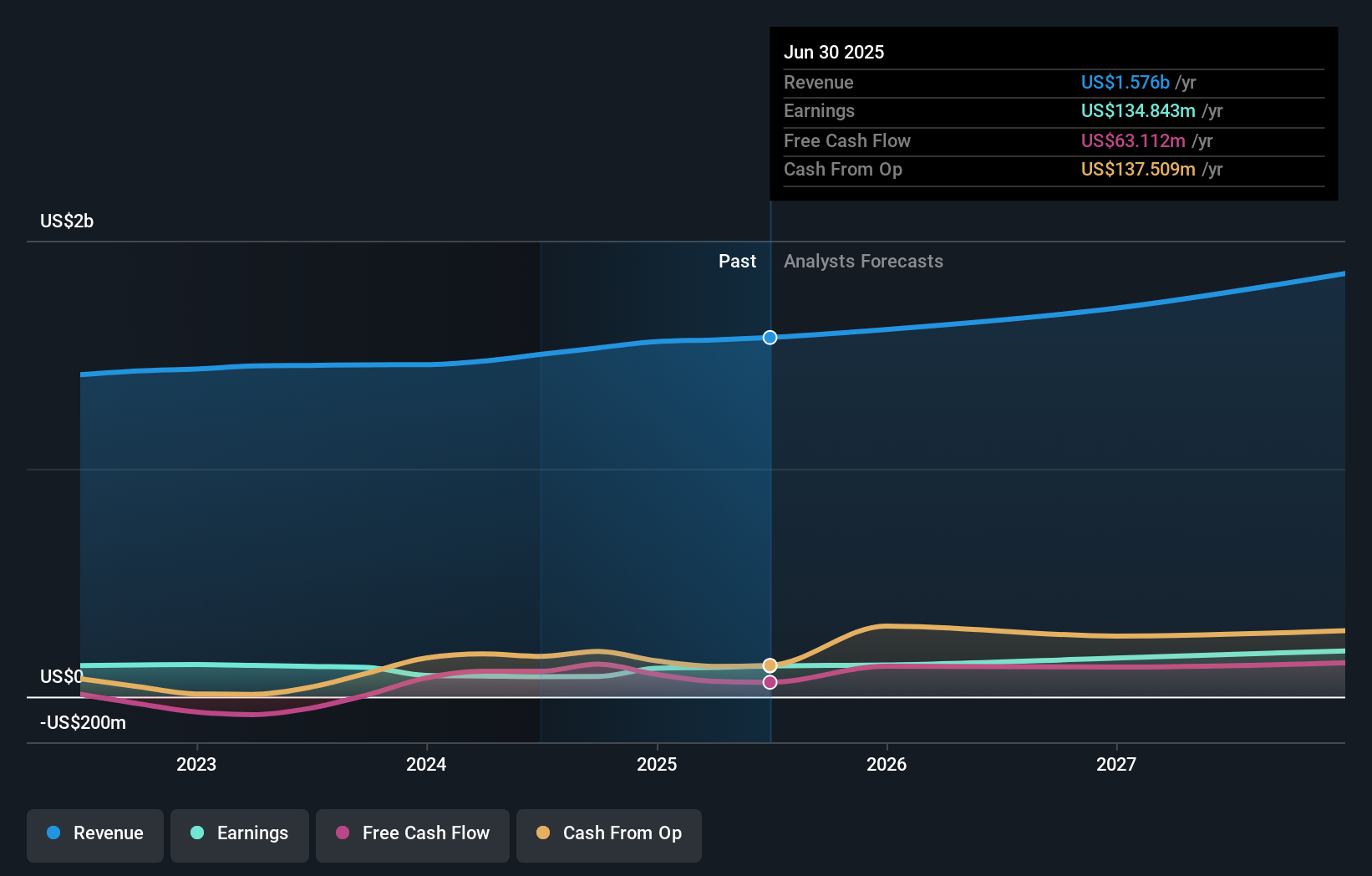

Sensient Technologies' outlook anticipates $1.9 billion in revenue and $216.5 million in earnings by 2028. This scenario assumes a 6.3% annual revenue growth rate and a $81.7 million increase in earnings from $134.8 million currently.

Uncover how Sensient Technologies' forecasts yield a $121.67 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Only one Simply Wall St Community member valued Sensient at US$97.78 per share before the latest results. Some market participants remain focused on risks around raw material cost pressures, which could influence the company’s long-term profitability. Explore a variety of viewpoints for a fuller picture.

Explore another fair value estimate on Sensient Technologies - why the stock might be worth just $97.78!

Build Your Own Sensient Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sensient Technologies research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sensient Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sensient Technologies' overall financial health at a glance.

No Opportunity In Sensient Technologies?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SXT

Sensient Technologies

Manufactures and markets colors, flavors, and other specialty ingredients worldwide.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives